Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario

How to Avoid a Big Tax Hit at Death in Canada

No one wants a tax surprise after death — especially your family.

Now, while we don’t have a death tax in Canada like some other countries, that doesn’t mean your family is off the hook. Taxes can still take a big bite out of your estate if you’re not prepared. This blog will break down how “death taxes” work, so you can make a plan and avoid leaving your loved ones with an unexpected tax bill.

Let’s get clear on what actually gets taxed after someone dies.

Table of Contents

- Does Canada Have a Death Tax?

- Is there an Estate Tax in Canada?

- Does Canada Have an Inheritance Tax?

- Probate in Canada

- Should You Transfer Assets Before Death?

- What Happens if There Is a Surviving Spouse?

- How to Minimize Your Final Tax Return

- How to Use Life Insurance in Estate Planning

- Registered Accounts and Taxation After Death

- Cottage and Real Estate Transfers

- Tax Considerations for Business Owners

- Charitable Giving as a Tax Strategy

- When Can the Estate Be Distributed?

- Filing Deadlines for the Final Tax Return

- Steps to Take Immediately After Death

- Common Questions

Does Canada Have a Death Tax?

No, Canada doesn’t have a formal death tax — but there’s a catch.

While there’s no specific tax charged just for dying, the Canada Revenue Agency (CRA) still gets involved. When someone dies, it’s as if they sold all their stuff — investments, cottages, even their business — at fair market value the day before death. This is called a deemed disposition.

The result of the deemed disposition is that any increase in value could be taxed as capital gains. So, while it’s not called a “death tax,” your estate may still owe hundreds of thousands—potentially millions.

For example, if you have investments that have increased in value, the gain will be fully taxable. Likewise, if you bought a second property and it has increased in value, that gain will be fully taxable on your final tax return.

When you understand Canada’s deemed disposition rules, you realize that your estate could see a huge tax hit unless you create a solid plan.

Is there an Estate Tax in Canada?

Technically, there is no estate tax in Canada, but tax still shows up in a different way.

Canada doesn’t charge an estate tax like the U.S. Instead, the tax shows up through the deceased person’s final tax return. Just as we explained in the previous paragraph, this tax occurs on your final tax return.

Your final tax return includes income earned in the year of death and any capital gains.

If you own RRSPs or RRIFs and didn’t leave them to a spouse or dependent child, the entire value can be taxed as income. That can mean a big tax bill. Good planning — like naming the right beneficiaries and using trusts — can keep more money in your family’s hands.

Does Canada Have an Inheritance Tax?

No, there is no inheritance tax in Canada — but taxes may still apply before assets are passed on.

When someone dies, their estate may owe taxes, but the person receiving the inheritance does not pay tax on what they receive. For example, if you inherit cash, a house, or investments, you do not report that as income. However, before the estate distributes anything, it must pay any taxes owed — like capital gains tax or taxes on RRSPs. That means the estate might shrink before it reaches the heirs. So, while you don’t pay tax on your inheritance, the estate itself might take a tax hit first.

Probate in Canada

Probate is not a tax, but it can still cost your estate money.

Probate is the legal process of confirming that a will is valid. Across Canada, probate often comes with a fee, and the rules depend on the province.

In Ontario, the Estate Administration Tax is $15 for every $1,000 of estate value over $50,000, with no tax on the first $50,000. In British Columbia, the fee is $6 per $1,000 over $50,000. Alberta uses a flat fee system, capped at $525. Quebec is different — notarial wills usually skip probate, and no fee is charged. These probate fees are not income or capital gains taxes, but they still reduce what your heirs receive. Smart planning can help limit or avoid probate.

Should You Transfer Assets Before Death?

Transferring assets before death can help, but it can also cause problems if done wrong.

Some people give away property, money, or investments while they’re alive to reduce probate fees or avoid taxes later. But this move can trigger its own taxes. For example, gifting a cottage means it’s treated as if you sold it, and you may owe capital gains tax right away.

Also, once you give something away, you can’t control it anymore. If the person you gave it to gets divorced or sued, that asset could be at risk. It’s important to weigh the benefits and risks carefully and speak with a qualified estate planning expert before making big decisions.

📖Related Read: How Do I Avoid Capital Gains Tax on Inherited Property in Canada?

What Happens if There Is a Surviving Spouse?

In many cases, assets can transfer to a surviving spouse without immediate tax.

If the deceased named their spouse or common law partner as a beneficiary on registered accounts like RRSPs or RRIFs, those assets can roll over tax-free. They won’t be considered taxable income on the final tax return. But be careful, the estate could still be taxed on the rollover, it needs to be done properly.

The same goes for certain types of trusts and pensions.

For other capital property, like a house or investments, there’s a special rule: the “spousal rollover.” This defers any capital gains tax until the surviving spouse sells or passes away.

This means no tax is owed right away, and the estate keeps its full value, for now. But clear planning and correct paperwork are needed to make sure the rollover happens properly. A good question to ask is, do you want the investment, home or investment property to roll over to a spouse.

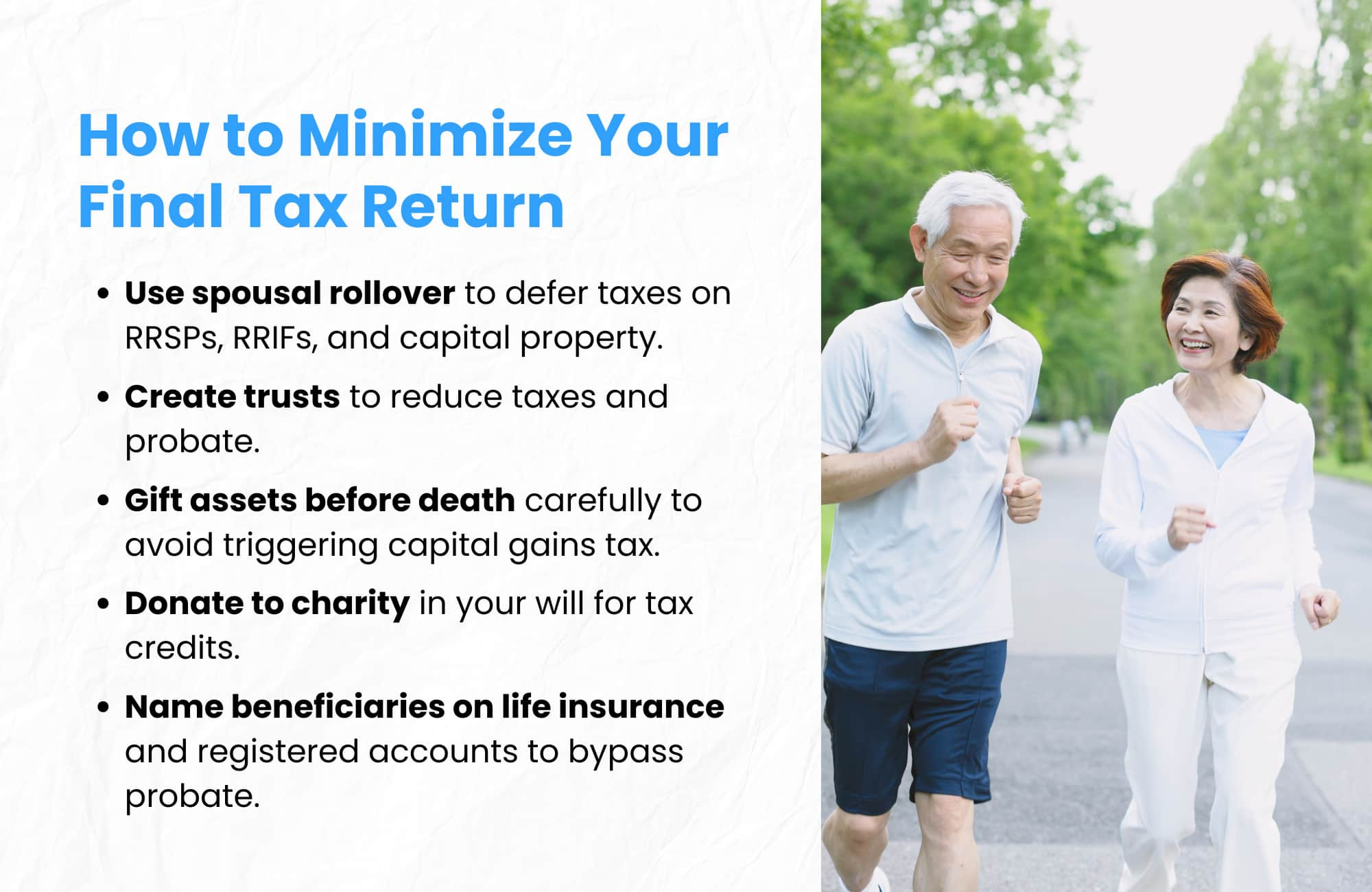

How to Minimize Your Final Tax Return

Smart planning can lower the taxes owed on your final return — and keep more money in your estate.

Here are a few common strategies:

- Use the spousal rollover to defer taxes on RRSPs, RRIFs, and capital property by leaving them to your spouse.

- Create a trust, like an alter ego trust or joint partner trust (available after age 65), to keep assets out of probate and reduce taxes.

- Give gifts before death, but watch out for capital gains. Gifting assets can trigger immediate tax if they’ve gone up in value.

- Donate to charity through your will. Charitable gifts can create tax credits that lower your final tax bill.

- Name beneficiaries directly on life insurance and registered accounts to avoid probate and reduce delays.

Each of these tools has rules. The best plan uses a mix that fits your situation and keeps things simple for your family.

📖 Related Read: What Is the Cost of a Living Trust in Canada?

How to Use Life Insurance in Estate Planning

Life insurance can be a powerful tool to protect your estate and support your family.

When set up right, a life insurance payout goes directly to your named beneficiaries tax-free and outside of probate. This means faster access to funds and no probate fees on the insurance amount. Life insurance can be a great way to pay taxes for pennies on the dollars if it is the right plan and set up properly.

You can use life insurance to cover final taxes, pay off debts, or leave a financial gift.

Some people even use it to equalize inheritances — for example, one child gets the cottage, the other gets the insurance. If the policy is owned by a trust or a business, it can open even more planning options. It’s flexible, fast, and often overlooked.

Registered Accounts and Taxation After Death

RRSPs and RRIFs can lead to a big tax bill unless a beneficiary is named.

When someone dies, the full value of their RRSP or RRIF is added to their income for that year, which can push the estate into a high tax bracket. But if a spouse or financially dependent child is named as the beneficiary, the account can transfer to them tax-free. This is called a “tax-deferred rollover.”

Naming a beneficiary directly also keeps the account out of probate, speeding up access and avoiding probate fees.

Cottage and Real Estate Transfers

Inheriting real estate like a cottage can trigger substantial capital gains tax.

When someone passes away, their property is treated as if it were sold at fair market value. If it’s not their principal residence, any increase in value since they bought it is taxed as a capital gain. That can mean hundreds of thousands of dollars in tax owed by the estate. To reduce this, some families transfer the property during life, use a trust to hold the cottage, or designate it as the principal residence (if it qualifies).

Each option has pros and cons. Getting advice helps avoid big tax surprises later.

Tax Considerations for Business Owners

When a business owner dies, their shares are taxed as if they were sold — even if the business stays in the family.

The CRA treats private company shares as having been sold at fair market value on the date of death. That means capital gains tax may apply, and the estate may owe a large amount, even if no money actually changed hands.

To plan ahead, business owners can use tools like a shareholders’ agreement, estate freeze, or family trust to manage how and when tax is triggered. Life insurance is also a common way to cover tax costs.

Smart succession planning keeps the business running and avoids a cash crunch. Speak with an estate planning expert if you’re a business owner.

Charitable Giving as a Tax Strategy

Donating to charity through your estate can lower taxes and leave a lasting impact.

When a donation is made through a will or directly from a registered account, the estate can claim a charitable tax credit. This credit can reduce taxes owed on the final return, sometimes to zero.

For example, donating publicly traded securities avoids capital gains tax and gives a full donation receipt. You can also name a charity as a beneficiary of your RRSP, RRIF, or life insurance policy.

This keeps the donation out of probate and speeds up the gift. It’s a smart way to support causes you care about — and ease your estate’s tax burden.

When Can the Estate Be Distributed?

An estate can only be distributed after debts are paid, taxes are filed, and probate is complete — and that takes time.

Most estates take 6 to 24 months to settle, but it can take longer if things are complex. The executor must first gather assets, apply for probate (if needed), pay all debts, and file the final tax return. The Canada Revenue Agency must also issue a Clearance Certificate before the estate can be fully distributed — this confirms that all taxes are paid.

Delays can happen if there’s no will, the will is challenged, or if assets are hard to value. Until everything is resolved, beneficiaries may need to wait.

Filing Deadlines for the Final Tax Return

The deadline to file a final tax return depends on the date of death, and missing it can cost the estate.

If the person died between January 1 and October 31, the final return is due by April 30 of the following year. If they died between November 1 and December 31, the return is due six months after the date of death.

Late filing can lead to penalties. According to the CRA, the penalties are as follows:

“The penalty is 5% of any balance owing, plus 1% of the balance owing for each full month that the return is late, to a maximum of 12 months.”

Filing on time is key to avoiding extra costs and delays in closing the estate.

Steps to Take Immediately After Death

Certain legal and financial steps need to be taken quickly after someone dies.

Here’s a simple list of what to do first:

- Get a Medical Certificate of Death. This is needed to register the death and begin any estate work.

- Register the Death with your province’s vital statistics office to get an official death certificate.

- Secure the Will and review it. If there’s no will, the estate is handled under provincial intestacy laws.

- Notify financial institutions, insurance companies, and Service Canada.

- Apply for probate if needed to get legal authority to manage the estate.

- Close accounts and cancel government benefits.

- File the final tax return for the deceased and pay any outstanding taxes.

These steps help protect the estate and prevent delays for the family.

Common Questions

Do you have to pay tax on a Registered Retirement Income Fund after death?

Yes. When someone dies, the full value of their RRIF is added to their income for that year, unless it transfers to a spouse or common-law partner. That means it can become taxable income and may create a large tax bill for the estate.

Can life insurance payouts be taxed as part of the estate?

Usually not. If a beneficiary is named, the life insurance payout goes directly to them, tax-free and outside the estate. If no beneficiary is named, the payout goes into the estate and could face probate fees, but it’s still not taxed as income.

What if the estate can’t cover the income tax owed on the final tax return?

If the estate doesn’t have enough funds to pay the tax, the executor may need to sell estate assets. In some cases, CRA may allow payment arrangements. Beneficiaries won’t receive anything until all debts, including taxes, are paid in full.

Discover How to Minimize Taxes and Secure Your Legacy

Did you know that without a solid estate plan, taxes and fees in Ontario could claim a significant portion of your wealth?

If you’ve worked hard to build your business, investments, and properties, protecting your legacy for your loved ones is critical. At Strategic Wealth Protection Partners, we specialize in helping high-net-worth individuals in Ontario secure their financial futures.

Our Living Estate Plan is designed to:

- Reduce estate taxes and probate fees.

- Simplify wealth transfer to your loved ones.

- Reflect your values and priorities in every detail.

Your Legacy Matters

With our personalized guidance, we’ll help you navigate options like Living Trusts to protect your assets and ensure your family’s peace of mind. Contact us today to book your Living Estate Plan Consultation and take the first step toward a secure future.

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.