Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

There is no “inheritance tax” in Ontario, but that doesn’t mean your estate won’t take a huge tax hit.

When someone passes away, their estate can lose more than 50% of its value to taxes if proper planning isn’t in place.

While Ontario does not have a specific “inheritance tax,” the government collects taxes through capital gains, final income tax returns, and estate administration fees.

For high-net-worth individuals, this can mean millions in taxes that could have been reduced or deferred with strategic estate planning. Understanding how these taxes work is essential to protecting your wealth if you own a business or multiple properties or have large investment accounts.

For example, registered accounts like RRSPs and RRIFs are fully taxable as income in the year of death, which can push the estate into the highest tax bracket. As you can see, it’s important to understand how your estate will be taxed after you pass.

Table of Contents

- How the Government Gets Your Wealth

- Why You Need to Know What a Deemed Disposition Is

- How Do Capital Gains Taxes Apply to Inherited Property?

- Which Inherited Assets Are Taxed in Ontario?

- How Is Real Estate Taxed When Inherited?

- What Is Probate?

- How Probate Fees Are Calculated in Ontario

- How to Avoid Probate

- Determining the Value of an Estate

- Assets Excluded From the Estate Value

- What Happens When There Is a Surviving Spouse?

- What Happens When There Is No Surviving Spouse?

- Transferring Investments and Retirement Accounts

- Inheritance and Business Ownership

- How to Minimize Taxes on an Inheritance in Ontario

- Executor Responsibilities and Tax Obligations

- How to Select the Right Executor

- Final Thoughts on Estate and Inheritance Taxes

- Common Questions

Your Final Tax Return Upon Death in Ontario Is How the Government Gets Your Wealth

The biggest tax hit happens when your final tax return is filed.

When you die, the government treats it as if you sold everything you own at fair market value. This can trigger capital gains tax on real estate, investment portfolios, and private businesses. The tax bill is paid from your estate before anything is passed to your heirs. RRSP or RRIF become fully taxable in the estate as well.

If you have significant assets, this could mean a tax bill in the millions. Planning ahead with trusts, tax-efficient investment structures, and proper beneficiary designations can help minimize the damage and ensure your heirs receive what you intended.

Why You Need to Know What a Deemed Disposition Is

Upon death, your assets are considered sold, even if no actual sale happens.

This is known as a deemed disposition, and it triggers capital gains tax on assets like cottages, rental properties, stocks, and private businesses. For example, if you bought a lakefront cottage for $500,000 and it’s now worth $2 million, the $1.5 million gain is subject to tax. Half of that gain is taxable, meaning a potential tax bill of over $400,000. If your heirs don’t have cash to cover it, they might be forced to sell the cottage.

Estate planning strategies (e.g., using trusts or gifting assets during your lifetime) can reduce this burden and protect your legacy.

How Do Capital Gains Taxes Apply to Inherited Property?

Capital gains tax is triggered when a property is inherited, but it applies to the estate, not the beneficiary.

As mentioned previously, when someone dies, the government treats all their assets as if they were sold at fair market value. This means that if a property has appreciated in value since it was purchased, the estate must pay capital gains tax on the increase. Only 50% of the capital gain is taxable, but at high-income tax rates, this can take a big chunk out of an estate.

Proper planning—like using a spousal rollover or trusts—can reduce or defer these taxes.

Which Inherited Assets Are Taxed in Ontario?

Some assets come with a tax bill, while others pass to heirs tax-free.

Real estate, investment accounts, and private businesses may be subject to capital gains tax when inherited, depending on their value increase. The estate—not the beneficiary—pays this tax.

Additionally, Ontario estates over $50,000 must pay an Estate Administration Tax, also referred to as probate fees.

However, life insurance proceeds and TFSAs pass to beneficiaries tax-free if structured properly.

How Is Real Estate Taxed When Inherited?

Inherited real estate can trigger a large tax bill, but exemptions may help.

When a property is inherited, the estate must pay capital gains tax if the property has increased in value. The taxable gain is based on the difference between the original purchase price and the market value at the time of death. However, if the property was the deceased’s principal residence, the principal residence exemption can eliminate capital gains tax.

For secondary properties—like cottages or rental homes—this tax can be substantial. Proper estate planning can help reduce the tax impact, especially for families with multiple properties.

What Is Probate?

Probate is the legal process that confirms a will and gives the executor authority.

When someone dies, their will must often go through probate to be validated by the court. Probate gives the executor the legal right to distribute assets and settle the estate.

If assets were held jointly or named beneficiaries were assigned (such as in life insurance policies), probate may not be required. However, for bank accounts, real estate, and investments without beneficiaries, probate is often necessary.

Since probate fees are based on the estate’s value, strategic estate planning can help reduce or avoid unnecessary costs.

How Probate Fees Are Calculated in Ontario

Probate fees are based on the value of the estate. Estates over $50,000 must pay an Estate Administration Tax, which is 1.5% of the estate’s value above the first $50,000. For an estate worth $10 million, that means $149,500 in probate fees.

Certain assets (e.g., jointly held property and life insurance with named beneficiaries) can avoid probate. Careful planning—including the use of multiple wills and trusts—can help minimize these fees.

Ontario Probate Fee Calculator

How to Avoid Probate

While probate is often necessary, certain strategies can help minimize probate costs in Ontario:

- Name beneficiaries on registered accounts – RRSPs, RRIFs, TFSAs, and life insurance policies can pass directly to beneficiaries without probate.

- Hold property jointly with right of survivorship – Jointly owned real estate and bank accounts can transfer directly to the surviving owner.

- Use multiple wills – A secondary will for private company shares and certain assets can reduce probate fees.

- Transfer assets to a trust – Trusts allow assets to bypass probate while maintaining control over distribution.

- Gift assets during your lifetime – Gifting property or investments before death removes them from your estate, reducing probate exposure.

Determining the Value of an Estate

The total estate value includes all assets owned at the time of death.

The estate administration tax (probate fees) in Ontario is based on the total value of the estate. This includes:

- Real estate (minus mortgages held in the deceased’s name)

- Investments, stocks, bonds, and mutual funds

- Cash and bank account balances

- Vehicles, jewelry, and valuable personal property

- Private business shares

The proper structuring of assets can help reduce probate costs and preserve wealth for beneficiaries.

Assets Excluded From the Estate Value

Certain assets are not included in probate calculations.

When calculating estate administration tax in Ontario, some of your assets will be excluded because they pass directly to beneficiaries or are structured outside of the estate. These include:

- Life insurance policies with named beneficiaries – The payout goes directly to the beneficiary and bypasses probate.

- Registered accounts with named beneficiaries – RRSPs, RRIFs, and TFSAs- are transferred outside of the estate if a beneficiary is assigned.

- Jointly owned property with right of survivorship – Homes, bank accounts, and other jointly owned assets transfer to the surviving owner without probate.

- Pension plans and annuities – Many pension benefits go directly to a surviving spouse or designated beneficiary.

- Trust-held assets – Assets placed in a trust before death do not go through probate, as they are no longer legally part of the estate.

As you can see, working with a professional is key if you have a complex estate with substantial assets.

What Happens When There Is a Surviving Spouse?

When a spouse inherits assets, taxes can often be deferred—but only with proper planning.

In Canada, when assets are transferred to a surviving spouse, they generally pass on a tax-deferred basis. This means the estate does not have to pay capital gains tax immediately. Instead, the surviving spouse inherits the assets at their original cost, delaying taxation until they sell the asset or pass away.

This applies to real estate, investments, and registered accounts like RRSPs and RRIFs—as long as the spouse is named as the beneficiary. Without this designation, the estate may have to pay taxes right away.

What Happens When There Is No Surviving Spouse?

When no spouse is left, the tax bill comes due—often in the hundreds of thousands or even millions.

If there is no surviving spouse, the government treats all assets as if they were sold at fair market value on the date of death. This deemed disposition can trigger significant capital gains tax, particularly on appreciated real estate, investment portfolios, and business holdings.

Registered accounts like RRSPs and RRIFs are fully taxable as income in the year of death, which can push the estate into the highest tax bracket. Without proper planning, heirs may be forced to sell assets just to cover the tax bill. Strategies like trusts, gifting, and staggered asset transfers can help reduce this burden and preserve more wealth for the next generation.

Transferring Investments and Retirement Accounts

RRSPs and RRIFs can trigger a massive tax bill if not transferred properly.

- When an RRSP or RRIF is inherited, the full value is considered taxable income in the year of death.

- If the account transfers to a surviving spouse or a financially dependent child or grandchild, taxes can be deferred.

- Without a tax-deferred transfer, the estate may face a tax bill of up to 50% of the account’s value.

- TFSAs are tax-free for beneficiaries, but only a spouse can inherit the account itself and continue its tax-free status.

- Strategies like naming the right beneficiaries and gradual withdrawals can help reduce tax exposure and preserve wealth.

Inheritance and Business Ownership

Private business owners face unique tax challenges when passing down their company.

When a business owner dies, their shares are treated as sold at fair market value, triggering capital gains tax on any appreciation. If the business is eligible for the Lifetime Capital Gains Exemption (LCGE)—currently over $1,250,000—some or all of the gain may be tax-free.

However, without proper planning, heirs may face liquidity issues, forced sales, or disputes over ownership. Family trusts, estate freezes, and buy-sell agreements can help reduce taxes and ensure a smooth transition. Planning ensures that the business remains intact and that wealth is transferred efficiently.

For more information on capital gains deduction limits, see the Government of Canada website.

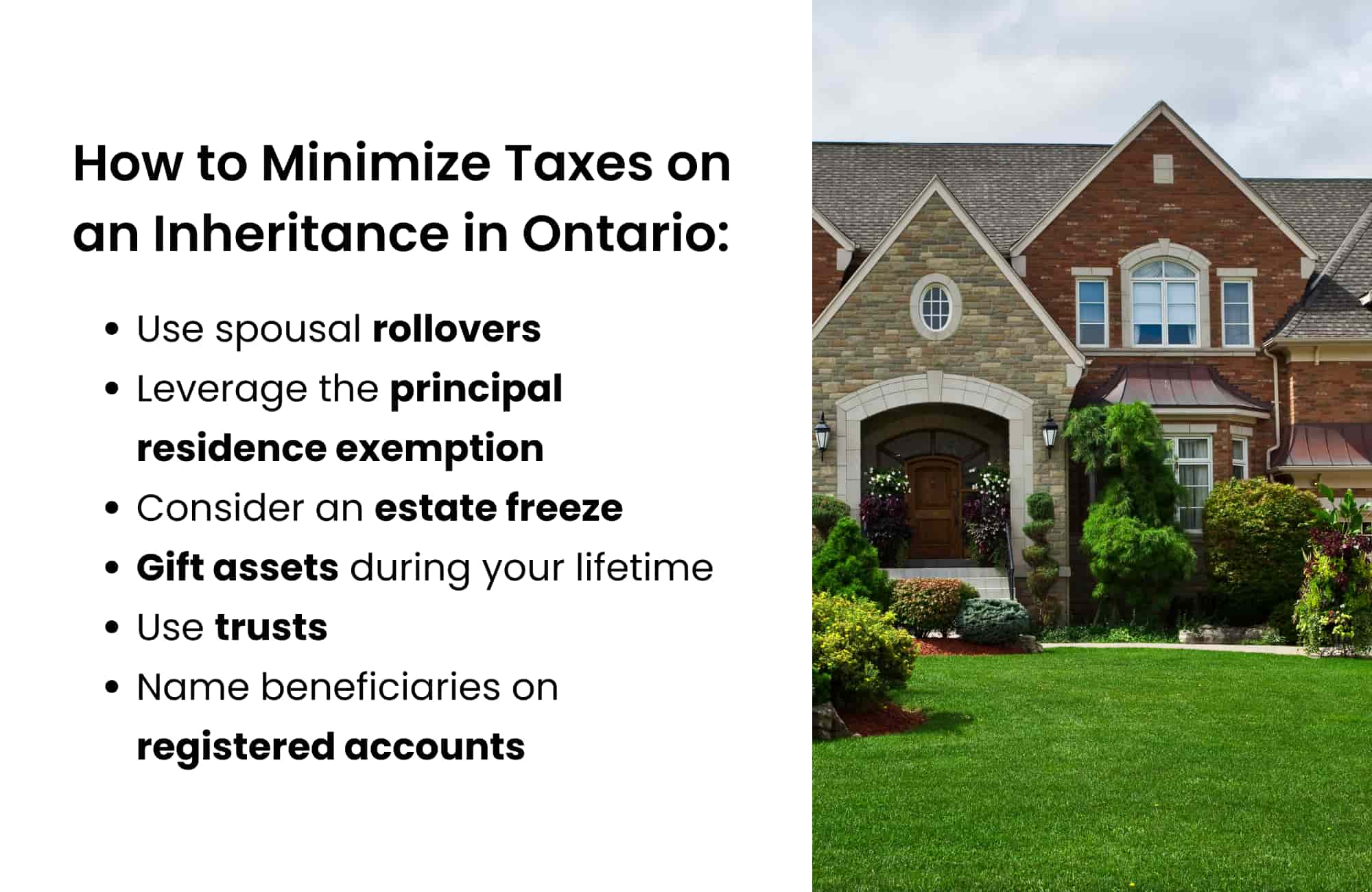

How to Minimize Taxes on an Inheritance in Ontario

Smart planning can significantly reduce the tax burden on inherited assets.

- Use spousal rollovers – Transferring RRSPs, RRIFs, and capital property to a surviving spouse can defer taxes until they pass away or sell the assets.

- Leverage the principal residence exemption – Designating a primary home as the principal residence can eliminate capital gains tax on that property.

- Consider an estate freeze – Business owners can lock in current asset values to pass future growth to heirs with reduced tax liability.

- Gift assets during your lifetime – Transferring property or investments before death can minimize estate taxes, though this requires careful planning to avoid unintended tax consequences.

- Use trusts – Family trusts and alter ego trusts can help control asset distribution while minimizing probate and income taxes.

- Name beneficiaries on registered accounts – RRSPs, RRIFs, and TFSAs with named beneficiaries bypass probate, reducing estate administration tax.

Executor Responsibilities and Tax Obligations

An executor has legal and financial duties—including handling taxes—when settling an estate.

- File the deceased’s final tax return – This must be completed within six months of death or by April 30 of the following year, whichever is later.

- Pay any outstanding income tax – The estate must cover taxes on capital gains, RRSPs, and other income before distributing assets.

- Handle estate administration tax (probate fees) – If probate is required, the executor must calculate and pay Ontario’s 1.5% tax on estate assets over $50,000.

- File an Estate Information Return – This must be submitted to the Ontario government within 180 days of receiving probate approval.

- Ensure compliance with CRA audits – The Canada Revenue Agency can review estate filings and issue reassessments, potentially increasing tax liabilities.

- Avoid personal liability – Executors can be held personally responsible for unpaid taxes if they distribute the estate before settling tax obligations. Seeking professional guidance is essential.

How to Select the Right Executor

Choosing the right executor is critical to ensuring your estate is handled smoothly and efficiently.

An executor is responsible for managing your estate, filing taxes, paying debts, and distributing assets to beneficiaries. This role can be complex, especially for high-net-worth individuals with multiple properties, businesses, and investments.

An executor should be organized, financially literate, and impartial to prevent conflicts among heirs. Many people choose a trusted family member, but in cases of complex estates, a professional executor, lawyer, or trust company may be a better choice.

Selecting the right person—or team—can prevent costly mistakes and ensure that your estate is settled properly.

Final Thoughts on Estate and Inheritance Taxes

Without proper planning, estate taxes can take a massive bite out of your wealth.

Ontario does not have a direct inheritance tax, but capital gains taxes, probate fees, and income taxes on registered accounts can erode over 50% of an estate’s value. Business owners, real estate investors, and those with significant assets need strategic estate planning to minimize these costs.

Tools like spousal rollovers, trusts, gifting, and proper beneficiary designations can help protect your legacy.

The best way to safeguard your wealth for future generations is to work with an experienced cross-border financial advisor, tax specialist, and estate lawyer to ensure everything is structured efficiently.

Estate planning is not just about avoiding taxes—it’s about securing your family’s financial future.

Common Questions about Inheritance Tax in Ontario

Do you have to report inheritance money to the CRA?

No, inheritance money itself is not taxable in Canada and does not need to be reported to the CRA.

However, if you earn income from inherited assets—such as rental income from a property or investment gains—you must report that income on your tax return.

Are gifts from an estate taxable in Canada?

No, gifts from an estate are not taxable for the beneficiary.

However, the estate itself may owe taxes on capital gains or income before distributing assets. Proper estate planning can help minimize these taxes and ensure beneficiaries receive their full inheritance.

Do beneficiaries pay tax on life insurance payouts in Canada?

No, life insurance payouts to a named beneficiary are tax-free.

However, if the life insurance proceeds are paid to the estate instead, they may be subject to probate fees and could be used to cover estate taxes or debts.

Can you give a living inheritance without tax consequences in Canada?

Yes, Canada has no gift tax, so you can give money or assets during your lifetime without immediate tax consequences.

However, gifting certain assets—such as real estate or stocks—may trigger a capital gains tax on any increase in value from the original purchase price.

What are the tax consequences of leaving my assets to a common-law partner?

Common-law partners are treated the same as married spouses for tax purposes.

This means they can inherit RRSPs, RRIFs, and real estate tax-free through a spousal rollover, deferring taxes until they sell the asset or pass away. Proper planning ensures a smooth transfer of wealth.

Which Canadian inheritance tax laws govern capital gains?

Canada does not have an inheritance tax, but when someone dies, their assets are considered sold at fair market value.

This deemed disposition triggers capital gains tax, which the estate must pay before distributing assets. Strategic estate planning can help reduce or defer this tax burden.

Discover How to Minimize Taxes and Secure Your Legacy

Did you know that without a solid estate plan, taxes and fees in Ontario could claim a significant portion of your wealth?

If you’ve worked hard to build your business, investments, and properties, protecting your legacy for your loved ones is critical. At Strategic Wealth Protection Partners, we specialize in helping high-net-worth individuals in Ontario secure their financial futures.

Our Living Estate Plan is designed to:

- Reduce estate taxes and probate fees.

- Simplify wealth transfer to your loved ones.

- Reflect your values and priorities in every detail.

Your Legacy Matters

With our personalized guidance, we’ll help you navigate options like Living Trusts to protect your assets and ensure your family’s peace of mind. Contact us today to book your Living Estate Plan Consultation and take the first step toward a secure future.

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- What Is the Final Tax Return After Death in Canada?

- How Much Is Probate Tax in Ontario?

- What Is the Final Tax Return After Death in Canada?

- Can I Write My Own Will in Ontario?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.