What is the Living Estate Plan Process?

And, how much does it cost?

Here’s how SWPP’s Living Estate Plan can help families and individuals in Ontario:

With over 30 years of experience in financial services, I’ve witnessed the challenges families face when a loved one passes away.

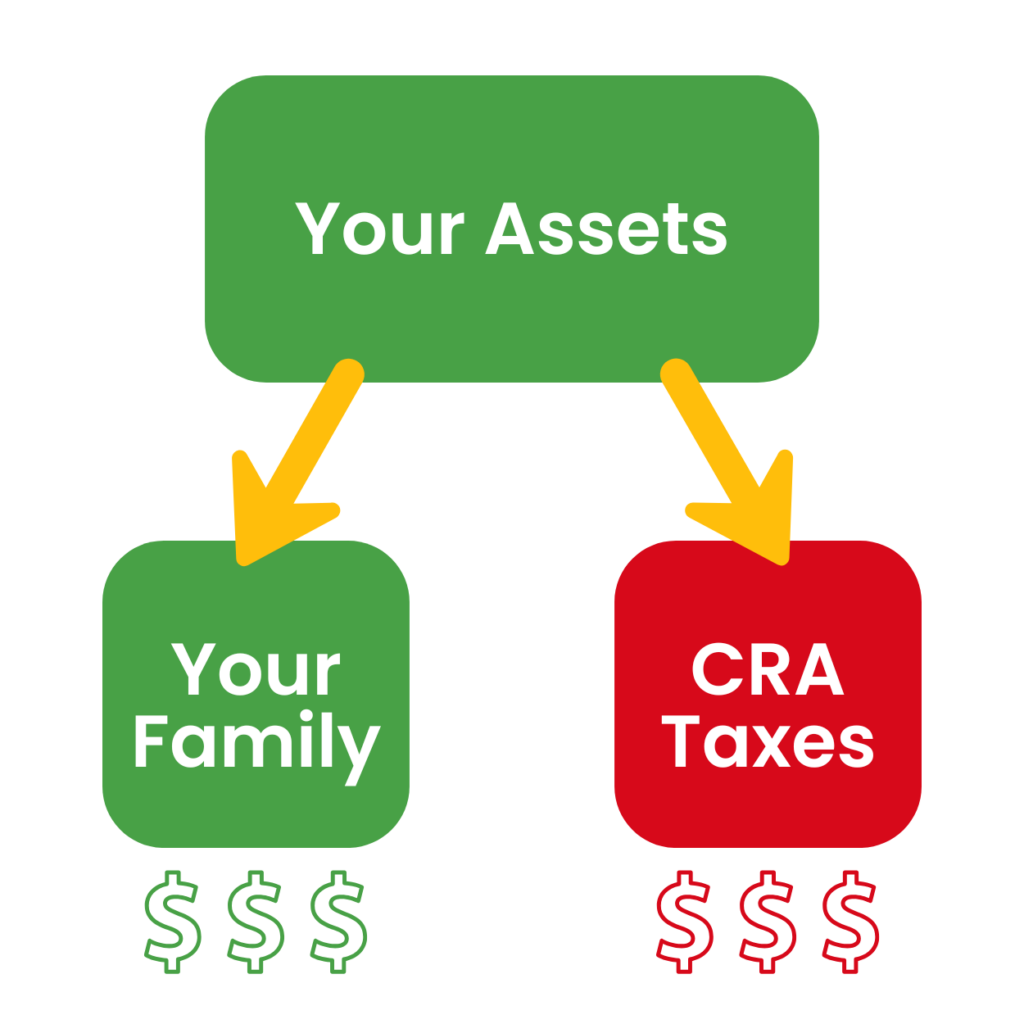

Assets can be lost to unnecessary taxes and fees. Families are left scrambling to locate unknown accounts.

Moreover, decisions are made under emotional stress—often at the worst possible time.

That’s why I created the Living Estate Plan. It’s a comprehensive process designed to ensure families are prepared. We want to ensure your assets are protected and your legacy is preserved.

In addition, SWPP’s $500 planning fee is only payable after we deliver your completed plan. Plus, if we can’t show you how to save at least 100 times your investment, you pay nothing.

Your first call will be a 30-minute complimentary assessment.

Share the problems you’re looking to solve and the goals you’d like to achieve.

Get a customized plan designed to dramatically reduce taxes and fees

Does the thought of spending unnecessary money stop you from getting the advice you need?

At Strategic Wealth Protection Partners Inc. (SWPP), we are committed to helping you reduce taxes and probate fees while building a legacy you’re excited to share with your family.

We believe in earning your trust first, which is why we offer a no-risk guarantee—our $500 planning fee is only payable after we deliver your completed plan. And if we can’t show you how to save at least 100 times your investment, you pay nothing.

That’s right—if we can’t help you preserve $50,000 or more for your family, your plan is completely free.

Experience the peace of mind that comes with smart planning—schedule your free consultation today and start securing your financial future without any risk.

Ron Cooke

President, Strategic Wealth Protection Partners Inc.

When it comes to planning your legacy, it’s not just about numbers.

It’s about ensuring your family remembers you for many years to come.

We understand that estate planning and creating trusts can feel intimidating and overwhelming, especially if it’s something you’ve never done before.

But with our simple, fives step Living Estate Plan, we’ll guide you through the process, simplifying every step to help you create a comprehensive estate plan or trust that protects your assets from unnecessary taxes and probate fees.

As part of this process, we use tools like the “Final Word” Journal, a heartfelt resource that captures your story, wishes, and memories alongside essential details like assets, accounts, and end-of-life plans.

With our simple, 5-Step Living Estate Plan, we’ll guide you through the process, simplifying every step to help you create a comprehensive estate plan or trust that protects your assets from unnecessary taxes and probate fees.

It’s not just about financial security; it’s about creating a meaningful legacy that reflects your values, provides lasting memories for your loved ones, and ensures your wishes are honoured.

Whether you’re looking to establish a trust to secure your assets or an estate plan that minimizes taxes and fees, we’re here to make it easy and effective.

Strategic Wealth Protection Partners helps families and business owners in Ontario with comprehensive estate planning.

SWPP’s Living Estate Plan service ensures Ontario families have an estate plan or living trust that protects their assets from unnecessary taxes and fees, including probate.

16 Industrial Parkway South, Suite 609, Aurora, ON, L4G-0R4