Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

Putting a house in a living trust in Canada means transferring legal ownership of the property to a trustee while alive.

The trustee manages it for the benefit of named beneficiaries. The living trust is used to control how the property is passed on, avoid or reduce probate, and maintain privacy. The process requires a trust agreement and a legal transfer of the home’s title to the trust.

While not common in all provinces, a living trust is useful for complex estates or incapacity planning.

Key Takeaways

- Professional advice ensures trusts are structured for family needs and tax efficiency

- A living trust avoids probate fees and court delays in Ontario

- Trusts can protect blended families and reduce disputes

- Tax implications include attribution rules and the 21-year rule which can cause complications

- Irrevocable living trusts are common for estate planning and tax strategies

What Are Living Trusts?

A living trust is a legal structure where you transfer ownership of your trust assets into a trust that is governed by a trust document.

Assets that you can put into a trust include your home, investments, or savings.

A living trust explains how your assets will be managed during your lifetime and how they should be distributed when you pass away. One of the main benefits of a living trust in Ontario is avoiding or reducing probate fees, which can be costly when a will alone is used to transfer property.

Who Needs a Living Trust in Canada?

Not everyone requires a living trust, but it can be valuable for families who want to avoid the court-supervised probate process.

It is often recommended for people with multiple properties, significant investments, or business holdings. A trust can also simplify the process for heirs, minimize delays, and protect family privacy at a time of grief.

When Does a Living Trust Make Sense for Your House?

A living trust can be especially helpful if you are part of a blended family.

In these situations, you may want to ensure that your spouse is cared for during their lifetime while still guaranteeing that children from a previous relationship inherit the home later. Without a trust, conflicts can arise, and intentions may be misunderstood or contested.

How Do Living Trusts Work in Canada?

A living trust is created while you are alive and becomes effective immediately.

You transfer ownership of your property to the trust, but you still retain control through the trustee role. Unlike a will, which only takes effect after death, the trust operates during your lifetime and continues seamlessly after you pass away, avoiding the delays and costs of probate.

How Can You Put a Living Trust in a House in Canada?

Here are the basic steps to place your house into a living trust:

- Draft a trust document with the help of an experienced estate planning professional.

- Transfer the legal title of your home into the name of the trust.

- Appoint a trustee to manage the property during your lifetime and after death.

- Ensure the trust is properly registered and maintained for ongoing compliance.

Advantages of Putting a House in a Living Trust

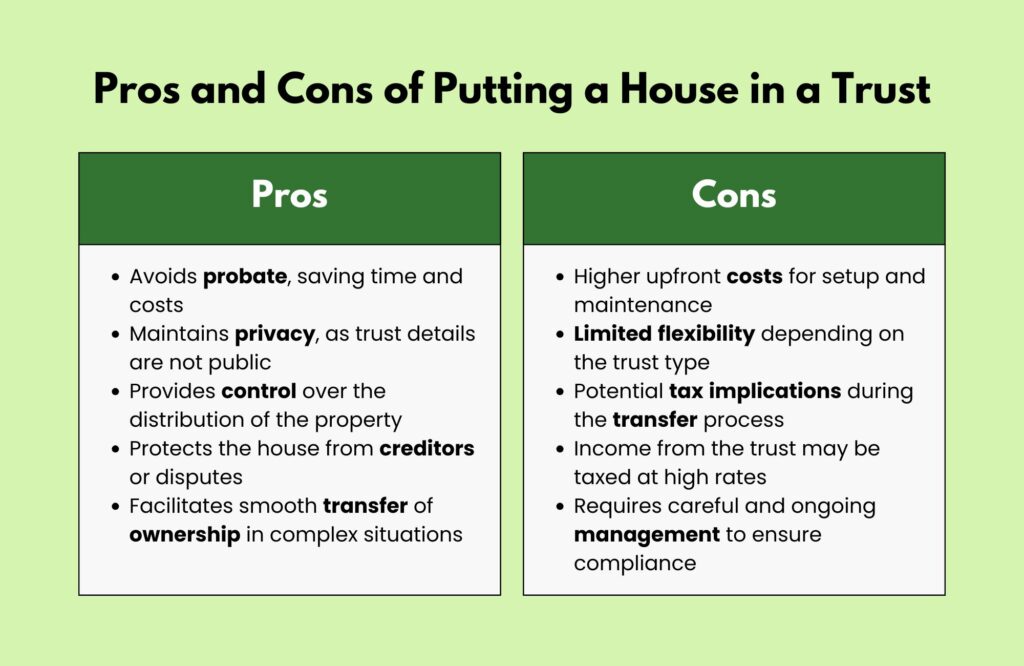

Placing your home in a living trust allows your family to bypass probate, which reduces delays and probate fees.

It can also provide more privacy, since trusts are not made public the way wills are. In addition, a trust allows you to clearly outline who benefits from the home and under what conditions, which can prevent disputes.

Disadvantages of Placing Your House in a Living Trust

Setting up a trust involves upfront legal costs, ongoing maintenance, and potential administrative requirements.

Once your home is placed in an irrevocable living trust, it generally cannot be removed or altered, which reduces flexibility. Some families may find that the complexity outweighs the benefits if their estate is simple or of modest value.

What Are the Tax Implications of a Living Trust in Canada?

However, trusts are subject to the 21-year rule, which deems a sale of assets every 21 years, potentially triggering capital gains tax and affecting the lifetime capital gains exemption.

21-year rule and attribution rules

When a house is held in a trust, there are important tax considerations under the Income Tax Act.

First, the trust must report taxable income annually, which may create a tax bill if the property generates rental income. There can also be potential tax benefits, such as using attribution rules in family trusts or accessing the principal residence exemption.

The ability to shift income to family members in lower tax brackets occurs through something called attribution rules. In simple terms, attribution rules decide whether income from the trust is taxed in the hands of the beneficiary (for example, a child or spouse) or is “attributed back” to the person who set up the trust. This can affect how much tax is actually paid.

Another key rule is the 21-year rule. Every 21 years, the trust is treated as if it sold all its assets at current market value, even though no sale actually took place. This “deemed sale” can create a capital gains tax bill, which may also affect how much of the lifetime capital gains exemption (the amount of profit you can make tax-free on certain assets) can be used.

Types of Living Trusts in Canada

Inter Vivos Trusts aka. Living Trusts

These types of trusts are created while the settlor (creator) is alive.

- Revocable Living Trust: Rare in Canada because revocable trusts are not tax-advantaged; the settlor can change or dissolve it anytime, and income is taxed to the settlor.

- Irrevocable Living Trust: Cannot be changed once set up; used for estate freezes, tax planning, and asset protection.

Common Specialized Forms of Inter Vivos Trusts

- Family Trust: Holds investments or business shares for family members; allows income splitting and succession planning.

- Alter Ego Trust: For individuals aged 65+; avoids probate and lets the settlor keep income during their lifetime.

- Joint Partner Trust: Like an alter ego trust but for married/common-law couples 65+; survives until both partners pass.

Living Trust vs. Will vs. Living Estate Plan

A trust and a will are tools, but they are not the same as having a full estate plan.

A will directs how assets pass after death, while a trust can manage assets during life and beyond. An estate plan, however, brings everything together—including tax strategies, trusts, wills, and succession planning—into a complete blueprint for protecting your wealth and your family’s future.

What Is the Cost of Putting a House in a Living Trust?

Creating a living trust in Ontario usually involves legal and registration fees, which vary depending on complexity.

The cost of setting up a living trust in Canada typically ranges from $2,000 to $15,000 when done through a legal professional. This price depends on the complexity of your financial situation and the assets being placed in the trust.

Beyond the setup, there may be ongoing maintenance costs such as trustee fees, accounting work, and compliance filings. For many families, the cost is outweighed by the probate savings and the peace of mind provided.

Read More: The Cost of a Living Trust in Canada

Is a Living Trust Right for Your House?

The decision depends on your family’s unique needs.

If you want to protect your home, reduce probate fees, and ensure smooth transitions for your family members, a trust may be worth considering.

However, you should speak with an experienced estate planning lawyer and financial planner to evaluate whether a trust is the best fit for your situation.

Common Questions about Living Trusts

Do I still pay property tax if my house is in a trust?

Yes, property tax is still payable even if the house is owned by a trust.

Can I be the trustee of my own living trust in Canada?

Yes, you can act as your own trustee, though you should name a successor trustee.

Will putting my house in a trust affect my mortgage?

In most cases, lenders allow it, but it is important to notify the bank first.

Can a house in a trust be rented out?

Yes, a trust-owned house can be rented, and the trust must report rental income.

Does a living trust protect my house from creditors?

Only an irrevocable living trust may provide some creditor protection, not a revocable one.

Is it better to gift a house or put it in a trust?

A trust often avoids immediate tax consequences, while gifting may trigger capital gains tax.

What is an irrevocable trust?

It is a trust that cannot be changed once set up, used for estate freezes and asset protection.

What is a testamentary trust?

It is a trust created in a will that takes effect only after death.

How much does a living trust cost in Ontario?

Costs vary but often range from several thousand dollars plus ongoing trustee or accounting fees.

Discover the Benefits of a Living Trust in Ontario

Are you an Ontario resident considering a living trust as part of your estate planning?

At Strategic Wealth Protection Partners, we’re here to guide you through every step of the process with expert advice and personalized support. Begin your estate planning journey today with a Living Estate Plan Consultation from our experienced team.

Our mission at SWPP is to help you create an estate plan that secures your legacy, shields your assets from unnecessary taxation, and ensures your loved ones are cared for. By designing a living trust tailored to your goals, our experts will help you build a plan that truly reflects your values and priorities.

Take control of your future—start planning today!

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- Pros and Cons of Putting a House in a Trust in Canada

- How to Avoid Inheritance Tax on a House in Canada

- Guide to Holding Property in a Trust in Ontario

- Living Trust Ontario Guide: What It Is & Do You Need One?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.