Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

What do I need to know about family trust tax benefits?

A family trust in Canada can help you split income among family members, which may lower your overall household tax bill.

It can also let you take advantage of the lifetime capital gains exemption if the trust holds shares in a qualifying small business. Some family trusts let you defer taxes or manage how and when assets are passed down, which is useful for long-term planning.

But there are rules that limit tax savings, like attribution rules and the 21-year deemed disposition rule that can trigger taxes later. To get the most benefit, it’s best to set up properly with advice from a tax or estate planning professional.

Key Takeaways

- Family trusts offer tax, privacy, and control advantages in estate planning

- The 21-year rule can create tax exposure if not planned for

- Trusts can multiply the Lifetime Capital Gains Exemption for business owners

- CRA rules now require more detailed trust reporting and disclosure

- Trusts require legal and tax expertise to manage properly over time

How Does a Family Trust Work?

A family trust works by transferring ownership of certain assets such as investments, business shares, or property into the trust, which is then managed by one or more trustees.

These trustees have a legal duty to manage the assets in the best interests of the beneficiaries, who are usually family members. A trust document outlines how the assets should be handled and may give the trustees flexibility in how and when distributions are made.

By using a trust, families can protect wealth and plan for future generations. In some cases, a family trust will allow families to gain tax advantages.

What Are the Main Types of Family Trusts?

Discretionary vs. Fixed

In a discretionary trust, the trustee decides how much income or capital each beneficiary receives, based on terms in the trust property. This allows for flexibility, income splitting, and adapting to changes in the family’s needs.

A fixed trust, by contrast, sets specific entitlements for each beneficiary in the trust deed, leaving no room for discretionary decisions. Discretionary trusts are often used when tax planning or asset protection are priorities.

Inter vivos vs. Testamentary

An inter vivos trust is created while the settlor is alive and is often used for tax planning and probate reduction. A testamentary trust is created through a will and only comes into effect after death.

Inter vivos trusts are separate legal entities and may trigger the 21-year deemed disposition rule. Testamentary trusts are subject to different tax rules and typically don’t last more than a generation unless structured carefully.

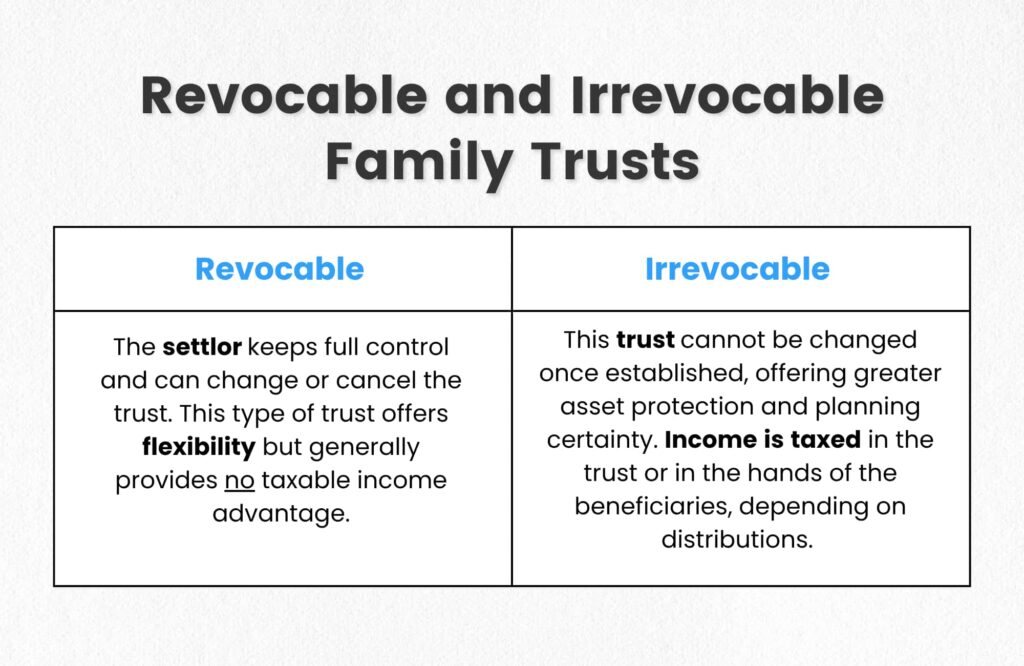

Revocable and Irrevocable Family Trusts

A key decision in trust planning is choosing between a revocable or irrevocable trust.

The difference impacts not only control and flexibility, but also the tax liability of the trust and its long-term effectiveness in estate planning.

Revocable Family Trusts

The settlor keeps full control and can change or cancel the trust. This type of trust offers flexibility but generally provides no taxable income advantage. It’s less commonly used in Canada due to limited estate planning benefits.

Irrevocable Family Trusts

This trust cannot be changed once established, offering greater asset protection and planning certainty. Income is taxed in the trust or in the hands of the beneficiaries, depending on distributions. It is more common for tax planning, wealth preservation, and probate fees reduction.

| Feature | Revocable Family Trust | Irrevocable Family Trust |

|---|---|---|

| Control | The settlor (creator) can change or cancel the trust at any time. | Once created, the trust cannot be changed or revoked without consent from all beneficiaries. |

| Flexibility | Offers full flexibility to update beneficiaries, trustees, or assets. | Limited flexibility; changes usually require legal steps and agreement from parties involved. |

| Tax Treatment | The settlor is usually taxed on income earned by the trust (attribution rules apply). | Income is taxed in the trust or in the hands of beneficiaries, depending on how it’s distributed. |

| Common Use | Less common due to limited tax benefits in Canada. | Common for income splitting, asset protection, and long-term estate planning. |

| Estate Planning Impact | Assets may still be considered part of the settlor’s estate. | Assets are removed from the settlor’s estate, which may help reduce probate exposure. |

What Are the Tax Advantages of Family Trusts?

Family trusts are often used to split income among family members in lower tax brackets, lowering the household’s overall tax burden.

Capital gains can also be distributed across multiple beneficiaries, enhancing access to the Lifetime Capital Gains Exemption when selling shares of a qualified small business corporation. A trust can defer tax by retaining income until strategically distributed.

The structure also shields certain assets from probate fees and avoids double taxation on death. However, the trust must be structured carefully to stay compliant with the Income Tax Act.

⭐ Related Read: How to Avoid Inheritance Tax on a House in Canada

What Are the Non-Tax Benefits of Choosing a Family Trust?

Trusts are about more than taxes; they create structure, control, and long-term planning.

Parents often set up trusts to manage inheritances for minor children, protect vulnerable beneficiaries, or navigate blended family dynamics. They help ensure trust’s assets are used according to your wishes, even after you’re gone.

Business owners may use them to plan succession and preserve family-owned enterprises. Trusts also provide privacy, unlike wills which become public after going through the probate process.

How Attribution Rules Affect Trust Taxation

The Income Tax Act includes attribution rules that can shift taxable income back to the settlor if the trust isn’t set up properly.

This often applies when income is retained in the trust or when minor children are named as beneficiaries. To avoid these rules, income must typically be distributed to adult beneficiaries and reported in their personal tax returns.

Attribution rules don’t apply to capital gains distributed to non-arm’s length adult beneficiaries. Proper planning is key to ensuring the intended tax benefits are actually realized.

How Family Trusts Use the Lifetime Capital Gains Exemption

Family trusts can multiply the Lifetime Capital Gains Exemption (LCGE) by allocating capital gains to multiple beneficiaries.

If the trust property includes shares in a qualified small business corporation, this strategy can eliminate tax on over $1 million per eligible beneficiary. Timing matters, gains must be allocated properly and beneficiaries must meet LCGE conditions.

This exemption is one of the most powerful tax tools in succession planning. The trust must be structured to allow for gain allocation before a business sale.

CRA Reporting and Filing Rules for Trusts

T3 return requirements

All trusts must file a T3 return annually if they earn income or make distributions during the year.

Basic reporting rules

As of 2023, most trusts must disclose all trust property, settlor, trustee, and beneficiary details, even if no income was earned.

What trustees need to do

Trustees must keep accurate records, file returns on time, and report full details to comply with CRA transparency obligations.

How to Create a Family Trust in Canada

- Decide if a family trust fits your needs and estate goals

- Select a trustee and identify beneficiaries

- Draft a legally sound trust deed

- Choose assets to transfer and retitle them into the trust

- Review all tax liability and reporting rules

- Consult a tax professional and estate lawyer to finalize the structure

- File required documentation and maintain compliance with CRA

- Reassess the trust regularly, especially near the 21-year mark

How Are Family Trusts Used in Estate Planning?

Family trusts can pass wealth to the next generation while avoiding the delays and costs of probate.

They provide a structured way to distribute assets, particularly in complex family or business situations. Trusts can also hold shares of a business or real estate, ensuring continuity and management.

Assets in the trust don’t go through probate, which saves time and keeps family matters private. Ultimately, a trust offers control across time, circumstances, and generations.

Costs and Drawbacks of Family Trusts

Family trusts can be expensive to set up and maintain, especially if professional services are needed for administration.

They also come with strict CRA reporting obligations and exposure to the 21-year deemed disposition rule. If attribution rules apply, tax savings may be reduced or eliminated.

Not all assets are suitable for trust ownership, especially those with specific legal designations. Poorly drafted trusts can lead to disputes or unintended taxable income burdens.

Common Questions

Can a family trust reduce income taxes?

Yes, if set up properly, it can split income among family members in lower tax brackets and reduce the overall tax burden.

What is the biggest mistake parents make when setting up a trust for their kids?

Choosing the wrong trustee or failing to define clear terms in the trust deed can lead to conflict and misuse of funds.

Can a family trust own a business in Canada?

Yes, many trusts hold shares of qualified small business corporations for succession planning and capital gains planning.

Who pays taxes on income earned in a family trust?

Either the trust pays at the top marginal rate or beneficiaries report it on their personal tax returns if income is distributed.

Discover the Benefits of a Living Trust in Ontario

Are you an Ontario resident considering a living trust as part of your estate planning?

At Strategic Wealth Protection Partners, we’re here to guide you through every step of the process with expert advice and personalized support. Begin your estate planning journey today with a Living Estate Plan Consultation from our experienced team.

Our mission at SWPP is to help you create an estate plan that secures your legacy, shields your assets from unnecessary taxation, and ensures your loved ones are cared for. By designing a living trust tailored to your goals, our experts will help you build a plan that truly reflects your values and priorities.

Take control of your future—start planning today!

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- Guide to Holding Property in a Trust in Ontario

- Tips on Setting Up a Trust in Ontario

- Do Living Trusts Go Through Probate in Canada?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.