Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

How Can My Family Avoid Capital Gains on an Inherited Cottage in Ontario?

How can I avoid capital gains on a cottage in Ontario?

Avoiding capital gains tax on a family cottage is one of the most emotional and financially sensitive parts of estate planning in Ontario. The goal is to keep the cottage in the family without leaving your loved ones with a heavy tax bill, or worse, forcing them to sell it just to cover the cost.

Methods to minimize the capital gains on a cottage in Ontario include using the Principal Residence Exemption, transferring the cottage over time, tracking your capital improvements, and using a trust.

I’ll cover all these options and more in this post.

While capital gains tax can’t always be avoided, it can often be minimized, deferred, or planned for thoughtfully.

That’s where good planning matters more than ever. The sooner you start the conversation, the more options you’ll have.

What Is Capital Gains Tax on a Cottage?

Capital gains tax is triggered when a property increases in value and is later sold, gifted, or transferred.

The Canada Revenue Agency treats the increase as a taxable gain, even if the property stays in the family. For example, if you bought a cottage for $200,000 and it’s now worth $800,000, the gain is $600,000. Half of that ($300,000) would be added to your taxable income in the year of transfer or death.

This is called the capital gains inclusion rate. The result can be a sizable tax bill—often unexpected and emotionally overwhelming if there’s no plan in place. (+)

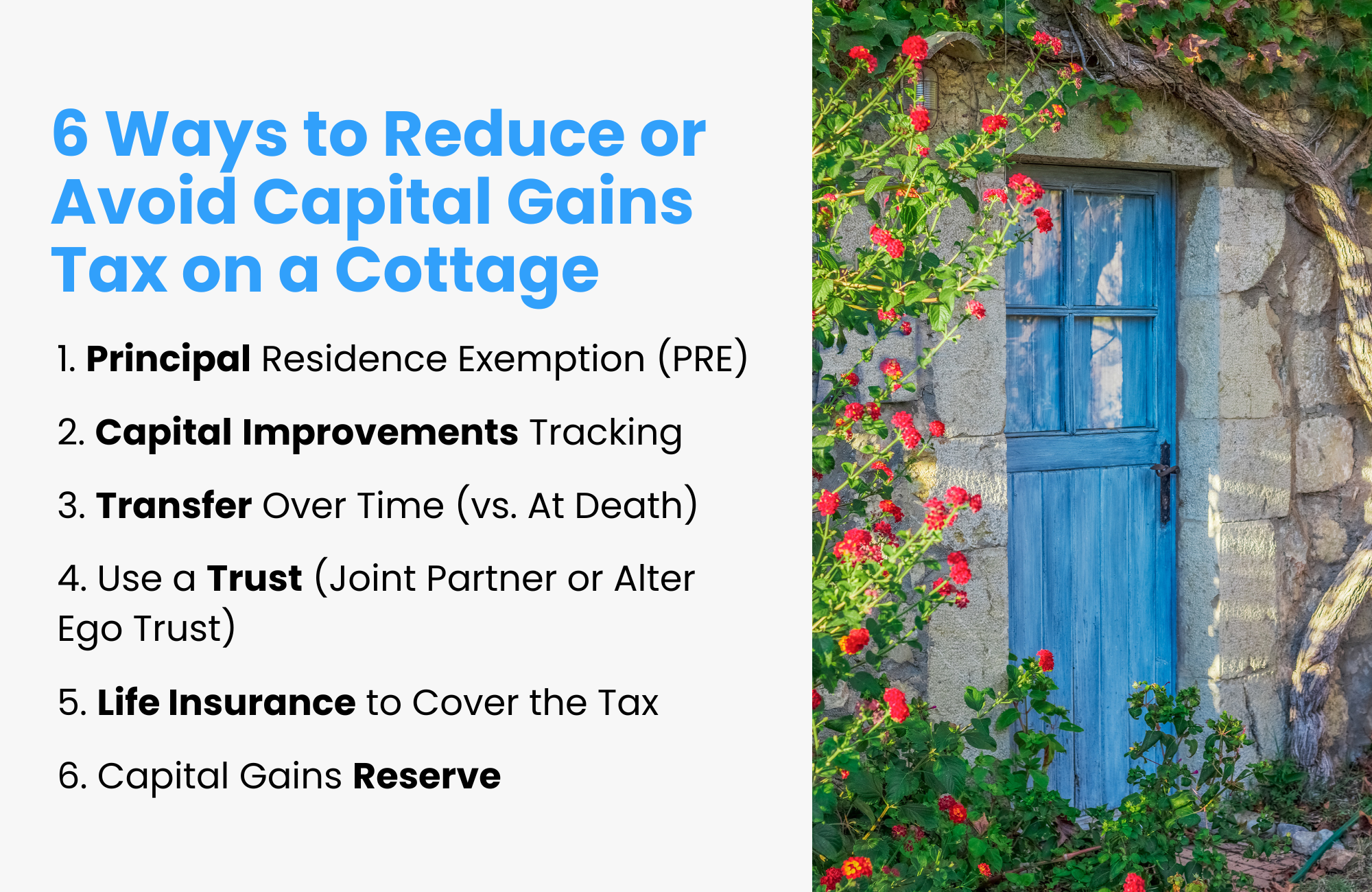

6 Ways to Reduce, Spread Out, or Avoid Capital Gains Tax on a Cottage

1. Principal Residence Exemption (PRE)

If the cottage qualifies as your principal residence, you may be able to fully shelter it from capital gains tax.

This is most effective if the cottage is used as your main home, or if you haven’t claimed the PRE on another property for those years. However, you can only designate one principal residence per family per year, and using it for the cottage may mean your city home becomes taxable later.

Strategic choices must be made based on growth and expected future gains.

2. Capital Improvements Tracking

Keep detailed records of renovations and upgrades—these increase your cottage’s adjusted cost base (ACB). The higher the ACB, the lower your capital gain.

This includes additions, docks, septic upgrades, insulation, and more. Many families lose thousands because they didn’t track receipts over decades. A shoebox full of receipts today can reduce tax years down the road.

3. Transfer Over Time (vs. At Death)

Instead of passing the cottage through your estate, you can gradually transfer shares or ownership over several years.

This can trigger smaller gains annually and make use of your capital gains reserve, which allows you to spread tax over up to five years. This also brings children into ownership earlier, potentially preparing them for the responsibility. But it also means giving up some control and needing a clear agreement among family members.

4. Use a Trust (Joint Partner or Alter Ego Trust)

Placing the cottage in a Joint Partner Trust or Alter Ego Trust allows you to keep control during your lifetime while avoiding probate and planning around capital gains.

The trust holds the cottage, and on your death, it passes to the next generation without going through your estate. This doesn’t eliminate tax but gives you more control over timing, planning, and ownership transition. It’s best used when you want simplicity and privacy in passing down family property.

5. Life Insurance to Cover the Tax

If the goal is to keep the cottage in the family but the tax can’t be avoided, life insurance can be used to fund the tax liability.

The policy pays out when you pass, giving your heirs cash to cover the CRA’s bill. This can prevent forced sales and reduce family stress. The downside? It requires ongoing premiums and should be factored into your overall estate plan.

6. Capital Gains Reserve

If you sell the cottage to a family member and receive payments over time, you may qualify for the capital gains reserve, which spreads the tax over five years.

This only works for arms-length structured sales, not gifts. It’s a way to soften the tax blow and give your children time to pay off the cottage value in installments. Legal agreements and CRA rules must be followed carefully.

📖Related Read: Pros and Cons of Putting a House in a Trust

Common Mistakes to Avoid

- Forgetting to document capital improvements, which inflates taxable gains

- Assuming the principal residence exemption applies without proper designation

- Gifting the cottage without understanding the tax consequences

- Leaving cottage ownership ambiguous in the will, which can spark family disputes

- Failing to plan for liquidity to pay the tax, leading to forced sales of the property

How Cottage Use Affects Tax Status

How the cottage is used can change how it’s taxed.

A personal-use cottage may qualify for the principal residence exemption, but if it’s rented out part-time or full-time, it may be treated as an income-producing property, limiting your PRE claim. Full-time rental use may even shift the property into a different tax category.

CRA expects clear reporting and consistency between use and declarations. Any mixed-use property requires careful documentation.

What Happens If You Don’t Have a Plan?

Without a plan, the cottage becomes a tax and emotional burden for your heirs.

A large capital gains bill could force the family to sell the cottage just to pay the taxes. This often leads to resentment and fractured relationships.

Probate fees and estate administration tax could further erode the value. A cherished family legacy can be lost without a clear, coordinated estate plan.

How to Make a Plan to Keep the Cottage in the Family

Keeping the cottage in the family takes more than a heartfelt wish—it takes planning.

That includes understanding your capital gains exposure, updating your will, and choosing the right tools like trusts, insurance, or structured transfers. Talk openly with your family about expectations, costs, and responsibilities. Put those decisions in writing and review them regularly.

A good plan preserves both the property and your family’s peace.

When to Get Professional Advice to Avoid Mistakes

If your cottage has appreciated significantly, has mixed-use, or you’re unsure about tax exposure, now is the time to seek advice.

Tax and estate rules in Ontario are complex but manageable with the right help. Many people wait too long and limit their options. Planning is most powerful when it’s done early and openly.

If your goal is to protect your family, your legacy, and your property, get a second set of expert eyes on your plan.

Common Questions

Should I gift the cottage while I’m still alive?

Gifting the cottage triggers capital gains tax immediately, even if no money changes hands. It also means giving up control, which can create legal and emotional complications.

Should I sell the cottage to my kids?

You can sell the cottage at fair market value, which triggers capital gains—but the capital gains reserve may help you spread the tax. However, selling below fair market value can cause double taxation and should be avoided.

How is capital gains tax calculated on a gifted cottage in Canada?

The CRA treats a gift as a deemed disposition at fair market value. You’ll pay tax on the increase in value from the time you bought it to the time you gifted it.

Who is responsible for paying capital gains tax on inherited property in Canada?

The estate pays the capital gains tax, not the beneficiary. This is settled before the property is transferred to the heirs.

What is a deemed disposition, and how does it trigger tax?

A deemed disposition means the CRA treats the asset as if it was sold, even if it wasn’t. This happens at death, or when a gift is made, triggering tax on any gain.

Summary of Key Points

- A taxable capital gain occurs when the cottage is sold, gifted, or transferred for more than its original cost (plus improvements).

- Under the Income Tax Act, 50% of the gain is taxable.

- Even gifts can trigger tax, and deemed disposition rules apply.

- Selling over time or using the capital gains reserve can help ease the tax load.

- Always track capital improvements—they increase your adjusted cost base (ACB) and lower tax.

- Without planning, your estate or heirs could face a large, unexpected tax bill.

- Estate planning and tax advice can protect the cottage, reduce tax, and preserve family harmony.

Discover How to Minimize Taxes and Secure Your Legacy

Did you know that without a solid estate plan, taxes and fees in Ontario could claim a significant portion of your wealth?

If you’ve worked hard to build your business, investments, and properties, protecting your legacy for your loved ones is critical. At Strategic Wealth Protection Partners, we specialize in helping high-net-worth individuals in Ontario secure their financial futures.

Our Living Estate Plan is designed to:

- Reduce estate taxes and probate fees.

- Simplify wealth transfer to your loved ones.

- Reflect your values and priorities in every detail.

Your Legacy Matters

With our personalized guidance, we’ll help you navigate options like Living Trusts to protect your assets and ensure your family’s peace of mind. Contact us today to book your Living Estate Plan Consultation and take the first step toward a secure future.

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- How Do I Avoid Capital Gains Tax on Inherited Property in Canada?

- Inheritance Tax Ontario: Everything You Need to Know

- How Much Money Can Be Legally Given to a Family Member as a Gift in Canada?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.