Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

How much is estate tax in Ontario?

It’s important to know that while there is no estate tax in Ontario, there are probate fees and capital gains taxes upon death. This can add up to a significant tax hit when someone dies.

Nobody wants to work hard their whole life, build up wealth, and then discover that a huge chunk of what they’ve built is going to the government.

But that’s what happens in most families.

In this blog, we’ll clearly break down how Ontario’s Estate Administration Tax works, what assets are included, and share practical tips on how you might reduce these costs.

Key Takeaways

- Ontario has no inheritance tax but estates may pay probate tax

- Probate applies to assets solely owned by the deceased

- Assets with beneficiary designations or joint ownership often bypass probate

- Estate administration tax is 1.5 percent above $50,000

- Proper planning reduces taxes payable and preserves estate assets

What Is the Estate Administration Tax in Ontario?

The Estate Administration Tax is a provincial fee paid to the Ontario government when an estate goes through probate.

It is often called probate fees, but its official name is estate administration tax. The estate trustee must calculate estate administration tax based on the estimated estate value and pay it before estate assets can be distributed.

This tax applies when probate is required, and it is paid from the deceased’s estate, not by individual beneficiaries.

When Is Probate Required in Ontario?

Probate is required when legal authority is needed to confirm the validity of a will or to transfer estate assets.

It is often necessary when there is real estate held solely in the deceased’s name or when banks require probate before releasing funds. In some cases probate can be avoided if assets are jointly owned or if there are proper beneficiary designations on accounts.

What Assets Are Subject to Probate in Ontario?

Assets that are owned solely by the deceased usually require probate.

This often includes real estate registered only in the deceased’s name, non-registered investment accounts, mutual funds without named beneficiaries, and bank accounts that do not have joint owners.

These estate assets form part of the calculation for probate fees and increase the taxes payable by the estate.

What Assets Can Bypass Probate in Ontario?

Some estate assets do not go through probate, reducing the amount of probate tax that must be paid.

Assets with a direct beneficiary designation, such as life insurance, RRSPs, RRIFs, or TFSAs, bypass the estate and go directly to the beneficiary. Joint ownership with right of survivorship also allows assets like homes and bank accounts to pass outside the estate, lowering the taxable estate value.

How Is the Estate Administration Tax Calculated?

The tax is calculated based on the fair market value of all assets included in the probate application.

The first $50,000 is exempt, and anything above that is taxed at 1.5 percent. For example, if the estimated estate value is $800,000, the estate would pay estate administration tax of $11,250.

Ontario Probate Fee Calculator

Is There Tax on RRSPs, RRIFs, and Real Estate Upon Death?

RRSPs and RRIFs are not subject to probate if there is a named beneficiary, but they are fully taxable as income on the deceased’s final return unless rolled to a spouse.

Real estate is treated as if it was sold at fair market value immediately before death, creating capital gains that can result in taxes payable by the estate.

Do Beneficiaries Pay Inheritance Tax?

Beneficiaries in Ontario do not pay inheritance tax because Canada does not have one.

However, they may receive assets that have already been reduced by income tax or capital gains tax paid by the estate.

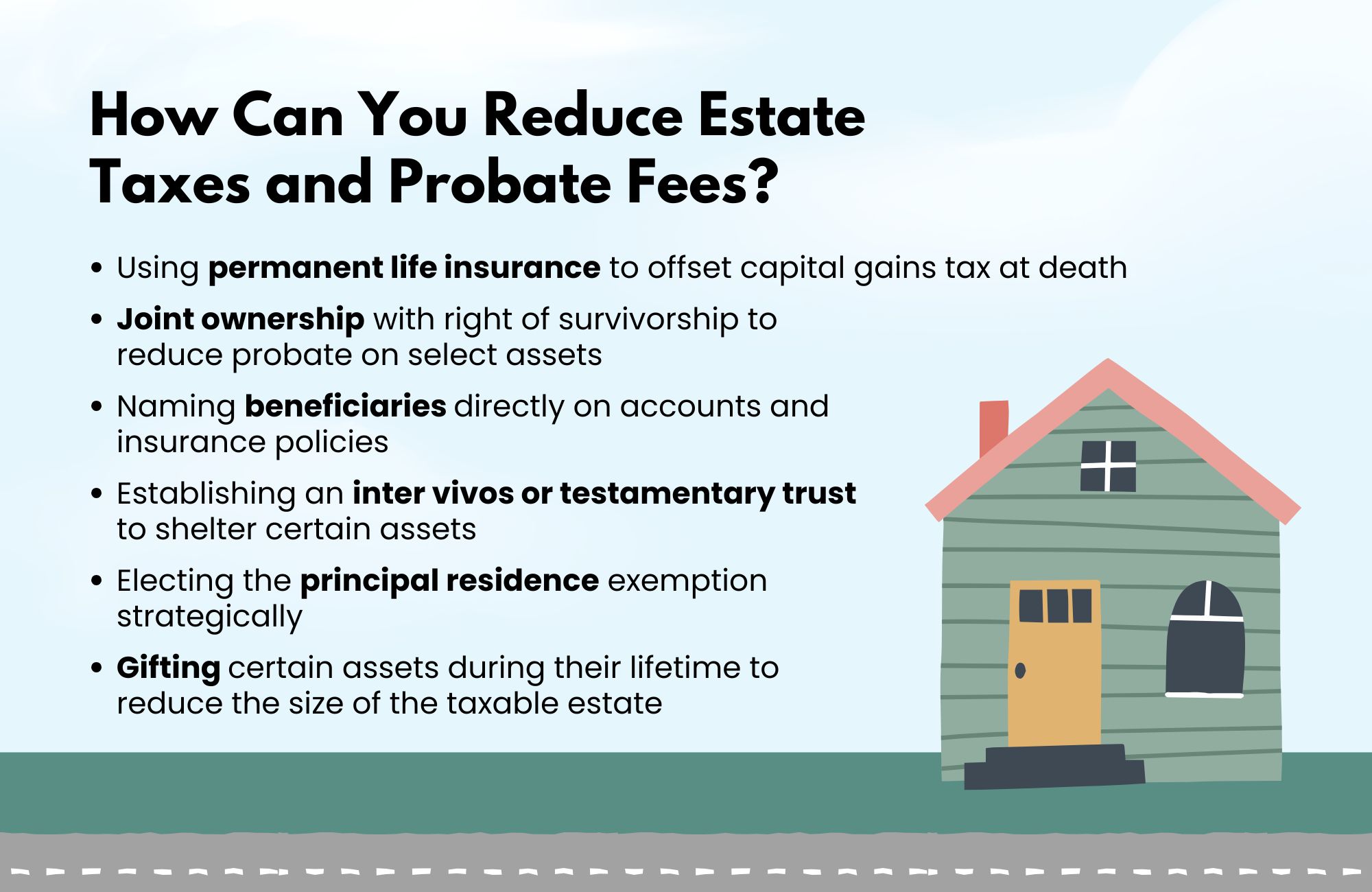

How Can You Reduce Estate Taxes and Probate Fees?

Families can protect more of their wealth through thoughtful estate planning strategies such as:

- Using permanent life insurance to offset capital gains tax at death

- Joint ownership with right of survivorship to reduce probate on select assets

- Naming beneficiaries directly on accounts and insurance policies

- Establishing an inter vivos or testamentary trust to shelter certain assets

- Electing the principal residence exemption strategically

- Gifting certain assets during their lifetime to reduce the size of the taxable estate

What Is the Estate Information Return?

The estate trustee must file an Estate Information Return with the Ministry of Finance after receiving probate.

This document provides a detailed breakdown of the estate assets and their fair market value. It must be filed within 180 days of the probate certificate being issued, and failure to file can result in penalties.

Common Questions

What are the taxes on inherited property in Canada?

Inherited property is not directly taxed, but capital gains tax may apply when the estate disposes of it at fair market value.

Do you have to pay taxes on inheritance in Canada?

There is no inheritance tax in Canada, but the estate may owe taxes before assets are distributed.

Is a living inheritance taxed in Canada?

If you give assets as a gift during your lifetime, there may be capital gains on the transfer, but the recipient does not pay inheritance tax.

How is estate tax calculated in Ontario?

The estate administration tax is based on the estate’s fair market value, exempting the first $50,000 and charging 1.5 percent on the remainder.

Can a bank release funds without probate in Ontario?

Banks often require probate to release significant funds, but smaller amounts may be released at the institution’s discretion without probate.

What is the most you can inherit in Canada without paying taxes?

There is no limit, since Canada does not have an inheritance tax, but the estate must settle all taxes payable first.

How do you apply for an estate certificate?

You apply through the Ontario Superior Court of Justice by submitting probate forms, supporting documents, and the estate administration tax payment. A Certificate of Appointment of Estate Trustee or Small Estate Certificate will then be issued by the court.

Summary of process: You apply for probate by filing court forms, the original will if one exists, and an affidavit of service. The estate trustee pays the estate administration tax at filing. Once approved, the court issues a Certificate of Appointment that authorizes the trustee to manage the estate.

Discover How to Minimize Taxes and Secure Your Legacy

Did you know that without a solid estate plan, taxes and fees in Ontario could claim a significant portion of your wealth?

If you’ve worked hard to build your business, investments, and properties, protecting your legacy for your loved ones is critical. At Strategic Wealth Protection Partners, we specialize in helping high-net-worth individuals in Ontario secure their financial futures.

Our Living Estate Plan is designed to:

- Reduce estate taxes and probate fees.

- Simplify wealth transfer to your loved ones.

- Reflect your values and priorities in every detail.

Your Legacy Matters

With our personalized guidance, we’ll help you navigate options like Living Trusts to protect your assets and ensure your family’s peace of mind. Contact us today to book your Living Estate Plan Consultation and take the first step toward a secure future.

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- Is Inheritance Taxable in Canada?

- How Much Is Probate Tax in Ontario?

- Estate Planning Ontario: A Simple Guide to Getting It Right

- Do Living Trusts Go Through Probate in Canada?

- How to Avoid Estate Tax in Ontario

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.