Is Probate Required in Ontario?

Is probate required in Ontario? Whether probate is required depends on the type, value, and ownership of the assets in the deceased’s estate.

Minimize taxes while protecting and growing your wealth. SWPP’s strategies help shield your assets, ensuring more of your legacy goes to your loved ones—not the government.

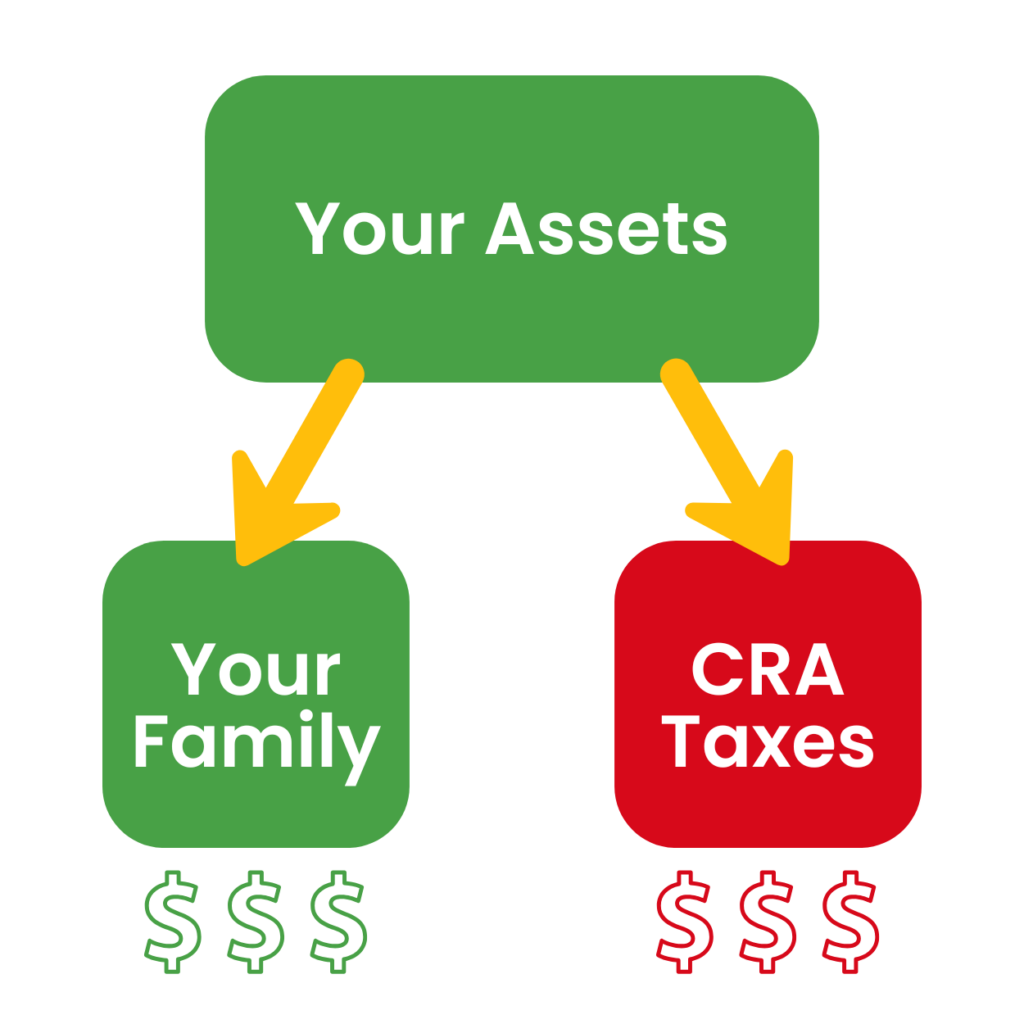

Ontario doesn’t have a direct estate tax on your total net worth. But that doesn’t stop the long arm of the government.

Assets like real estate (excluding your principal residence) and non-registered investments are deemed sold at fair market value upon death. The resulting capital gains are usually taxed at Ontario’s highest marginal tax rate, which exceeds 53.53% as of 2024.

Plus, factor in the additional costs like probate fees, executor fees, legal fees, and accounting fees.

What will be left for your family?

Imagine what your children will say when they learn that you could have avoided the taxes and estate fees by simply planning ahead?

Without proper planning, the total tax burden on your estate could be staggering. Some of your assets may even face double taxation.

SWPP’s Living Estate Plan helps minimize taxes while also protecting and even growing your wealth.

Take control of your financial future today. We’ll help you explore options like Living Trusts to safeguard your assets and provide lasting peace of mind for your family. Connect with Strategic Wealth Protection Partners to see how we can help you secure your legacy.

Our Living Estate Plan is designed to:

Your first call will be a 30-minute complimentary assessment.

Share the problems you’re looking to solve and the goals you’d like to achieve.

Get a customized plan designed to dramatically reduce taxes and fees

Does the thought of spending unnecessary money stop you from getting the advice you need?

At Strategic Wealth Protection Partners Inc. (SWPP), we are committed to helping you reduce taxes and probate fees while building a legacy you’re excited to share with your family.

We believe in earning your trust first, which is why we offer a no-risk guarantee—our $500 planning fee is only payable after we deliver your completed plan. And if we can’t show you how to save at least 100 times your investment, you pay nothing.

That’s right—if we can’t help you preserve $50,000 or more for your family, your plan is completely free.

Experience the peace of mind that comes with smart planning—schedule your free consultation today and start securing your financial future without any risk.

Ron Cooke

President, Strategic Wealth Protection Partners Inc.

Protect your business and ensure it thrives for generations to come.

Keep your properties in the family without the burden of estate taxes.

Ensure your children receive the legacy you intend for them.

Simplify your estate to ensure everyone is satisfied with their share.

Preserve family memories and keep your cottage for future generations.

Create a lasting legacy that keeps your memory alive for many years to come.

During our 35 years experience we’ve helped families protect millions of dollars from taxes.

We are licensed and recognized advisors. Our goal is to protect your family’s money and assets. We help families, business owners, and real estate investors do comprehensive estate planning in Ontario.

We’re focused on making sure you leave the most for your loved ones instead of giving your hard-earned assets to CRA.

An estate plan does the following:

When it comes to planning your legacy, it’s not just about numbers.

It’s about ensuring your family remembers you for many years to come.

We understand that estate planning and creating trusts can feel intimidating and overwhelming, especially if it’s something you’ve never done before.

But with our simple, fives step Living Estate Plan, we’ll guide you through the process, simplifying every step to help you create a comprehensive estate plan or trust that protects your assets from unnecessary taxes and probate fees.

As part of this process, we use tools like the “Final Word” Journal, a heartfelt resource that captures your story, wishes, and memories alongside essential details like assets, accounts, and end-of-life plans.

Provide your loved ones with everything they need – all in one place. Make it simple and easy for everyone.

We’ll help you plan ahead with confidence and clarity.

Schedule a complimentary 30-minute call with an Ontario estate planning expert.

Is probate required in Ontario? Whether probate is required depends on the type, value, and ownership of the assets in the deceased’s estate.

Probate is required in Ontario when a financial institution, land registry office, or other authority needs legal proof that a will is valid and that

How do family trusts work in Canada? A family trust is a legal structure that lets you move assets such as investments, businesses, or real

Canada doesn’t have an estate tax or inheritance tax. But that doesn’t mean your estate avoids tax. When you pass away, the Canada Revenue Agency

In Canada, a trust is a legal arrangement where one person (the trustee) manages assets on behalf of someone else (the beneficiary). The person who

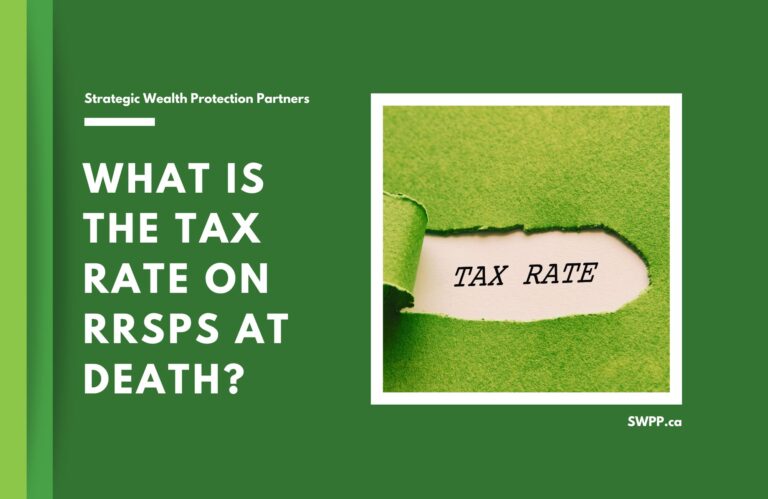

How much tax will my estate or beneficiaries pay on my RRSP when I die?

Your RRSP value is fully taxable in the year

Have you considered the following:

At SWPP, we specialize in helping blended families navigate estate planning challenges with a thoughtful Living Estate Plan.

With a Living Estate Plan, we can help you answer these questions and more:

At SWPP, we help you solve these problems and ensure your family’s cottage leaves a harmonious legacy.