Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

Writing Your Will in Ontario

A legal will protects your wishes and your loved ones.

Without a will, the Ontario courts will decide who gets your assets and who will administer your estate, both of which may not match what you want.

A will is a legally binding document that gives instructions on who receives your assets and when. It also covers who will look after any dependent children. And it names someone to carry out your wishes and administer your estate.

Many people put off writing a will because they worry it’s too complicated, or they think they have plenty of time. But life is unpredictable. Having a proper will in place gives you peace of mind You’ll know that your family is protected and your legacy will be handled as you wish.

In this post, I’ll cover how to write a will in Ontario including step-by-step instructions on how to get started.

Table of Contents

- Brief Overview of Writing a Will

- How to Write a Will in Ontario: Step-by-Step Guide

- Key Facts about Wills in Ontario

- Should You Write Your Own Will?

- How to Keep Your Will Up to Date

- The Benefits of Working with a Professional If You Have Substantial Assets

- Why You Should Reach Out to SWPP

- A Will Is Not an Estate Plan

- What an Estate Plan Does for You

- What Happens If You Don’t Have a Will in Ontario?

- Working with a Lawyer to Make a Will

- When to Speak with an Accountant and Financial Advisor

- How to Choose Your Estate Trustee (Executor)

- Estate Taxes and Probate Planning

- Key Estate Planning Tools to Consider

- Considering Living Trusts

- Common Questions About Wills in Ontario

Brief Overview of Writing a Will

Start by listing your assets and deciding who should receive them.

Then, choose an executor to carry out your wishes and, if needed, name a guardian for minor children. Finally, work with a lawyer to draft a legally valid will, sign it properly, and store it in a safe place.

For more details on how to write a will in Ontario, keep reading.

And if you live in Ontario and have a complex estate, I recommend you learn more about SWPP’s Living Estate Plan. A will is not enough, particularly if you have substantial assets including real estate or businesses.

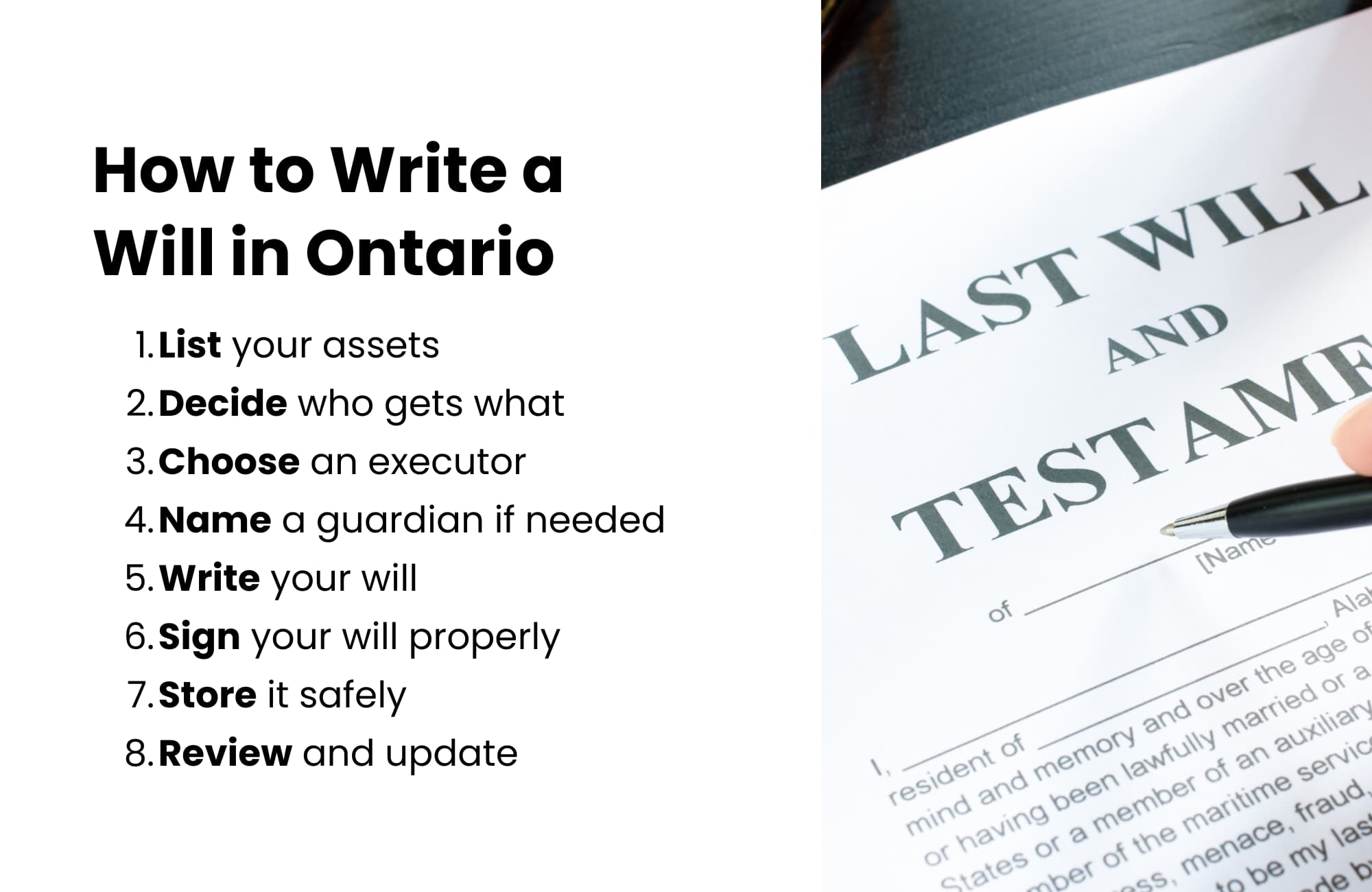

How to Write a Will in Ontario: A Simple Step-by-Step Guide

- Review and update – Revise your will after major life changes.

- List your assets – Include property, bank accounts, investments, and personal belongings.

- Decide who gets what – Name beneficiaries for each asset.

- Choose an executor – Select a trusted person to manage your estate.

- Name a guardian if needed – Pick someone to care for minor children.

- Write your will – Use a lawyer, will kit, or handwritten (holograph) will.

- Sign your will properly – A typed will needs two adult witnesses.

- Store it safely – Keep it in a secure place and tell your executor.

Key Facts about Wills in Ontario

A will is a legal document that protects your estate.

- A will allows you to choose who receives your assets after you pass away.

- You must be at least 18 years old and of sound mind to create a will.

- A handwritten will must be entirely in your handwriting and signed.

- A typed will requires two adult witnesses who are not beneficiaries.

- Without a will, the Ontario government decides how your estate is distributed.

Should You Write Your Own Will?

Writing your own will can be risky if done incorrectly.

You need to clearly state who will receive your assets and who will manage your estate. If you type your will, two witnesses must sign it, and they cannot be beneficiaries. (A beneficiary is someone who benefits from the will i.e. inherits some of your assets.)

A handwritten will does not require witnesses, but it must be written entirely by you. Mistakes can cause delays, legal battles, or assets going to the wrong people.

A lawyer can ensure your will follows Ontario law. If you have significant assets or family considerations, professional help is the best way to protect your wishes and avoid costly errors.

However, if you’d like to write your own will, there are three main ways to do so:

- Using an Online Tool

- Completing a Will Kit

- Writing it By Hand

If you have substantial assets, I would not recommend going the DIY route. Nonetheless, you may find this information interesting. (+)

Using an Online Tool

Online will platforms provide templates, but they have limitations.

Many websites offer step-by-step guidance to create a basic will. These tools can be useful if your estate is simple and you do not have complex assets. However, they may not account for specific legal issues, like cross-border assets, blended families, or business ownership.

If the document is not properly signed or witnessed, it may not be legally valid. Mistakes can lead to disputes or delays in settling your estate. If you choose this option, review it carefully and consider having a lawyer check it.

In addition, an online tool won’t help you deal with potential tax implications. When you work with an estate planning professional, they can help you minimize taxes and ensure you leave a well-organized estate.

Completing a Will Kit

A will kit provides a fill-in-the-blank approach, but it may not meet your specific needs.

These kits include pre-written forms with spaces to enter your beneficiaries, executor, and asset details. They are simple to use but don’t offer legal guidance. If your estate is complex or if you have specific wishes, a kit may not cover everything properly.

A will kit must be signed and witnessed correctly to be valid. Errors can cause confusion, and courts may reject it. If you use a will kit, follow the instructions exactly and review it with a legal professional if possible.

Writing a Handwritten Will, Called a Holograph Will

A holograph will is valid in Ontario, but it comes with risks.

A holograph will must be entirely written by hand and signed by you. It does not require witnesses, which makes it an easy option in urgent situations. However, unclear wording or missing details can create legal problems.

If your instructions are vague or incomplete, your will may be challenged in court. A handwritten will should be a last resort rather than your primary estate plan. For better protection, consider a formal will prepared with legal guidance.

How to Keep Your Will Up to Date

A will should change as your life changes.

Major events like marriage, divorce, new children, or significant financial shifts can affect your estate plan. If your will does not reflect your current situation, your assets may not go where you intend. A review every few years ensures that your wishes are clear and legally valid.

Even small changes require legal steps. You can update your will by creating a new one or adding a codicil, a formal amendment. Keeping your will current protects your loved ones and ensures your estate is handled as you want.

The Benefits of Working with a Professional If You Have Substantial Assets

Who You Work With Matters

A will is only one part of protecting your wealth and your family.

If you have different types of assets or assets more than $2 million dollars, a simple will may not be enough. Estate planning involves tax strategies, investment management, and legal protection to ensure your legacy is preserved.

A team of professionals—including an estate lawyer, a financial advisor, an insurance specialist, and a tax advisor—can help you create a plan that works in your best interest.

Without expert guidance, your estate could face unnecessary taxes, delays, or even disputes. Working with professionals ensures your wishes are clear, your wealth is protected, and your loved ones receive what you intend.

Why You Should Reach Out to SWPP

Your estate deserves a strategy that protects your wealth and minimizes taxes.

At Strategic Wealth Protection Partners (SWPP), we specialize in helping successful professionals, business owners, and retirees protect their legacy. Through our Living Estate Plan, we work to eliminate taxes and probate fees and ensure that more of your wealth goes to your family—not the government.

A Will Is Not an Estate Plan

A will is important, but it’s only one piece of protecting your wealth.

Many people think writing a will is enough. But a will simply directs how your assets are distributed. It doesn’t protect your estate from taxes, probate fees, or potential legal battles. If you have substantial assets, you need an Estate Plan first.

An estate plan is a full strategy for managing and passing down your wealth. It ensures your assets are structured in the most tax-efficient way, making the settlement process easier for your family. Without this planning, your estate could face unnecessary costs, delays, and family disputes.

Remember, your estate plan comes first. Your will comes second.

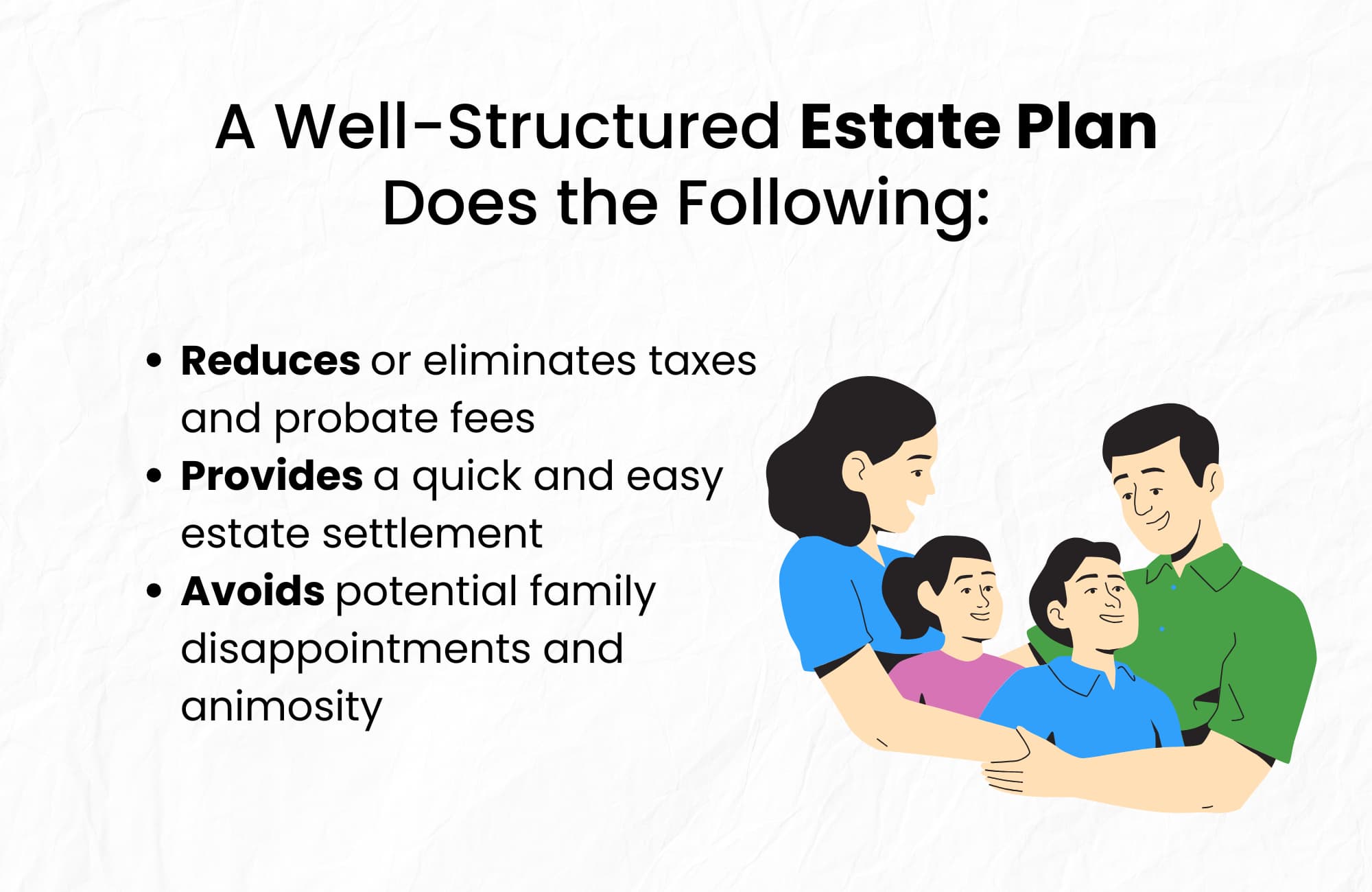

What an Estate Plan Does for You

A complete estate plan does more than just divide assets—it protects them. A well-structured estate plan does the following:

- Reduces or eliminates taxes and probate fees – Without planning, your estate could lose a significant portion to taxes. A well-structured plan helps minimize these costs.

- Provides a quick and easy estate settlement – Your family should not have to deal with delays, confusion, or legal battles. A proper estate plan ensures everything is handled efficiently.

- Avoids potential family disappointments and animosity – Clear instructions reduce the risk of conflict. Your plan can prevent misunderstandings and legal disputes.

A will provides direction, but an estate plan builds the foundation. If you want to protect your wealth and make things easier for your loved ones, start with an estate plan first—then write your will to support it.

What Happens If You Don’t Have a Will in Ontario?

If you pass away without a will, Ontario law determines who gets your assets.

This process is called dying intestate. The Ontario Succession Law Reform Act sets strict rules about how your estate is divided. Your wishes, family dynamics, and financial goals are not considered. This can create delays, higher taxes, and even legal disputes among family members.

Your spouse, children, and other relatives may not receive what you intended. If you die without a will, your spouse may not receive all your assets. If you have no close family, your estate could end up with the Ontario government. Without a will, your loved ones could face unnecessary stress, legal fees, and financial hardship.

Working with a Lawyer to Make a Will

Benefits

A lawyer ensures your will is legally sound and protects your assets.

Many people try to write their own will, but small mistakes can cause big problems. A lawyer ensures your will is clear, properly signed, and follows Ontario law. This is especially important if you have significant assets, a business, or family members with different needs.

A lawyer can also help with structuring your estate to avoid legal disputes. While there is a cost involved, it is a small price to pay for peace of mind and financial protection. A lawyer does not help with tax planning, reducing probate fees, and saving estate fees.

Downsides

The downside of working with a lawyer is the cost.

Hiring a lawyer is more expensive than using a will kit or online tool. Fees vary based on the complexity of your estate. If your assets are straightforward, you may feel that a lawyer is unnecessary.

However, mistakes in a DIY will can cost your family far more in legal fees later. A lawyer can prevent errors that lead to disputes or unexpected taxes. For most people with significant assets, the benefits outweigh the costs.

Finding a Lawyer

The Law Society of Ontario can help you find a lawyer.

If you need help finding a qualified estate lawyer, the Law Society of Ontario offers a referral service. You can access it here: Law Society Referral Service.

When to Speak with an Accountant and Financial Advisor

A lawyer drafts your will, but an accountant and estate planner help structure your assets to reduce taxes and maximize what your family receives.

If you have substantial wealth, business interests, or cross-border assets, professional guidance is essential.

An accountant helps with tax planning, ensuring your estate does not face unnecessary income tax, capital gains tax, or probate fees. A financial advisor ensures your investments, retirement accounts, and insurance policies align with your estate plan. Together, they help secure your financial future and protect your legacy.

How to Choose Your Estate Trustee (Executor)

Your estate trustee is responsible for carrying out your will and settling your estate.

This person, also called an executor, handles everything from paying debts to distributing assets. It is a critical role that requires trust, responsibility, and financial knowledge.

Choosing the right person ensures your estate is managed smoothly, while the wrong choice can create delays and disputes. Many people name a spouse or child, but not everyone is suited for the role.

If your estate is complex, consider naming a professional trustee, such as a lawyer or trust company, to avoid legal and financial complications.

Estate Taxes and Probate Planning

Without proper planning, your estate could face unnecessary taxes and delays.

In Ontario, there is no estate tax, but your estate may owe income tax and probate fees. Capital gains tax applies to certain assets, such as investments and real estate, which can create a significant tax burden.

Probate fees, officially called Estate Administration Tax, apply to most estates and are based on the total value of your assets. Proper planning, such as naming beneficiaries on registered accounts and using trusts where appropriate, can help reduce these costs.

Key Estate Planning Tools to Consider

Using the right estate planning tools can help protect your wealth and simplify asset distribution.

Joint tenancy allows assets, such as a home or bank account, to pass directly to the surviving owner without going through probate. This can be useful for spouses but may not always be the best option for estate planning, especially for tax purposes.

Life insurance provides a tax-free payout to beneficiaries, helping to cover estate costs or providing financial security for loved ones.

Trusts offer control over how and when assets are distributed, helping to reduce probate fees and protect wealth for future generations.

Each tool serves a different purpose, and professional advice ensures they are used effectively.

Considering Living Trusts

A living trust can help you protect your assets and reduce probate fees.

Unlike a will, a living trust allows you to transfer assets while you are still alive, which can help avoid probate and keep your estate private. This is especially useful if you have substantial wealth, own property in multiple locations, or want to provide for beneficiaries over time. Certain types of trusts can also help reduce taxes or protect assets from potential legal claims.

However, trusts require proper setup and ongoing management. A financial advisor and estate lawyer can help determine if a living trust is right for your situation.

👉Read More: Quick Guide to Living Trusts in Ontario

Common Questions About Wills in Ontario

Can I write my own will in Ontario?

Yes, you can write your own will in Ontario, but it must follow legal requirements.

A handwritten will (holograph will) must be entirely in your handwriting and signed. A typed will must be signed in front of two adult witnesses. Mistakes can cause legal issues or disputes.

Should I write a will without a lawyer?

You can, but it’s risky, especially if you have substantial assets or a complex estate.

A lawyer ensures your will is legally valid and structured properly to reduce taxes and avoid disputes. DIY wills often contain errors that lead to delays, legal fees, or assets not being distributed as intended.

Is a will kit legal in Ontario?

Yes, a will kit can be legal if it meets Ontario’s requirements.

It must be signed and witnessed correctly to be valid. However, will kits are generic and may not cover all situations, especially if you have significant assets, dependents, or special family circumstances. Legal advice is recommended.

How much does it cost to write a will in Ontario?

Costs vary depending on the method.

A will kit or online tool may cost under $100, while a lawyer-drafted will typically costs between $400 and $1,500. Complex estates requiring tax or trust planning will cost more. The investment ensures your estate is handled properly and your wishes are protected.

How do I write a will without a lawyer in Canada?

You can use a will kit, an online service, or write a handwritten (holograph) will.

A typed will must be signed in front of two witnesses who are not beneficiaries. A handwritten will must be written entirely by you. Without legal guidance, errors may cause future complications.

Can anyone legally make a will?

To make a will in Ontario, you must be at least 18 years old and of sound mind.

This means you understand what a will is, what assets you own, and to whom you are leaving them. Some exceptions allow younger individuals, like military members, to make a will.

Can I make a will if I’m under 18?

If you are under 18 years old, you can make a will if you are married or were married, thinking about marriage to a person, and your will states this, and you marry the named person, a member of the Canadian Forces or a sailor at sea or on a voyage.

How can I ensure that my will is a legally binding document?

Your will must be properly signed and witnessed to be legally valid in Ontario.

A handwritten (holograph) will must be entirely in your handwriting and signed. A typed will requires two adult witnesses who are not beneficiaries. Working with a lawyer ensures your will meets all legal requirements.

What is an estate executor?

An estate executor, also called an estate trustee, is the person responsible for carrying out your will.

They manage your assets, pay debts, file taxes, and distribute your estate to beneficiaries. Choosing a trustworthy and organized executor is important to ensure your estate is settled smoothly and efficiently.

What will happen to my entire estate if I don’t have a will?

If you die without a will in Ontario, your estate is distributed according to provincial intestacy laws.

Your spouse and children may inherit first, but the government decides who gets what. This process can cause delays, higher taxes, and potential disputes among family members, making estate settlement more difficult.

What is a trust and do I need one?

A trust is a legal arrangement where assets are held by a trustee for the benefit of someone else.

Trusts can help reduce taxes, avoid probate, and provide long-term financial support for beneficiaries. You may need one if you have significant assets, dependents, or specific estate planning goals.

A Will Isn’t Enough to Protect Your Family’s Inheritance

Writing a will is a crucial step, but it’s just the beginning.

A will only states who gets what, but it doesn’t help you minimize estate taxes, avoid probate fees, or prevent legal delays.

In Ontario, probate fees (Estate Administration Tax) and capital gains taxes on properties can take a significant portion of your estate. If you own multiple properties, the financial burden could be even greater, forcing your loved ones to sell assets just to cover unexpected costs.

Without proper estate planning, your family could receive far less than you intended. The good news? There are strategies to protect your wealth—but they must be set up before it’s too late.

Keep Your Wealth in the Family with Proper Planning

A well-structured estate plan does more than just pass on your assets—it ensures your wealth stays in the family.

By using tools like trusts, life insurance, and gifting strategies, you can:

✅ Reduce or eliminate probate fees

✅ Minimize capital gains taxes on real estate

✅ Prevent legal disputes and family conflicts

Without these safeguards, your loved ones may face delays, unnecessary legal battles, and financial strain. A strong estate plan gives you peace of mind, knowing that your family will be cared for and your legacy will be protected exactly as you intended.

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re writing a will, you may find these articles helpful:

- Is a Living Trust Better than a Will in Canada?

- Why Do People Use a Trust Instead of a Will in Canada?

- How Much Does a Will Cost in Ontario?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.