Quick Guide to Living Trusts in Ontario

Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

A Guide to Living Trusts for Ontario Families with Complex Estates

If you own multiple properties, a business, or have significant assets, planning your estate can feel overwhelming.

High-net-worth families often face unique challenges. Probate delays, privacy concerns, and the smooth transfer of assets can all become major issues. A living trust can help.

A living trust is a powerful tool that offers control, privacy, and efficiency. This guide will explain what a living trust is, how it works, and when it might be the right choice for your family.

But first, what is a living trust in Ontario?

An Ontario living trust is a legal arrangement that allows a person (the settlor) to transfer ownership of their assets to a trust during their lifetime. Managed by a trustee for the benefit of specified beneficiaries, the goal of a living trust is to simplify asset management, distribution and control.

Table of Contents

- What Is a Living Trust in Ontario?

- Living Trusts as an Estate Planning Tool

- Examples of When to Use a Living Trust

- Living Trusts vs Wills

- Do You Need a Will and a Trust?

- Revocable vs. Irrevocable Living Trusts in Ontario

- When to Consider a Living Trust

- Benefits of Living Trusts in Canada

- Disadvantages of Living Trusts in Canada

- Discover the Benefits of a Living Trust in Ontario

- Living Trusts and Avoiding the Probate Process

- Tax Implications of Setting Up a Living Trust in Ontario

- How to Set Up a Living Trust in Ontario

- Mistakes to Avoid When Setting Up a Living Trust in Ontario

- Tax Rules for Living Trusts in Ontario

- How Are Living Trusts Taxed Upon Death?

- Is a Living Trust the Right Choice for Your Family?

- Q & A

What Is a Living Trust in Ontario?

A living trust is a legal arrangement for managing assets.

You, as the settlor, transfer ownership of your assets to a trust. A trustee then manages these assets to benefit your chosen beneficiaries. The trust can include real estate, financial accounts, and other valuable property. Unlike a will, a living trust becomes active while you’re still alive.

This means you can manage and control the trust during your lifetime and even after death, making it an effective tool for proactive estate planning.

Living Trusts as an Estate Planning Tool

Living trusts are ideal for managing complex estates.

If you own multiple properties, such as vacation homes or rental properties, a living trust can simplify management and transfer. It also keeps your estate private, as trusts do not go through probate, unlike wills. This can save time and reduce stress for your family.

Probate delays in Ontario can be lengthy, and fees can add up quickly. For high-net-worth families, a living trust ensures that your wishes are carried out smoothly without unnecessary costs or complications.

Examples of When to Use a Living Trust

Here are three scenarios where a living trust could help.

1.) A family owns a cottage in the Muskoka and rental properties in Toronto.

A living trust ensures these properties pass to the next generation without probate delays or public disclosures about the properties.

2.) A couple runs a successful small business in Ontario.

They want to ensure their business transitions smoothly to their children. A living trust can provide clear guidelines for succession.

3.) Parents with a blended family of five children want to divide assets fairly, including significant financial investments and real estate.

A living trust helps ensure each child receives their share while minimizing potential disputes.

By considering these examples, you can see how a living trust could fit your family’s unique needs. It provides peace of mind and simplifies the process for everyone involved.

Case Study: Life Insurance as a Strategic Estate and Tax Planning Tool for a Real Estate Investor in His 50s

The Problem:

*James, a successful real estate investor in his early 50s, owned several residential investment properties—houses, condos, and similar assets—through a corporation.

Like many high-net-worth investors, James was concerned about the significant tax bill his estate would face upon his death. He initially believed that transferring his assets into a trust would help reduce or defer these estate taxes.

However, during the estate planning process, it became clear that a trust wasn’t the right fit for James.

He didn’t intend to hold on to his current properties long-term.

Instead, he planned to sell them and reinvest in larger commercial properties at a later date. Selling would trigger capital gains tax regardless of whether the assets were inside a trust, making the cost of setting up the trust unnecessary and counterproductive.

The Solution:

Instead of using a trust, James implemented a more flexible and cost-effective strategy: permanent life insurance tailored to cover future tax liabilities.

Key components of this solution included:

- Customized Life Insurance: A policy was structured to grow alongside James’s assets. Whether he kept his current properties or reinvested in new ones, the insurance benefit would provide his estate with the liquidity needed to cover taxes.

- Corporate Ownership of Assets: Since his properties were held in a corporation, James faced a potential double taxation issue: once when the corporation sells the properties and again when money is distributed to shareholders (e.g., his estate). The insurance policy addressed this by providing funds that could be accessed mostly tax-free through the corporation to pay estate taxes.

- Leveraged Insurance Strategy: James paid a large premium into the insurance policy, then borrowed back that money using the policy as collateral. He reinvested those funds into new real estate opportunities. This allowed him to maintain liquidity and continue growing his portfolio without tying up capital.

- Tax Efficiency: The interest on the loan used to borrow against the policy was tax-deductible because it was used for investment purposes. Additionally, a portion of the insurance cost could also be deducted, further improving the tax efficiency of the overall strategy.

Why This Worked:

This approach provided several strategic benefits:

- Flexibility: It accommodated James’s plan to sell and reinvest in different properties.

- Liquidity: It ensured there would be funds available to pay taxes, avoiding forced sales of assets.

- Tax Minimization: It reduced the risk of double taxation and made use of deductible interest and insurance expenses.

- Wealth Multiplication: By borrowing against his insurance and reinvesting, James effectively had two streams of growth—his insurance and his real estate investments—while only paying loan costs on one.

The Outcome:

James felt reassured and confident after going through this process. And he was relieved that he hadn’t been saddled with a trust that he didn’t need.

Our solution addressed his primary concern: ensuring his loved ones wouldn’t face a heavy tax burden after his death. At the same time, it gave him the freedom to keep expanding his real estate portfolio, a passion of his. He was able to continue doing what he loved (finding and investing in great real estate deals) while knowing his estate plan was secure and tax-efficient.

*Names have been changed to protect the identity of SWPP’s clients.

Living Trusts vs Wills

A living trust and a will serve different purposes.

A will outlines how your assets will be distributed after your death. It also appoints guardians for minor children. On the other hand, a living trust holds assets during your lifetime and simplifies the transfer process after death. Unlike a will, a living trust can help your family avoid probate.

If you have complex assets, both tools may be useful. A living trust can manage certain assets, while a will handles items outside the trust.

Read More: Living Trusts vs. Wills in Canada

Do You Need a Will and a Trust?

Many people benefit from using both a living trust and a will.

A living trust is great for assets like real estate, investments, and savings. It allows you to decide who manages these if you become incapacitated. It also provides privacy and prevents probate. A will ensures that any items left out of the trust, such as personal belongings, are distributed as you wish.

Each has strengths, and together, they create a complete estate plan.

Revocable vs. Irrevocable Living Trusts in Ontario

The type of trust you choose depends on your goals and how you wish the trust to be managed.

Revocable Living Trust

A revocable living trust offers flexibility.

A revocable living trust can be changed or cancelled at any time while you’re alive. You retain control of the assets in it. Many people use this option to manage assets during their lifetime. It also makes transferring assets easier after death.

However, this type of trust doesn’t protect assets from creditors. It also won’t reduce taxes. Still, it’s a strong tool for simplifying estate planning and ensuring your wishes are honoured.

Irrevocable Living Trust

An irrevocable living trust is a permanent legal arrangement.

Once created, you cannot easily change or cancel an irrevocable living trust. You give up control of the assets in it. However, this structure provides advantages, such as protecting assets from creditors and potentially lowering taxes.

These trusts are ideal for individuals who want to secure assets for future generations. They’re also helpful in estate planning for high-net-worth individuals. Due to the complexity, it’s essential to consult with an experienced advisor or legal professional when setting one up.

Revocable vs Irrevocable Living Trusts

Here’s a clear table outlining the key differences between irrevocable and revocable living trusts:

| Feature | Revocable Living Trust | Irrevocable Living Trust |

|---|---|---|

| Control | You retain full control of the assets. | You relinquish control of the assets. |

| Flexibility | Can be changed or canceled anytime. | Cannot be changed or cancelled easily. |

| Creditor Protection | Does not protect assets from creditors. | Protects assets from creditors. |

| Tax Benefits | No significant tax benefits. | May reduce estate and income taxes. |

| Purpose | Simplifies estate planning and asset transfer. | Secures assets and protects wealth long-term. |

When to Consider a Living Trust

A living trust is helpful for families and individuals with complex estates.

If you have significant assets, own property in multiple locations, or want to avoid probate, a living trust is worth considering. It’s especially beneficial for individuals nearing retirement who want to ensure their estate is managed smoothly.

Living trusts may also be ideal for blended families or dependents who may need financial support.

They provide clarity and control over how assets are distributed. Additionally, they allow you to name someone to manage your affairs if you become incapacitated. Consulting with a professional ensures your living trust aligns with your goals.

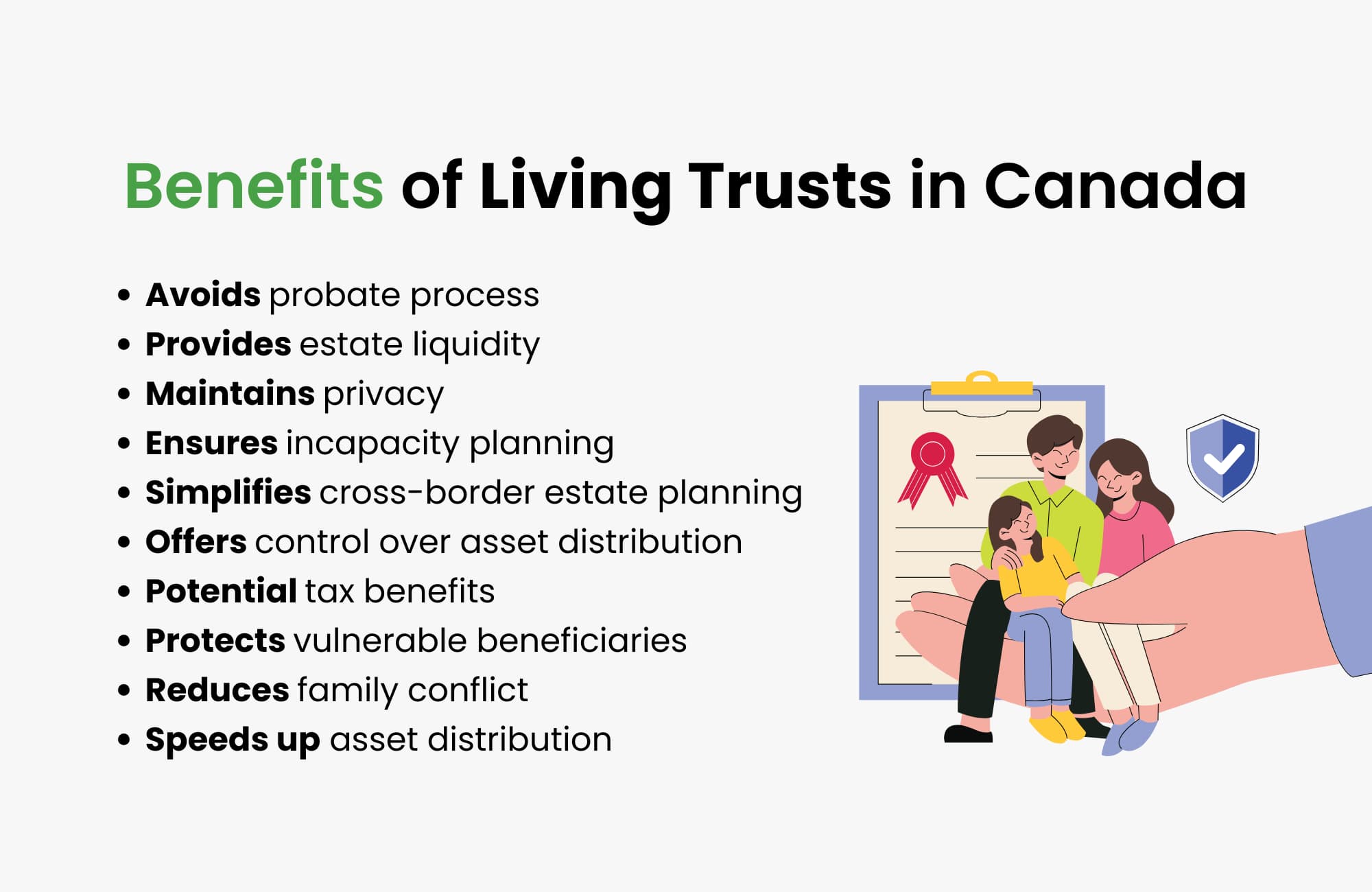

Benefits of Living Trusts in Canada

Living trusts offer many advantages, including potential tax benefits when combined with other financial planning tools.

One major benefit is avoiding the probate process. In Ontario, probate can delay the distribution of assets and involve costly fees. A living trust allows assets to be transferred directly to heirs, saving time and money.

Here is a list of the many benefits of a living trust:

- Avoids probate process: Assets transfer directly to heirs without delays or probate fees.

- Provides estate liquidity: Immediate access to funds helps heirs cover expenses like taxes and funeral costs.

- Maintains privacy: Unlike a will, a trust is not a public document, keeping your affairs confidential.

- Ensures incapacity planning: Names a trusted person to manage your assets if you cannot.

- Simplifies cross-border estate planning: Ideal for individuals with assets in multiple countries, such as Canada and the U.S.

- Offers control over asset distribution: Specify when and how heirs receive their inheritance.

- Potential tax benefits: May reduce estate taxes and preserve more wealth for your heirs.

- Protects vulnerable beneficiaries: Ensures minor children or dependents are financially supported.

- Reduces family conflict: Clear instructions help prevent disputes over your estate.

- Speeds up asset distribution: Heirs can access assets quickly without legal delays.

Discover the Benefits of a Living Trust in Ontario

Are you an Ontario resident considering a living trust as part of your estate planning?

At Strategic Wealth Protection Partners, we’re here to guide you through every step of the process with expert advice and personalized support. Begin your estate planning journey with a Living Estate Plan Consultation from our experienced team.

Our mission at SWPP is to help you create an estate plan that secures your legacy, shields your assets from unnecessary taxation, and ensures your loved ones are cared for. By designing a living trust tailored to your goals, our experts will help you build a plan that truly reflects your values and priorities.

Take control of your future and start planning today.

Schedule a Living Estate Call HERE.

Disadvantages of Living Trusts in Canada

A living trust isn’t a magic bullet, and it isn’t right for everyone.

Here is a list of some of the disadvantages of a living trust:

- Initial costs: Setting up a trust can cost $2,500 to $15,000.

- Ongoing maintenance: You must regularly update the trust to reflect changes in your assets or beneficiaries.

- Complexity: Trusts are more complicated to set up and manage than wills.

- No creditor protection for revocable trusts: Assets in a revocable trust are not shielded from creditors. However, they are shielded when placed in an irrevocable trust.

- Limited tax benefits for revocable trusts: These trusts generally don’t reduce income or estate taxes unless paired with other financial tools and strategies.

- Requires proper funding: Assets must be retitled into the trust, which can be time-consuming and costly.

- Potential for trustee mismanagement: If a poorly chosen trustee mismanages the trust, it can cause financial issues.

- Not ideal for small estates: If your estate is quite modest, the cost and effort may outweigh the benefits.

- No probate avoidance for excluded assets: Any assets left outside the trust may still go through probate.

- Irrevocable trusts limit control: With irrevocable trusts, changes are difficult or impossible once the trust is established.

- Professional fees: You may need to pay advisors, lawyers, or accountants to manage the trust.

- Not a substitute for a will: A will is still needed to cover assets not included in the trust.

If you’re considering a trust, it’s important to work with an estate planning professional who can create a Living Estate Plan that will cover all aspects of your estate planning and assess whether a living trust is right for you.

Living Trusts and Avoiding the Probate Process

A living trust can help you bypass the delays and costs of probate.

In Ontario, probate is the court process for validating a will and distributing assets. It often involves delays and probate fees, which can be up to 1.5% of the estate’s value. In other words, if your estate is valued at $2M, probate could cost $30,000 in Ontario.

A living trust allows assets to pass directly to your beneficiaries, avoiding probate entirely.

Avoiding probate not only saves time and money but also keeps your financial affairs private. While a will becomes part of the public record, a trust remains confidential. If your goal is to simplify asset distribution for your heirs, a living trust is a smart solution.

Tax Implications of Setting Up a Living Trust in Ontario

Living trusts have specific tax rules in Ontario.

For revocable living trusts, you remain the owner of the trust assets during your lifetime. This means you continue to report income from those assets on your personal tax return, with no immediate tax savings.

Irrevocable living trusts, however, may offer tax benefits. They can help reduce estate taxes by removing assets from your taxable estate. Additionally, income generated within the trust may be taxed at lower rates if it is distributed to beneficiaries in lower tax brackets.

Setting up a trust may trigger capital gains taxes if assets are transferred into the trust. It’s crucial to work with an estate planning professional and tax advisor to understand how these rules apply to your particular situation.

How to Set Up a Living Trust in Ontario

Setting up a living trust involves careful planning. We recommend that you seek professional advice if you’re considering setting up a living trust in Ontario.

1.) Seek estate planning guidance.

Work with a professional to create an estate plan that considers every aspect of your legacy, including creating a trust. Your trust should be part of a larger estate and legacy plan.

2.) Determine your goals for the trust.

Decide what you want the trust to accomplish. This includes protecting assets, avoiding probate, or providing for specific beneficiaries. Clear goals will shape how the trust is structured.

3.) Create the trust document.

Work with an experienced estate planning lawyer to draft the trust agreement. This legal document outlines the trust’s purpose, beneficiaries, trustee, and asset management instructions.

4.) Appoint a trustee.

Select someone reliable to manage the trust. This could be a family member, a trusted friend, or a professional trustee, depending on your needs and the complexity of the trust.

5.) Consult financial and tax advisors.

Seek advice from financial and tax professionals, especially if you have cross-border assets or investments. If you have assets on both sides of the border, you will want to ensure compliance with Canadian and U.S. laws while maximizing tax benefits.

6.) Fund the trust by transferring assets.

Retitle property, bank accounts, investments, or other assets into the trust’s name. This step is critical, as the trust won’t function without assets in it.

7.) Notify relevant parties.

Inform financial institutions, insurance companies, and other entities of the trust. They may require additional paperwork to recognize the trust’s authority over assets.

8.) Review and update the trust regularly.

Revisit the trust document periodically or after major life events (e.g., marriage, divorce, or the birth of a child). This ensures it reflects your current wishes and financial situation.

9.) Educate family members.

Communicate the trust’s purpose and structure to your beneficiaries or key family members to avoid confusion or disputes later.

While this may sound complicated, working with a professional means you’ll have guidance during every step of the process.

Mistakes to Avoid When Setting Up a Living Trust in Ontario

Avoid these common mistakes to ensure your living trust works as intended.

- Failing to fund the trust: Many people create a trust but forget to transfer assets into it. Without this step, the trust cannot function properly.

- Choosing the wrong trustee: Picking someone unreliable or unqualified can lead to mismanagement of the trust. Always choose a trustee who understands their responsibilities.

- Neglecting to update the trust: Life changes, such as marriage, divorce, or new children, require updates to your trust. Failing to do so can create confusion.

- Overlooking professional advice: Setting up a trust without guidance from legal and financial advisors can result in errors that are costly to fix.

- Ignoring cross-border complexities: If you own property in the U.S. or have cross-border ties, not addressing jurisdictional rules can lead to unintended tax consequences.

When you work with an estate planning professional, you will be able to avoid these common mistakes.

Tax Rules for Living Trusts in Ontario

Income earned within a trust is subject to taxation under Canada’s Income Tax Act.

For revocable living trusts, the trust’s income is reported on your personal tax return. You’re taxed on any income earned by the assets held in the trust. This means there are no immediate tax savings.

Irrevocable living trusts, however, are treated as separate entities for tax purposes.

The trust itself is taxed on income it retains, often at the top marginal rate. Alternatively, income distributed to beneficiaries is taxed at their individual tax rates, which may be lower.

High-income families benefit from splitting income among beneficiaries in lower tax brackets. This strategy can reduce the overall tax burden. However, creating and managing these trusts requires careful planning to comply with the Income Tax Act and avoid penalties.

How Are Living Trusts Taxed Upon Death?

Upon death, living trusts in Canada face specific tax rules under the Income Tax Act.

When the creator (settlor) of a living trust passes away, the trust is deemed to have disposed of its assets at fair market value. This triggers potential capital gains taxes on any appreciated assets. For example, if a property in the trust has increased in value, the gain will be taxed.

If the trust is a revocable trust, its assets are treated as part of the settlor’s estate. The capital gains are reported on the settlor’s final tax return. This aligns with standard tax rules for individuals.

For irrevocable trusts, the trust remains a separate entity. It continues to exist after death, and the trustee must handle ongoing tax filings. Any income earned within the trust is taxed at the top marginal rate unless it’s distributed to beneficiaries, who then pay tax at their own rates.

Proper planning can minimize taxes:

- Utilize the principal residence exemption for real estate to reduce capital gains.

- Plan for tax deferral strategies where applicable.

- Work with advisors to structure the trust in a way that reduces the tax burden for your heirs.

Understanding these rules ensures your estate plan aligns with your goals while reducing the tax impact on your beneficiaries.

Is a Living Trust the Right Choice for Your Family?

A living trust can be a powerful tool, but it depends on your family’s estate planning goals.

If your priority is avoiding probate, ensuring privacy, or simplifying the transfer of assets, a living trust might be ideal. However, living trusts may not be necessary for smaller estates or families whose primary goal is to reduce costs. Setting up a trust requires time, effort, and ongoing management.

Q & A

What is a trust agreement?

A trust agreement is a legal document that establishes the trust, names the trustee and beneficiaries, and provides instructions for managing and distributing the trust’s assets.

What are estate taxes in Ontario?

Ontario does not have a specific estate tax, but probate fees (Estate Administration Tax) apply at approximately 1.5% of the estate’s value.

In addition, all assets are deemed to be sold at fair market value upon death, and any resulting capital gains are taxed on the final income tax return unless transferred to a surviving spouse or a spousal trust. This can result in substantial tax implications.

What is an inter vivos trust?

An inter vivos trust, or living trust, is created during the settlor’s lifetime to manage assets and distribute them according to specific terms.

What is the role of a successor trustee in managing a living trust?

A successor trustee takes over management of the trust if the original trustee becomes incapacitated or passes away, ensuring the trust operates as intended.

Which assets can you include in a living trust in Ontario?

You can include real estate, bank accounts, investments, business interests, and personal property, but not registered accounts like RRSPs or TFSAs.

How much does a living trust cost in Ontario, Canada?

Setting up a living trust may cost $2,500 to $15,000 or more, depending on its complexity and the professional fees.

Can you put your house in a living trust in Canada?

Yes, you can transfer ownership of your house into a living trust.

What is an alter ego trust?

An alter ego trust is a type of inter vivos trust available to Canadians aged 65 or older. The settlor (creator of the trust) retains control and benefits from the trust assets during their lifetime, and it allows probate avoidance and smooth asset transfer upon death.

What is a bare trust?

A bare trust holds legal title to assets for a beneficiary, who has full control and ownership rights. The trustee acts only as a nominee, and the trust income is taxed in the

Discover the Benefits of a Living Trust in Ontario

Are you an Ontario resident considering a living trust as part of your estate planning?

At Strategic Wealth Protection Partners, we’re here to guide you through every step of the process with expert advice and personalized support. Begin your estate planning journey today with a Living Estate Plan Consultation from our experienced team.

Our mission at SWPP is to help you create an estate plan that secures your legacy, shields your assets from unnecessary taxation, and ensures your loved ones are cared for. By designing a living trust tailored to your goals, our experts will help you build a plan that truly reflects your values and priorities.

Take control of your future—start planning today!

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- How Does a Living Trust Work in Ontario?

- How to Create a Living Trust in Canada

- How Much Does a Living Trust Cost in Ontario?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.