When it comes to planning your legacy, it’s not just about numbers. It’s about ensuring your family remembers you for many years to come.

It’s about ensuring your family remembers you for many years to come.

We understand that estate planning and creating trusts can feel intimidating and overwhelming. It can be particularly stressful if you’ve never done it before.

And most people don’t have the time or expertise to navigate Ontario estate planning on their own.

That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we’ll guide you through the process.

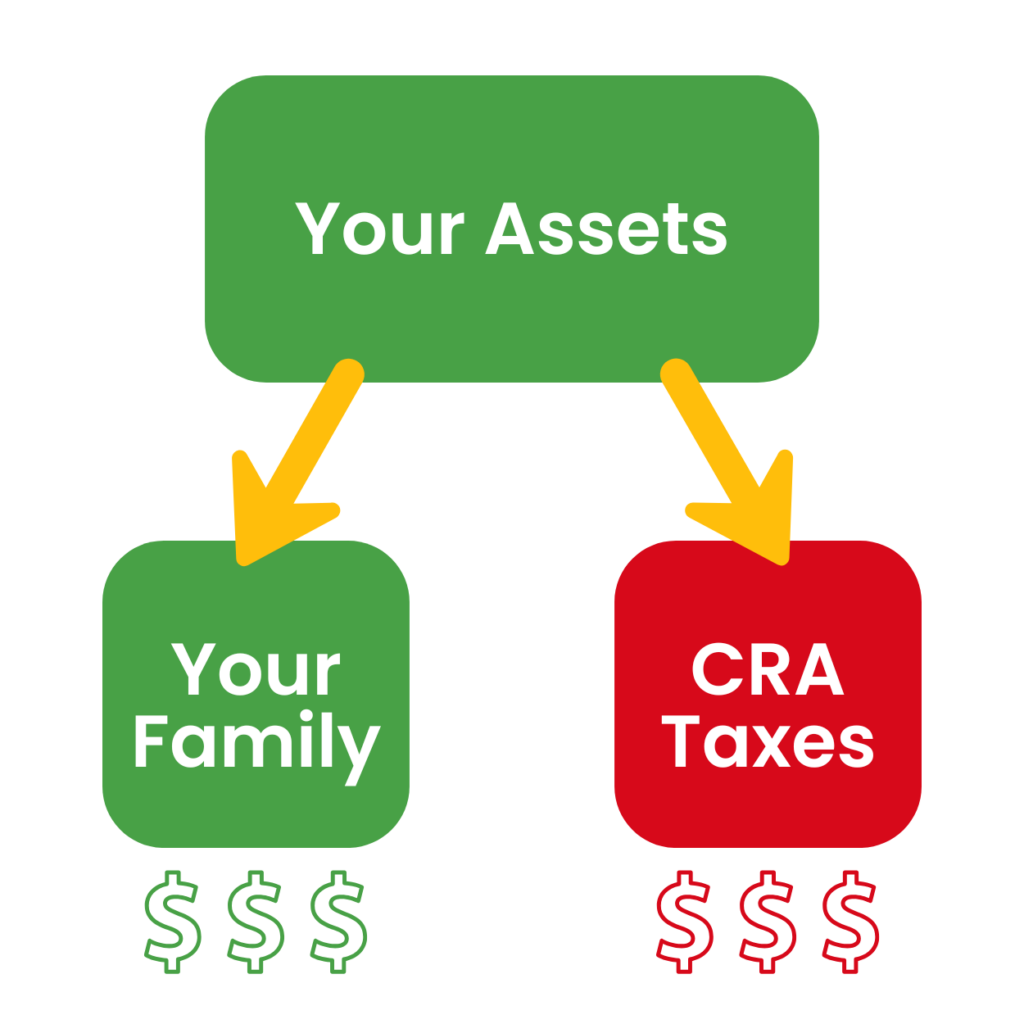

We’ll simplifying every step to help you create a comprehensive estate plan or trust that protects your assets from unnecessary taxes and probate fees.

It’s not just about financial security.

It’s about creating a meaningful legacy that reflects your values, provides lasting memories for your loved ones, and ensures your wishes are honoured.

Your first call will be a 30-minute complimentary assessment.

Share the problems you’re looking to solve and the goals you’d like to achieve.

Get a customized plan designed to dramatically reduce taxes and fees

Does the thought of spending unnecessary money stop you from getting the advice you need?

At Strategic Wealth Protection Partners Inc. (SWPP), we are committed to helping you reduce taxes and probate fees while building a legacy you’re excited to share with your family.

We believe in earning your trust first, which is why we offer a no-risk guarantee—our $500 planning fee is only payable after we deliver your completed plan. And if we can’t show you how to save at least 100 times your investment, you pay nothing.

That’s right—if we can’t help you preserve $50,000 or more for your family, your plan is completely free.

Experience the peace of mind that comes with smart planning—schedule your free consultation today and start securing your financial future without any risk.

Ron Cooke

President, Strategic Wealth Protection Partners Inc.

An estate plan does the following:

This heartfelt resource captures your story, wishes, and memories. It also shares essential details like assets, accounts, and end-of-life plans.

This journal ensures your family is left with clarity, comfort, and a lasting reminder of how much you cared.

Whether you’re looking to establish a trust to secure your assets or an estate plan that minimizes taxes and fees, we’re here to make it easy and effective.

Take the first step today. Schedule an introductory call. Click on the link below or use our calendar to schedule a call.

Schedule Your Estate Planning Consultation

If there are no times that fit your schedule, please use our contact form or call (905) 727 7001.