Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

“How can I legally and efficiently avoid probate in Ontario while protecting my estate?”

If you’re searching how to avoid probate in Ontario, you’ve probably been told that you need to get a trust.

But this isn’t the best option for every situation. In fact, trusts are just one of a few strategies that you can use to avoid probate. Avoiding probate in Ontario means setting up your estate so that your assets can pass directly to your heirs without the courts’ involvement.

The most effective ways to do this are naming beneficiaries on registered accounts, using joint ownership carefully, creating trusts, setting up dual wills (especially for business owners), and sometimes holding assets in a corporation.

Each option has legal and tax implications, so it’s essential to get advice from an Ontario estate planning expert who understands your situation.

Key Takeaways:

- Dual wills are often critical for business owners or those with private company shares who wish to avoid unnecessary probate on corporate assets.

- Revocable or alter ego trusts can help transfer assets privately while maintaining control.

- Joint ownership is not always the best solution as it can cause tax issues and disputes.

- Holding property or investments in a corporation can reduce probate exposure.

- Mistakes in probate avoidance often cost far more than the probate fees themselves.

- Get expert advice early, so you don’t make any costly estate planning mistakes.

What Is Probate and When Is It Required in Ontario?

When someone passes away in Ontario, their executor must often go through a legal process called probate.

Probate is the court’s confirmation that the Will is valid and that the executor has the legal authority to act on behalf of the estate. In Ontario, probate is formally known as applying for a Certificate of Appointment of Estate Trustee. It’s required when an executor needs to prove their authority to banks, investment firms, or the Land Registry Office before transferring or distributing assets.

People often try to avoid probate because it can lead to delays, public disclosure, and Estate Administration Tax (often called probate fees).

However, not every asset requires probate. Understanding when probate is legally necessary, and when it can be avoided is key to efficient and private estate planning.

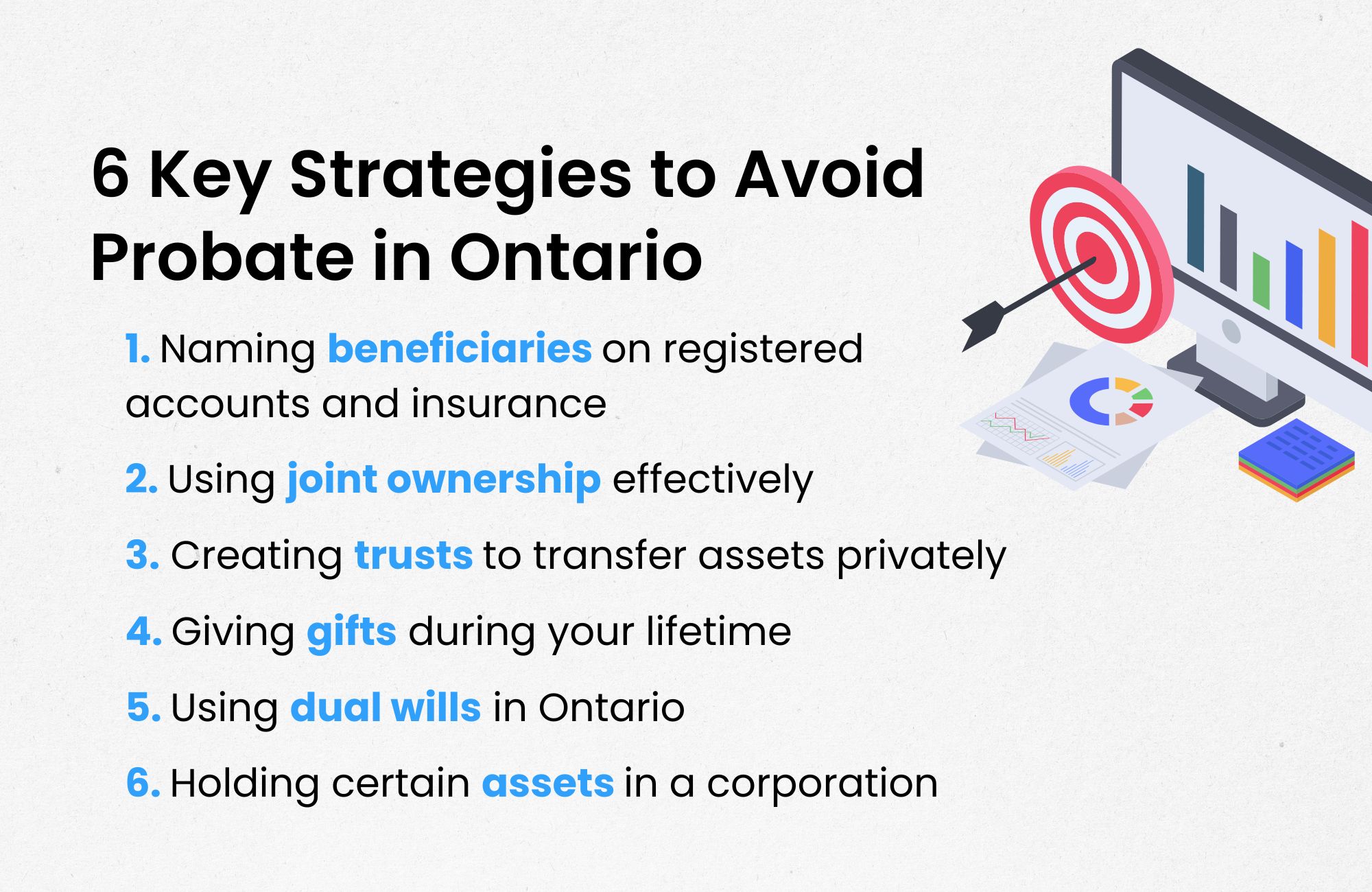

6 Key Strategies to Avoid Probate in Ontario

1. Naming Beneficiaries on Registered Accounts and Insurance

By naming direct beneficiaries on life insurance, Registered Retirement Savings Plans (RRSPs), and Tax-Free Savings Accounts (TFSAs), these assets can pass directly to your beneficiaries outside of the estate. Since they don’t flow through your estate, they avoid probate fees and can be accessed faster by your loved ones.

2. Using Joint Ownership Effectively

Joint ownership with right of survivorship allows the surviving joint owner to automatically inherit the asset when the other passes away. This approach is common with spouses for property or bank accounts. However, it must be used carefully. If joint ownership is added with adult children, it could create unintended tax or creditor issues later.

3. Creating Trusts to Transfer Assets Privately

A trust is a legal arrangement where a trustee manages assets for beneficiaries according to your wishes. Because trust-held assets are owned by the trust and not the individual, they generally bypass probate entirely. Trusts can help ensure a private, controlled transfer of wealth while minimizing taxes and avoiding court involvement.

4. Giving Gifts During Your Lifetime

Gifting assets while you’re alive can reduce the size of your estate, lowering future probate fees. It also allows you to witness the benefits of your generosity. However, gifting large assets can trigger capital gains tax, so it should always be part of a coordinated tax and estate planning strategy.

5. Using Dual Wills in Ontario

In Ontario, individuals, especially business owners, can use dual Wills. One Will covers assets that must go through probate (such as bank accounts and real estate not held jointly), and the other covers assets that don’t, like private company shares. This structure can significantly reduce the overall Estate Administration Tax payable at death.

6. Holding Certain Assets in a Corporation

If you own a business, holding assets within a corporation can help reduce probate exposure. Corporate-owned assets typically don’t require probate when shares, rather than individual assets, are passed to beneficiaries. This approach can maintain privacy, control, and flexibility within a family’s estate plan.

What Assets Are Subject to Probate in Ontario?

In Ontario, not all assets go through probate. Generally, probate is required for:

- Real estate owned solely in your name

- Bank or investment accounts without a named beneficiary or joint owner

- Private company shares not covered under a secondary Will

- Personal possessions or valuable collectibles forming part of your estate

Assets that typically avoid probate include jointly owned property, registered accounts with designated beneficiaries, life insurance, and trust-held assets.

How Are Probate Fees Calculated in Ontario?

Probate fees in Ontario are officially known as the Estate Administration Tax. As of now, the tax is calculated at approximately $15 for every $1,000 of the estate’s value above $50,000.

For example, an estate valued at $1 million would face roughly $14,250 in probate fees.

While this may sound manageable, probate fees are only one part of the total cost of settling an estate — delays, legal fees, and loss of privacy can add up quickly.

Ontario Probate Fee Calculator

How Long Does Probate Take in Ontario?

In most cases, probate takes four to six months, but it can be delayed if there are issues with the Will, missing documents, or disputes among beneficiaries. Complex estates or real estate holdings in multiple jurisdictions can also extend timelines.

When proper planning is done in advance, some or all of these delays can be avoided — giving families faster access to funds and a smoother administration process.

Key Considerations Before You Take Action

Before attempting to avoid probate, it’s important to understand the full picture.

1. Know the Risks of Poorly Planned Probate Avoidance

While it may seem simple to add children as joint owners or transfer assets during life, these strategies can backfire. Without proper legal and financial guidance, they can expose assets to creditor claims, family disputes, or unexpected tax consequences. A poorly structured plan can cost more than it saves.

2. Understand What Happens If You Don’t Probate a Will

If you fail to probate a Will when required, banks and financial institutions may refuse to release funds, and land transfers may be delayed. The executor could face personal liability for distributing assets without proper court authority. Probate exists to protect both executors and beneficiaries, so knowing when it’s required is essential.

💡 Real Case Study: How Jerry Avoided Probate Fees and Protected His Family’s Privacy

Almost everyone who reaches out to me about estate planning has the same goal: they want to avoid probate fees and ensure more of their hard-earned money goes to their loved ones, not to the government.

When Jerry first booked a consultation, that was exactly what he wanted to learn.

Jerry is a widower with two adult children. Like many parents, he wanted to make things easier for them when he’s gone. He had gone through a difficult experience after his own parents passed away, watching a significant portion of their estate disappear in probate taxes and legal costs.

He didn’t want his son and daughter to go through the same thing.

During our meeting, I reviewed his financial picture. Jerry held RRSPs, TFSAs, and a non-registered investment account. Because his wife had already passed away, we focused on ensuring that his assets would flow directly to his children, rather than through his estate, which is what triggers probate.

For his RRSP, we set up his son and daughter as designated beneficiaries, allowing those funds to transfer directly to them outside of the estate. For his TFSA and non-registered accounts, we transferred the assets into accounts with a life insurance company, which can designate direct beneficiaries and bypass probate altogether.

This simple but powerful structure means that when Jerry eventually passes, all of his investment accounts will pass straight to his children, without the delays, costs, or public exposure that come with probate.

In total, this plan will save Jerry’s estate more than $50,000 in probate taxes.

An equally important benefit is privacy. When an estate goes through probate, the Will becomes a public document. Anyone can request a copy and see who received what and how much the estate was worth. By structuring his assets outside of probate, Jerry’s plan keeps his estate completely private, and his children protected from unwanted calls or solicitations after his passing.

Jerry was so relieved by the outcome that he’s since referred several of his friends to learn how to protect their families the same way.

As I often remind clients, saving taxes is valuable — but protecting your privacy is priceless.

Work with an Ontario Estate Planning Expert to Avoid Mistakes

Probate planning isn’t about avoiding taxes at all costs, it’s about controlling how your estate is settled and ensuring your wishes are carried out efficiently and privately.

Working with an experienced estate planning professional in Ontario helps you navigate the fine line between proper tax and estate planning and compliance with the law. Whether it’s through trusts, dual Wills, or beneficiary designations, a coordinated plan will save your family unnecessary stress, time, and money.

Common Questions

What is exempt from probate in Ontario?

Assets with named beneficiaries such as RRSPs, TFSAs, and life insurance, along with jointly owned property, are generally exempt from probate.

Can you settle an estate without probate in Ontario?

Yes, if all assets pass through joint ownership, beneficiary designations, or trusts, probate may not be necessary.

How do I avoid probate on my bank accounts in Canada?

You can avoid probate by adding a joint account holder with right of survivorship or by designating beneficiaries where permitted.

How long can you keep an estate open after death in Ontario?

There’s no strict time limit, but most estates are settled within one to two years, depending on complexity and court processing times.

Final Thoughts

In Ontario, probate is more than just a legal formality, it’s a process that can affect how long your loved ones wait, how much they pay, and how private your estate remains. While it can’t always be avoided, the right combination of trusts, beneficiary designations, dual Wills, and tax planning can make a world of difference.

Understanding when probate applies and how to reduce its impact ensures your estate passes efficiently, privately, and in line with your wishes.

Discover How to Minimize Taxes and Secure Your Legacy

Did you know that without a solid estate plan, taxes and fees in Ontario could claim a significant portion of your wealth?

If you’ve worked hard to build your business, investments, and properties, protecting your legacy for your loved ones is critical. At Strategic Wealth Protection Partners, we specialize in helping high-net-worth individuals in Ontario secure their financial futures.

Our Living Estate Plan is designed to:

- Reduce estate taxes and probate fees.

- Simplify wealth transfer to your loved ones.

- Reflect your values and priorities in every detail.

Your Legacy Matters

With our personalized guidance, we’ll help you navigate options like Living Trusts to protect your assets and ensure your family’s peace of mind. Contact us today to book your Living Estate Plan Consultation and take the first step toward a secure future.

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- How Much Does an Estate Have to Be Worth to Go to Probate in Ontario?

- What Assets Are Not Subject to Probate in Canada?

- Who Pays Probate Fees in Ontario?

- What Is the Best Trust to Avoid Probate in Canada?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.