Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

What Do You Need to Know about Family Trusts in Canada?

How do family trusts work in Canada?

A family trust is a legal structure that lets you move assets such as investments, businesses, or real estate into a separate “container” that you control for the benefit of your family.

When you put assets in a trust, you can still manage the assets. However, you no longer own the assets personally. Using a trust can help you protect your wealth, reduce taxes over time, and pass assets to the next generation on your own terms.

In Canada, family trusts may be used by people who have significant investments, own a business, or hold multiple properties.

A trust can help you do the following:

- freeze the value of your company

- multiply the lifetime capital gains exemption for your family

- protect assets from divorce or creditors

- simplify the transition of wealth to your children

- prevent assets from going through probate

However, a family trust isn’t the right solution for every family. Keep reading to find out more about how family trusts work and whether they are right for you.

Table of Contents

- What Is a Family Trust in Canada?

- What Are the Types of Family Trusts in Canada?

- What Are the Required Roles in a Family Trust?

- What Are the Benefits of a Family Trust in Canada?

- What Are the Downsides of a Family Trust in Canada?

- What Is a Wasting Freeze and How Does It Work?

- What Are the Tax Implications of Family Trusts in Canada?

- How to Set Up a Family Trust in Canada

- Before You Set Up a Family Trust

- Family Trusts and Business Succession Planning

- Securing Your Family’s Future with a Family Trust

- Common Questions

- Case Study: Hinata’s Family Trust and Tax Planning Strategy

Key Points:

- Expect meaningful costs: $10,000–$35,000+ for the set up and annual administration for filings and recordkeeping.

- A family trust is a legal structure that holds assets for your family, managed by a trustee for tax and protection benefits.

- Trusts allow capital gains and some income to flow to beneficiaries, using their lower tax brackets and exemptions.

- The 21-year rule triggers deemed gains every 21 years, so proactive tax planning is essential.

- A family trust provides strong asset protection from lawsuits, creditors, and professional liability.

- A family trust shields family wealth from the divorce or financial problems of adult children.

- You can hold a cottage or second property in a trust to reduce probate fees and simplify inheritance.

- Trusts help you transfer business shares smoothly and maintain control of voting shares even after retirement.

- A family trust lets you freeze the value of your business so future growth is taxed to your children, not you.

- You can multiply the Lifetime Capital Gains Exemption (LCGE) across multiple family members for major tax savings on Qualified Small Business Corporation (QSBC) shares.

- You typically remain in control of a family trust by acting as the trustee or by appointing a corporate trustee.

What Is a Family Trust in Canada?

A family trust is a legal arrangement that holds and manages trust property on behalf of selected family members.

It acts as a protective structure designed to control, distribute, and shelter assets like investments, real estate, or qualified small business corporation shares.

Used properly, a trust can reduce taxes, provide income to loved ones, and ensure a smooth transition of wealth from one generation to the next. For many families in Ontario, it’s one of the most powerful estate planning tools available.

📖Read More: Estate Planning Ontario: A Simple Guide to Getting It Right

What Are the Types of Family Trusts in Canada?

These are the main types of trusts used in Canada’s estate and tax planning:

- Inter vivos trust: Set up during a person’s lifetime; often used for tax planning, income splitting, and asset protection.

- Testamentary trust: Created through a will and activated after death; commonly used for structured inheritance.

- Alter ego trust: For individuals 65+, this helps avoid probate and maintain control of assets during one’s lifetime.

- Joint partner trust: Created by spouses or common-law partners, this type defers taxes until both individuals pass away.

- Family trust: Used to support multiple beneficiaries and manage ownership of private company shares or investments.

- Wasting freeze: A specialized tax strategy that gradually reduces the taxable value of an estate over time, especially useful for business owners with a growth-focused exit plan.

Resource: Types of Trusts and Codes

What Are the Required Roles in a Family Trust?

Settlor:

The settlor is the person who creates the trust and makes the first contribution. Their role is foundational; they legally establish the trust, but typically step back after that.

Trustee:

The trustee manages the trust assets, ensures all legal requirements are met, and makes decisions about distributions. They have a fiduciary duty to act in the best interests of the beneficiaries.

Beneficiary:

The beneficiaries are the individuals, usually family members, who benefit from the trust. They may receive income, capital, or both, depending on how the trust is structured.

What Are the Benefits of a Family Trust in Canada?

Family trusts provide strong tax benefits and long-term protection for families.

Some of the main advantages include:

- Reducing overall taxable income through income splitting

- Protecting assets from creditors or marital breakdown

- Deferring probate and simplifying estate administration

- Accessing the lifetime capital gains exemption (LCGE) when selling qualified small business corporation shares

- Keeping wealth within the family across generations

- Managing assets for minors or vulnerable beneficiaries

Used with precision, a trust can also serve as the foundation for more advanced planning, such as the wasting freeze, discussed below.

What Are the Downsides of a Family Trust in Canada?

Family trusts are complex and require legal and tax expertise to set up and maintain.

They are taxed at the highest marginal rate on income retained in the trust, unless that income is allocated out.

There is also the 21-year rule, where the CRA deems all assets in the trust to be sold every 21 years, which can trigger capital gains tax unless managed properly. This can lead to a significant tax liability if ignored.

What Is a Wasting Freeze and How Does It Work?

A wasting freeze is a tax planning strategy that works alongside a family trust or holding company.

It is used by business owners or investors who want to reduce the future tax burden of their estate while maintaining income during retirement.

Here’s how it works: the owner “freezes” the current value of their shares and receives preferred shares that decline in value over time, often through redemptions. Meanwhile, the future growth of the company or asset goes to new common shares, usually held by a family trust for children or grandchildren.

Each year, as the preferred shares are redeemed, they are taxed, often as dividends providing annual income to the owner.

This gradual reduction lowers the value of the owner’s estate and helps pre-fund the tax liability that would otherwise arise on death. It also allows the dividend tax credit to be used strategically, softening the tax impact.

A wasting freeze is especially useful when combined with life insurance, which can fund any remaining taxes at death without selling core assets.

What Are the Tax Implications of Family Trusts in Canada?

Trusts are treated as separate taxpayers under the Income Tax Act, and income not distributed is taxed at the top personal rate.

However, income can be distributed to family members in lower tax brackets, resulting in significant tax savings. Capital gains earned in the trust can be allocated out, and with proper planning, trusts can access the capital gains exemption on the sale of qualified small business corporation shares. In some cases, families can multiply the LCGE across multiple beneficiaries, potentially sheltering millions of dollars in capital gains.

Trusts must file T3 returns annually, and the 21-year deemed disposition rule requires ongoing review to avoid unplanned tax consequences.

📖Read More: How Does Taxation of Trusts Work in Canada?

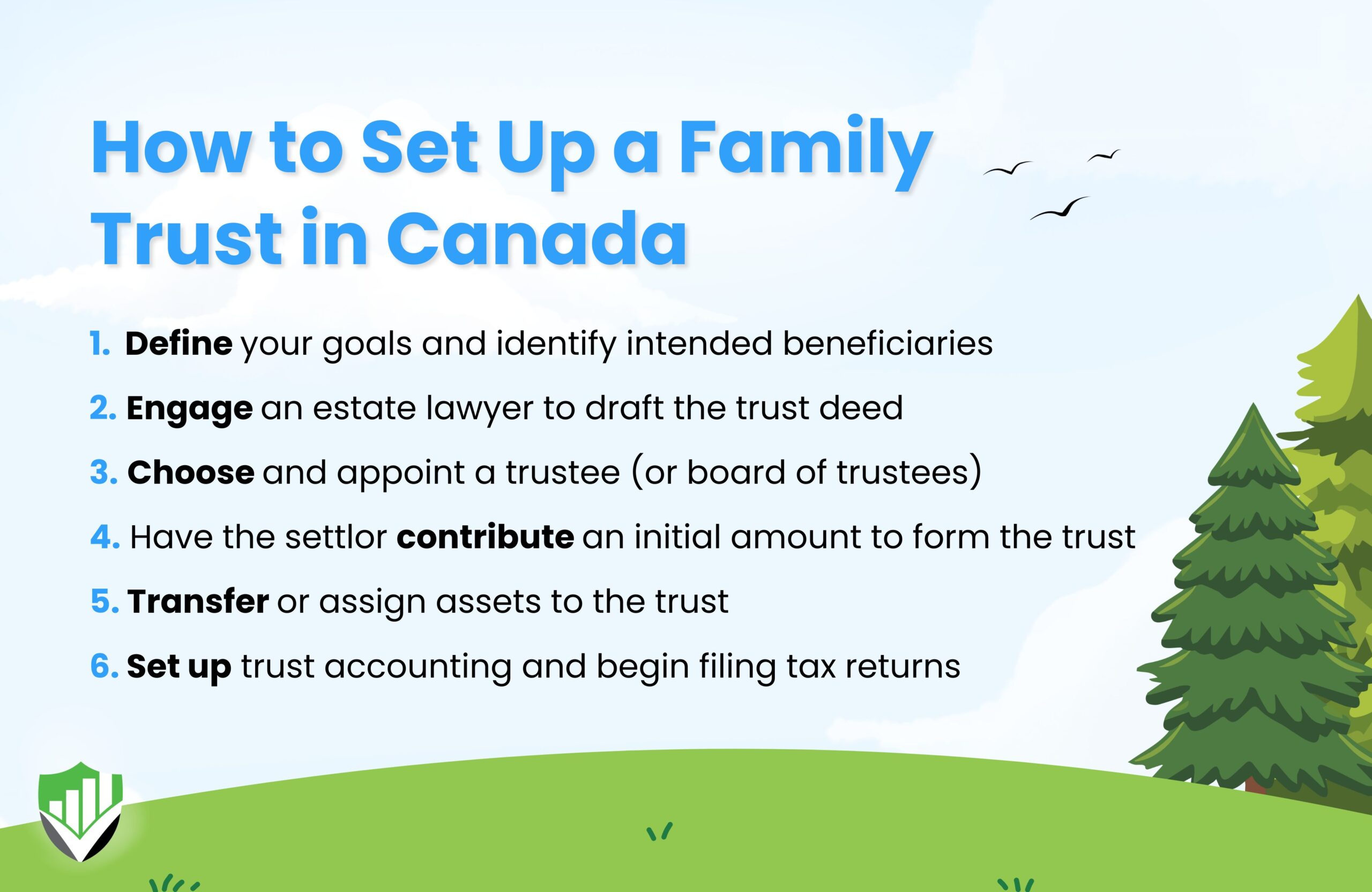

How to Set Up a Family Trust in Canada

Here’s a simplified step-by-step outline:

- Define your goals and identify intended beneficiaries

- Engage an estate lawyer to draft the trust deed

- Choose and appoint a trustee (or board of trustees)

- Have the settlor contribute an initial amount to form the trust

- Transfer or assign assets (such as private company shares) to the trust

- Set up trust accounting and begin filing tax returns

Before You Set Up a Family Trust

Setting up a trust takes time, and you’ll want to involve your accountant, lawyer, and estate planner from the start.

Costs to establish a trust in Canada range from $3,000 to $10,000 or more, depending on complexity. Ongoing administration, including tax filing and trustee management, adds yearly costs.

But most importantly, trusts should never be set up in isolation. They must be part of a bigger plan that includes insurance, tax planning, business succession, and a long-term family strategy.

Family Trusts and Business Succession Planning

If you’re a business owner, a family trust can be central to your exit strategy.

It allows you to freeze your value today, shift future growth to your children, and multiply the lifetime capital gains exemption when the business is eventually sold.

When combined with a wasting freeze, the tax value of your estate can be reduced gradually each year, meaning a smaller estate tax bill later and more wealth preserved for your family. It’s a smart way to pass the torch while still maintaining control during your lifetime.

Securing Your Family’s Future with a Family Trust

A family trust isn’t just a legal tool; it’s a framework for protecting the people you love and the assets you’ve worked hard to build.

Whether you want to reduce your tax burden, leave a business intact, or simply support your children wisely, a trust allows you to do it with clarity, structure, and foresight.

Common Questions

Initial legal costs can range from $3,000 to $10,000, with annual accounting and tax filing fees also required.

Most family trusts are irrevocable, but some decisions—like changing trustees or updating investment directions—can be modified.

The biggest mistake is not clearly defining the trustee’s powers or goals, which can lead to confusion or unintended distributions.

There’s no inheritance tax, but distributed income or capital gains may be taxable in the beneficiary’s hands.

A trust can provide tax-efficient support for children during your lifetime while retaining control and flexibility.

The trust deed outlines the settlor, trustee, beneficiaries, purpose, distribution rules, and trustee powers.

Trusts are separate tax entities and must file T3 returns. Attribution and the 21-year rule are key considerations.

Summary:

- Trusts must be managed carefully with legal and tax professionals.

- Family trusts help protect wealth, control distribution, and reduce tax over time.

- The wasting freeze reduces estate tax liability while providing annual income.

- Trusts support business succession and access the capital gains exemption.

- Planning around the 21-year rule avoids unnecessary tax shocks.

Case Study: Hinata’s Family Trust and Tax Planning Strategy

When Hinata*, a 47-year-old business owner, looked at how much his company had grown, he felt proud—but also concerned.

He had inherited the business from his father 15 years earlier, when it was valued at $5 million. Through years of steady expansion, he increased that value to $15 million. With that growth came two key worries:

- The future tax burden his family would face when he passes away.

- Whether he would be able to fully benefit from the Small Business Capital Gains Exemption (SBCGE) if he eventually sold the company.

Hinata is married and has two children from his first marriage. He wanted to make sure the business would support all of them without unnecessary tax erosion.

The Planning Strategy

1. Estate Freeze to Shift Future Growth to the Family Trust

To manage Hinata’s growing tax exposure, the team at SWPP (Strategic Wealth Protection Partners) implemented an estate freeze. This allowed him to “lock in” the current $15 million value of his shares for tax purposes. Any future growth would now accrue inside a family trust, benefiting his children.

This structure positions his family to:

- Reduce the capital gains tax Hinata would otherwise face in the future.

- Increase the value that ultimately passes to his children.

- Potentially multiply the Small Business Capital Gains Exemption across family members if the business is sold.

2. Planning for a Wasting Freeze

In addition to the estate freeze, we built a plan for a wasting freeze, giving Hinata a way to gradually draw down and reduce his personal tax exposure over time.

He also intends to do a second refreeze in about ten years, which would allow him to further limit the tax consequences of any additional appreciation.

3. Life Insurance to Cover Remaining Tax Liability

Even with strong planning, unexpected tax liabilities can still arise. To make sure his family would never face financial strain from an unforeseen tax bill, we arranged a life insurance plan designed specifically to fund any remaining tax obligation.

The Outcome

Today, Hinata has a clear, flexible, and forward-looking plan:

- His children will benefit from the company’s future growth.

- His personal tax exposure is being managed proactively.

- His family will have liquidity to cover taxes when he passes away.

- He remains positioned to take advantage of the SBCGE if he chooses to sell the business.

For the first time in years, Hinata feels confident that his success will translate into long-term security for his family. His planning gives him flexibility if he sells, stability if he doesn’t, and peace of mind either way.

*Names and identifying details have been changed to protect the identity of SWPP’s client.

Discover the Benefits of a Living Trust in Ontario

Are you an Ontario resident considering a living trust as part of your estate planning?

At Strategic Wealth Protection Partners, we’re here to guide you through every step of the process with expert advice and personalized support. Begin your estate planning journey today with a Living Estate Plan Consultation from our experienced team.

Our mission at SWPP is to help you create an estate plan that secures your legacy, shields your assets from unnecessary taxation, and ensures your loved ones are cared for. By designing a living trust tailored to your goals, our experts will help you build a plan that truly reflects your values and priorities.

Take control of your future—start planning today!

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- Putting a House in a Living Trust in Canada

- How Does Taxation of Trusts Work in Canada?

- Guide to Holding Property in a Trust in Ontario

- Estate Planning Ontario: A Simple Guide to Getting It Right

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.