Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario

Estate taxes in Canada can be confusing, but understanding the key rules can save your family money.

While there is no estate tax in Canada, that doesn’t mean the government won’t take a share of your wealth. This guide will explain how assets are taxed at death, what strategies can reduce your tax bill, and how to protect your estate for your heirs.

The three key things everyone should know about estate taxes in Canada are:

- Capital Gains Tax: The government treats your assets as if they were sold the day before you pass away, which can result in a hefty tax bill. The estate will need to pay capital gains tax on any gains.

- Registered Accounts: RRSPs and RRIFs are fully taxable at death unless transferred to a spouse or qualified beneficiary.

- Probate Fees: Ontario charges probate fees on estates, but proper planning can help minimize these costs.

By understanding these essentials, you can take action now to ensure your family keeps more of what you’ve built.

Table of Contents

- Estate Taxes and Inheritance Taxes in Canada

- Estate Taxes and Deemed Disposition in Canada

- Capital Gains Taxes

- Understanding the Principal Residence Exemption

- How RRSPs and RRIFs Are Taxed at Death

- Impact of Business Ownership on Estate Taxes

- How Does Probate Affect Your Estate?

- The Executor’s Role in Estate Tax Filing

- Strategies to Reduce Estate Taxes Legally

- Tax Considerations When Selling an Inherited Property

- Tax Considerations for Surviving Spouses and Beneficiaries

- Life Insurance as an Estate Tax Planning Tool

- Estate Tax Implications for Non-Residents

- Taxation of Foreign-Owned Property

- Common Questions about Estate Taxes in Canada

Estate Taxes and Inheritance Taxes in Canada

There’s a lot of confusion about estate taxes in Canada, specifically whether estates are taxed at death and how much might be owed.

Even though Canada doesn’t enforce a traditional estate tax, capital gains taxes, deemed disposition rules, and probate fees still impact what loved ones inherit. By understanding how these factors apply to your situation, you can plan proactively, reduce taxes, and ensure a smoother transition of assets to your beneficiaries.

While there isn’t an inheritance tax in Canada, without proper estate planning, a large portion of your estate will go to the government due to taxes on capital gains.

Estate Taxes and Deemed Disposition in Canada

When a person passes away, the Canada Revenue Agency (CRA) considers all assets sold at fair market value.

This is called a deemed disposition, and it can trigger capital gains taxes. Let’s say the deceased owned investments, rental properties, or secondary residences. In this case, any increase in value since purchase is taxed as a capital gain. Half of the gain is taxable at the deceased’s marginal tax rate.

Additionally, probate fees may apply when transferring assets through a will. These costs reduce the inheritance left to beneficiaries. Planning ahead with tax-efficient strategies can help lower the tax burden and maximize what heirs receive.

Example: $3M Estate

John, a resident of Ontario, has passed away, leaving an estate valued at $3 million. His assets include:

- Primary residence: $1 million (principal residence exemption applies, so no capital gains tax)

- Investment portfolio: $1 million (with $400,000 in capital gains)

- Cottage: $1 million (with $500,000 in capital gains)

The deemed disposition rules apply, meaning the investments and cottage are considered “sold” at fair market value.

Tax Calculation:

- Investment portfolio: $400,000 capital gain → 50% taxable = $200,000

- Cottage: $500,000 capital gain → 50% taxable = $250,000

- Total taxable capital gains: $450,000

- Estimated tax (assuming 50% marginal tax rate): $225,000

Additionally, probate fees in Ontario (1.5% on assets over $50,000) would be approximately $42,750.

Total estate taxes & probate fees: $267,750, reducing the net estate for heirs, less all the other fees and real estate costs.

Capital Gains Taxes

Capital gains taxes apply when an asset’s value has increased since purchase.

For example, if you bought a second property, such as a cottage for $200,000, and it’s worth $500,000 when you pass away, the $300,000 gain is taxable. The CRA treats the cottage as if it were sold the day before death. Half of the gain is added to your final income tax return.

Proper estate planning can help reduce this tax liability and protect wealth for your heirs.

Understanding the Principal Residence Exemption

Your principal residence is exempt from capital gains tax, but only one property qualifies.

If you own multiple properties, such as a home and a cottage, only one can be designated as the principal residence for tax-free status. The other property may be subject to capital gains tax upon sale or death. Strategic planning (e.g., gifting property before death or selling it during your lifetime) can help reduce tax exposure.

How RRSPs and RRIFs Are Taxed at Death

Registered accounts like RRSPs and RRIFs are fully taxable upon death unless transferred to a spouse.

Without proper planning, RRSP and RRIF balances are added to the final income tax return, which can push the estate into the highest tax bracket. A $500,000 RRSP could result in taxes of $250,000 or more. Naming a spouse as the beneficiary allows a tax-free rollover.

If the beneficiary is a child with a disability, special tax-deferral options may also apply.

Impact of Business Ownership on Estate Taxes

Private business owners may face additional estate tax challenges due to shares and assets.

When a business owner dies, shares of the business are deemed to be sold at fair market value. This can trigger a large capital gains tax bill. However, the lifetime capital gains exemption may reduce taxes on qualified small business shares.

Proper estate planning, including the use of family trusts or corporate restructuring, can help minimize taxes and ensure a smooth business transition.

How Does Probate Affect Your Estate?

Probate fees in Ontario can add up, increasing the cost of transferring assets.

Probate is the court process of validating a will. Ontario charges probate fees of 1.5% on estate values over $50,000. This means a $2 million estate could face $29,500 in fees. Probate planning (e.g., using named beneficiaries on accounts, joint ownership, and trusts) can reduce probate costs and speed up asset transfers to heirs.

Probate fees are different in every province and territory.

Thus, it’s important to look up probate fees for your province or territory. For example, in Alberta, probate is a flat fee that is based on the size of the estate. Meanwhile, in BC, probate is $14 per $1,000 for values over $50,000, and in Saskatchewan, all estates must pay 0.7% of the estate’s value.

Find the most up-to-date info on your provincial or territorial government’s website.

Read More: What Is the Best Trust to Avoid Probate in Canada?

The Executor’s Role in Estate Tax Filing

The executor is responsible for filing the final tax return and ensuring estate taxes are paid.

This includes reporting capital gains, RRSP withdrawals, and other taxable income. The executor may also need to apply for a clearance certificate from the CRA to confirm all taxes are paid before distributing assets. Choosing an executor with financial knowledge or hiring professional assistance can ensure compliance and avoid tax penalties.

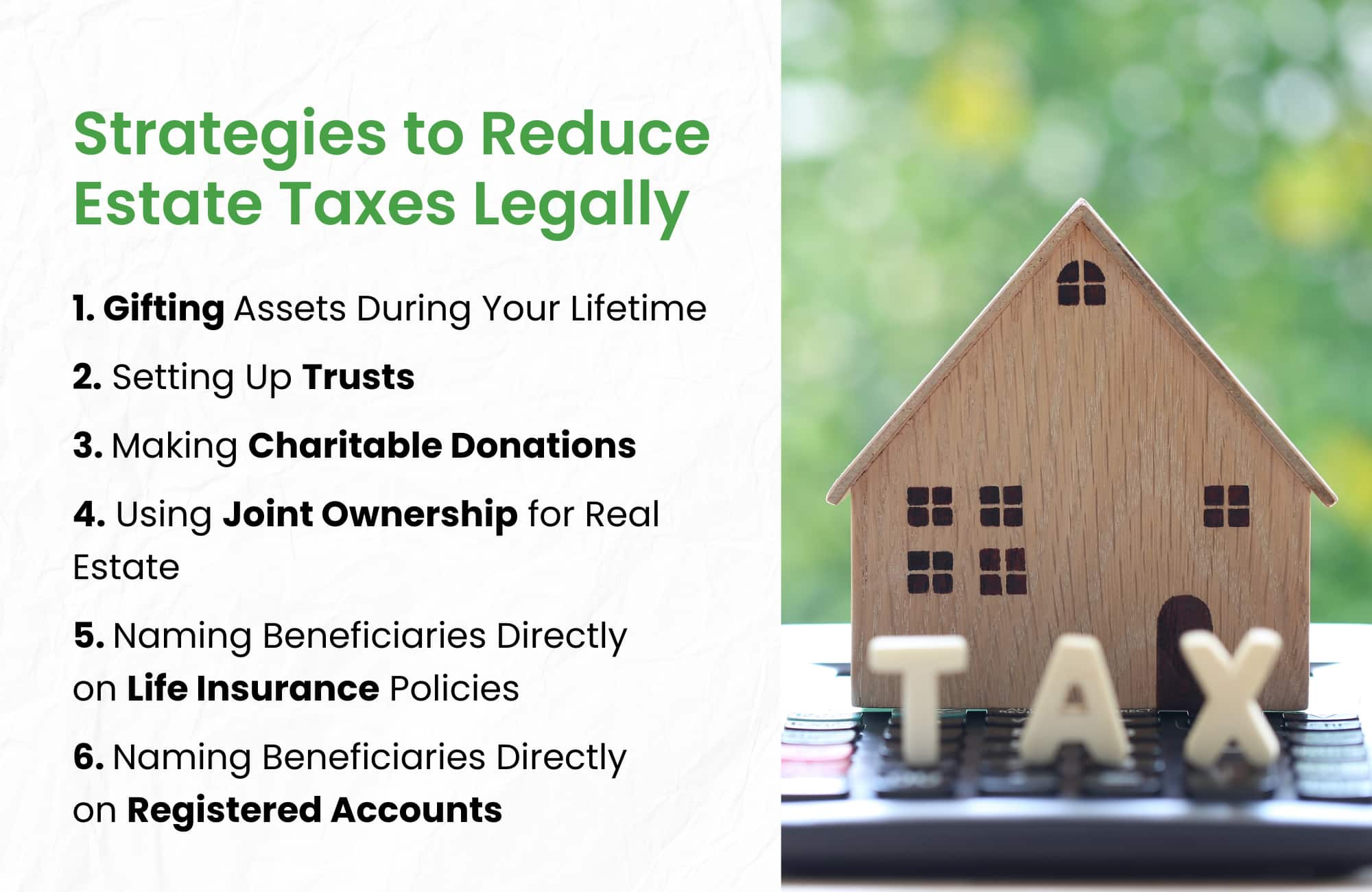

Strategies to Reduce Estate Taxes Legally

Proactive estate planning can help lower taxes and maximize what heirs receive.

Strategies include gifting assets during your lifetime, setting up trusts, making charitable donations, and using joint ownership for real estate. Naming beneficiaries directly on life insurance policies and registered accounts also avoids probate and estate taxes.

A well-structured plan ensures more of your wealth goes to your loved ones rather than the government.

Gifting Assets During Your Lifetime

Giving assets to your heirs while you are alive can reduce the overall value of your estate, minimizing estate taxes upon your passing.

In Canada, gifts are generally not subject to tax, but capital gains may apply if the asset has increased in value. Thoughtful planning ensures that gifting does not trigger unnecessary tax burdens while benefiting your heirs sooner.

Setting Up Trusts

Trusts can be an effective way to control how assets are distributed while reducing estate taxes and probate fees. A family trust, for example, allows assets to grow outside of your estate and provides flexibility in income distribution.

By structuring a trust properly, you can protect wealth for future generations while taking advantage of potential tax benefits.

Related Read: Pros and Cons of Putting a House in a Trust in Canada

Making Charitable Donations

Donating to charities through your will or during your lifetime can significantly reduce estate taxes. Charitable gifts qualify for tax credits, which can offset the taxes owed on your final return.

In some cases, setting up a donor-advised fund or leaving securities to charity can maximize both tax benefits and philanthropic impact.

Using Joint Ownership for Real Estate

Owning property jointly with the right of survivorship allows assets to transfer directly to the co-owner without passing through probate.

Right of survivorship is a legal principle that allows property owned jointly by two or more people to pass directly to the surviving owner(s) when one owner dies. This means the asset does not go through probate and is not included in the deceased’s estate for tax purposes.

This can simplify the inheritance process and reduce estate administration fees. However, it’s important to consider potential legal and tax implications before adding a joint owner.

Naming Beneficiaries Directly on Life Insurance Policies

Life insurance proceeds can bypass probate when beneficiaries are named directly, ensuring faster payouts and avoiding estate taxes.

This strategy helps provide financial security to your heirs without increasing the taxable value of your estate. Reviewing your beneficiary designations ensures they align with your overall estate plan.

Naming Beneficiaries Directly on Registered Accounts

Registered accounts such as RRSPs, RRIFs, and TFSAs allow you to name beneficiaries, which helps avoid probate and estate taxes.

The funds transfer directly to the named beneficiary, reducing delays and administrative costs. Proper planning ensures that tax-efficient strategies are in place for passing down these assets.

Tax Considerations When Selling an Inherited Property

Selling inherited property can trigger capital gains taxes depending on its value at death.

If the property’s value increases between the date of death and sale, the estate or beneficiaries may owe tax on the additional gain. Keeping records of the property’s fair market value at the time of inheritance helps determine tax obligations.

Some families sell quickly to minimize tax exposure, while others hold properties as investments.

Tax Considerations for Surviving Spouses and Beneficiaries

Spouses benefit from tax-free asset transfers, while other beneficiaries may face tax burdens.

A surviving spouse can inherit assets like RRSPs and real estate without immediate tax consequences. However, when assets pass to children or other beneficiaries, they may be subject to capital gains taxes and probate fees. Understanding these rules helps families plan ahead and minimize taxes. This is where proper estate planning is critical.

Life Insurance as an Estate Tax Planning Tool

Life insurance can provide tax-free funds to cover estate taxes.

A properly structured life insurance policy ensures liquidity so that heirs are not forced to sell assets to pay taxes. For example, if an estate faces $500,000 in taxes, a life insurance payout can cover this cost, preserving the estate’s value. Naming a beneficiary directly also keeps the payout outside the estate, avoiding probate fees.

Estate Tax Implications for Non-Residents

Non-residents with Canadian assets may face estate taxes in both Canada and their home country.

For example, a U.S. citizen who owns Canadian property may be subject to capital gains tax in Canada and estate tax in the U.S. Tax treaties between countries can help prevent double taxation, but planning with cross-border tax specialists is essential to minimize tax liabilities.

Taxation of Foreign-Owned Property

Owning foreign property can create tax complications for Canadian estates.

Canadian residents must report foreign assets worth more than $100,000 to the CRA. If a Canadian inherits or owns property abroad, capital gains taxes may apply in both Canada and the foreign country. Understanding these rules and consulting tax professionals can help avoid surprises when passing on international assets.

Common Questions about Estate Taxes in Canada

Do you pay tax when you inherit a house in Canada?

No, Canada does not have an inheritance tax. However, if the deceased owned the house, their estate may owe capital gains tax if the property was not their principal residence. The beneficiary may also pay land transfer tax if they later sell or transfer the property.

How much is an estate taxed in Canada?

Canada does not have a direct estate or inheritance tax. However, upon death, the deceased is deemed to have disposed of all assets at fair market value, potentially triggering capital gains tax on any appreciation. Additionally, some provinces levy probate fees or estate administration taxes based on the estate’s value.

Which taxes need to be paid when settling an estate in Canada?

Settling an estate may involve paying income tax on the deceased’s final return, capital gains tax on asset appreciation, and provincial probate or estate administration taxes. Addressing all tax obligations ensures proper estate distribution.

How do you calculate probate (estate administration tax) in Canada?

In Ontario, estate administration tax (often called probate) is 0.5% on the first $50,000 of the estate’s value and 1.5% on anything above that.

This tax is based on the fair market value of all assets passing through probate, including real estate, bank accounts, and investments, but excluding jointly owned assets. All provinces and territories are different, so to get an accurate number, you’ll need to look up your jurisdiction to find out how probate is calculated.

When is the final estate tax return due in Canada?

The final tax return is generally due April 30 of the year following the person’s death. However, if they died between November and December, the deadline is six months after their death. Executors should file as soon as possible to avoid penalties and ensure smooth estate distribution.

What happens if estate taxes are not paid on time?

If taxes aren’t paid, the estate may face interest charges, penalties, and delays in distributing assets. The Canada Revenue Agency (CRA) can hold the executor personally liable if distributions are made before settling outstanding taxes. Proper planning ensures taxes are paid promptly to avoid legal and financial issues.

What is the three-year rule for a deceased estate?

The three-year rule applies to reassessments by the CRA. If a final tax return is filed and assessed, the CRA generally has three years to audit or reassess it. However, if they suspect fraud or major errors, they can reassess beyond three years, potentially increasing the estate’s tax liability.

What happens if someone dies and they leave unpaid taxes?

Before distributing assets, an executor must ensure all taxes owed by the deceased and the estate are paid. This includes income tax, capital gains tax, and estate administration tax. If taxes remain unpaid, the Canada Revenue Agency (CRA) may pursue the estate or even hold the executor personally responsible.

What is an adjusted cost base in estate planning?

The adjusted cost base (ACB) refers to the original purchase price of an asset, plus any costs for improvements. It determines how much capital gain or loss applies when an asset is sold or deemed sold at death. Proper ACB records help minimize tax liabilities for the estate and beneficiaries.

Discover How to Minimize Taxes and Secure Your Legacy

Did you know that without a solid estate plan, taxes and fees in Ontario could claim a significant portion of your wealth?

If you’ve worked hard to build your business, investments, and properties, protecting your legacy for your loved ones is critical. At Strategic Wealth Protection Partners, we specialize in helping high-net-worth individuals in Ontario secure their financial futures.

Our Living Estate Plan is designed to:

- Reduce estate taxes and probate fees.

- Simplify wealth transfer to your loved ones.

- Reflect your values and priorities in every detail.

Your Legacy Matters

With our personalized guidance, we’ll help you navigate options like Living Trusts to protect your assets and ensure your family’s peace of mind. Contact us today to book your Living Estate Plan Consultation and take the first step toward a secure future.

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- How to Avoid Estate Tax in Ontario

- How Much Is an Estate Taxed in Canada?

- How to Avoid Estate Tax in Canada

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.