Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

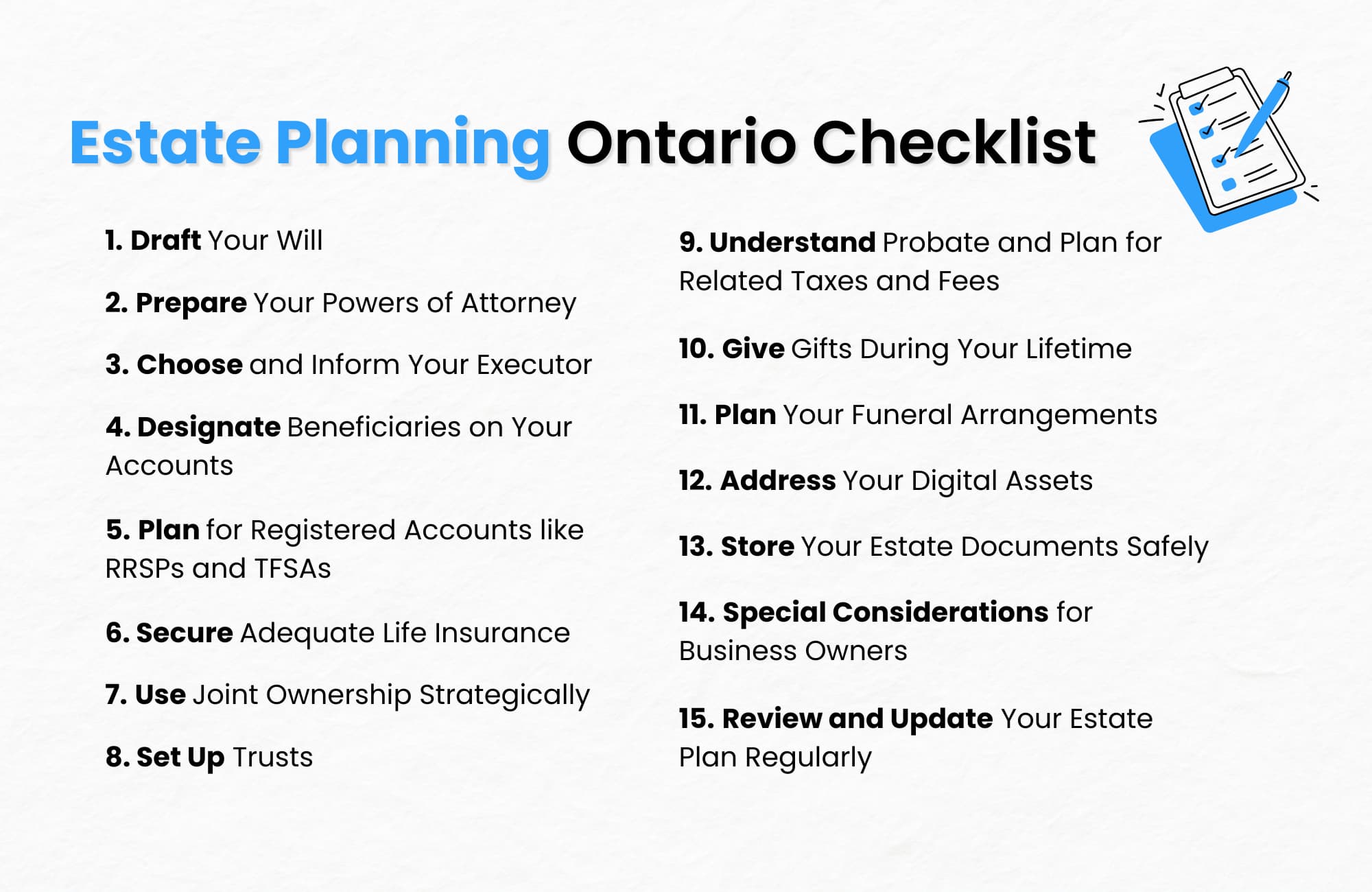

This Ontario estate planning checklist is for anyone who wants to organize their assets, protect loved ones, and reduce stress for their family.

Whether you’re writing a will for the first time or reviewing an existing estate plan, this step-by-step estate planning guide helps ensure nothing important is missed. It’s especially useful for Ontario residents with property, savings, or dependents who want a clear, structured way to prepare for the future.

An estate planning checklist will help get everything done with no risk of missing a step. However, keep in mind that a checklist is no substitute for doing your estate planning with a professional.

If you have a complex estate with $2M or more in investments and multiple properties, it may be smart to speak with an estate planning specialist.

Key Takeaways

- A will alone is not a complete estate plan.

- Powers of attorney protect decisions during your lifetime.

- Naming beneficiaries helps avoid probate delays and fees.

- Life insurance can reduce taxes and build wealth.

- Estate plans must be reviewed and updated regularly.

1. Draft Your Will

A will is one of the most recognized legal documents, but it is important to remember that a will alone is not a comprehensive estate plan.

A will simply directs how all your assets should be distributed when you pass away. This may not happen if you only have a will as some of the assets that are to go to a son or daughter may be used instead to pay taxes, leaving that child without any inheritance.

A true estate plan goes much further, addressing taxes, family dynamics, trusts, and long-term protections for your wealth and loved ones.

2. Prepare Your Powers of Attorney

In Ontario, a power of attorney is essential to protect your wishes if you become unable to make decisions for yourself.

You can appoint someone to handle your property, including bank accounts, real estate, and financial matters, and another person to make personal care decisions regarding your health and wellbeing.

These attorney documents are considered necessary legal documents, as they provide protection during your lifetime, not just after death.

3. Choose and Inform Your Executor

Selecting an estate executor is one of the most important decisions in estate planning.

This individual will be responsible for managing your estate, filing taxes, paying debts, and distributing assets. It is crucial to discuss this role with them ahead of time so they are prepared for the responsibility and understand your wishes clearly.

4. Designate Beneficiaries on Your Accounts

Many assets, such as pensions, insurance policies, and registered accounts, allow you to name a beneficiary directly.

By designating a beneficiary, these assets can transfer outside the estate, avoiding probate. This simple step reduces costs, provides faster access for your loved ones, and ensures the inheritance goes exactly where you intend.

5. Plan for Registered Accounts like RRSPs and TFSAs

Registered accounts such as RRSPs and TFSAs must be carefully planned because their tax treatment is specific under the Canadian system.

Naming beneficiaries allows these accounts to bypass probate while potentially reducing the overall tax liability of your estate. Without proper planning, these accounts could create a significant tax bill for your estate that other beneficiaries must pay.

6. Secure Adequate Life Insurance

Life Insurance is more than protection against loss—it can be a strategic tool in estate planning.

It ensures there is money available to pay taxes on death so that your loved ones inherit your assets intact. It can also build wealth during your lifetime, offering peace of mind and financial security for both today and tomorrow. Life insurance can also be used for retirement income.

7. Use Joint Ownership Strategically

Joint ownership can be a useful way to pass on property without going through probate.

However, joint ownership must be handled carefully to avoid unintended tax consequences or disputes between heirs. Used properly, it can reduce delays and simplify the transfer of certain assets.

8. Set Up Trusts

Trusts are powerful estate planning tools that can hold property, investments, or other assets for beneficiaries.

They can provide tax efficiencies, protect vulnerable family members, and reduce probate fees. Trusts must be carefully created through a legal document to ensure they meet Ontario laws and your family’s specific needs.

9. Understand Probate and Plan for Related Taxes and Fees

In Ontario, probate is the court process that confirms a will’s validity and gives authority to the executor.

Probate fees are based on the value of the estate and can add up quickly. With proper tax planning and estate structuring, you can significantly reduce these fees while minimizing the impact of estate taxes on your beneficiaries.

10. Give Gifts During Your Lifetime

Gifting during your lifetime allows you to see your loved ones benefit from your generosity.

It can also reduce the size of your taxable estate, helping lower probate fees. Careful planning ensures gifts are made in a way that does not create additional tax consequences for you or your family.

11. Plan Your Funeral Arrangements

Preplanning your funeral ensures your wishes are respected and spares your family difficult decisions during a time of grief.

Setting funds aside and documenting your preferences is a thoughtful part of a complete estate plan. It also reduces the risk of disagreements among family members.

12. Address Your Digital Assets

In today’s world, digital assets from online bank accounts to social media and cloud storage are an important part of estate planning.

Without guidance, these accounts may be overlooked or lost. Include instructions in your estate plan so your digital presence is handled with the same care as your physical assets.

13. Store Your Estate Documents Safely

Your will, attorney documents, insurance records, and other necessary legal documents should be stored in a safe, accessible location.

Copies should also be given to your financial advisors and estate executor. Proper storage ensures there is no confusion when these documents are needed most.

14. Special Considerations for Business Owners

If you own a business, estate planning must include a clear succession plan.

Without it, your business could face disruption, loss of value, or disputes. Planning for continuity ensures that both your family and the company you built are protected.

15. Review and Update Your Estate Plan Regularly

Life changes, and so should your estate plan.

Births, deaths, marriages, divorces, and changes in the law all require updates to your plan. Regular reviews ensure that your estate plan always reflects your current wishes and circumstances.

Avoiding Estate Taxes and Probate

Ontario residents must plan for both estate taxes and probate fees.

While there is no separate “estate tax” in Canada, assets are subject to deemed disposition under the Income Tax Act, which can create a large tax burden.

With careful use of trusts, joint ownership, life insurance, and charitable giving, families can reduce these costs and preserve wealth for future generations.

Building Your Wealth Today

Estate planning is not only about what happens after death it is also about how you live today.

Protecting your assets, reducing unnecessary tax exposure, and building security for your family brings peace of mind. A balanced estate plan allows you to enjoy life now while knowing your legacy is secure.

Common Questions about Estate Planning

What assets are not considered part of an estate in Canada?

Assets with named beneficiaries, such as insurance policies and RRSPs, usually pass outside the estate.

What documents are needed for estate planning in Ontario?

Key documents include a will, powers of attorney, life insurance, and trust agreements if applicable.

Can a beneficiary ask to see bank statements in Canada?

Beneficiaries may review estate financial records, but access is limited to estate-related accounts, not personal banking history.

What are the three main issues to consider in estate planning?

The key issues are taxes, family dynamics, and protecting assets for future generations.

Get the Free Printable Estate Planning Checklist (Ontario) PDF – CLICK HERE >>

Discover How to Minimize Taxes and Secure Your Legacy

Did you know that without a solid estate plan, taxes and fees in Ontario could claim a significant portion of your wealth?

If you’ve worked hard to build your business, investments, and properties, protecting your legacy for your loved ones is critical. At Strategic Wealth Protection Partners, we specialize in helping high-net-worth individuals in Ontario secure their financial futures.

Our Living Estate Plan is designed to:

- Reduce estate taxes and probate fees.

- Simplify wealth transfer to your loved ones.

- Reflect your values and priorities in every detail.

Your Legacy Matters

With our personalized guidance, we’ll help you navigate options like Living Trusts to protect your assets and ensure your family’s peace of mind. Contact us today to book your Living Estate Plan Consultation and take the first step toward a secure future.

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- How to Avoid Capital Gains on a Cottage in Ontario

- Pros and Cons of Putting a House in a Trust in Canada

- How to Avoid Estate Tax in Canada in 2025

- Guide to Holding Property in a Trust in Ontario

- Living Trust Ontario Guide: What It Is & Do You Need One?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.