Written by Ron Cooke, President & Founder of Strategic Wealth Protection Partners in Ontario, CEA®, Member of the Estate Planning Council Canada

What are the disadvantages of putting a house in a trust?

Placing a house in a trust can be costly to set up and maintain, as it often involves legal and administrative fees.

The process may also require transferring the property title, which can trigger land transfer taxes or other fees in some cases. Once the house is in a trust, you may have limited flexibility to make changes, depending on the type of trust established.

Additionally, trust income might be taxed at the highest marginal rate if not distributed to beneficiaries. Understanding the financial implications is essential to determine if a trust aligns with your goals.

What are the advantages of putting a house in a trust?

Putting a house in a trust can protect it from probate, saving time, money, and ensuring privacy.

Trusts also allow you to specify how the property will be managed or distributed, providing greater control over its use. They are particularly useful in protecting assets from creditors or legal disputes.

Additionally, a trust can ensure a smooth transition of ownership, especially in complex family situations. For vacation or rental properties, trusts can play a key role in long-term planning and tax efficiency.

Should you put a house into a trust?

The decision to put a home into a trust has to be weighed carefully.

You have to consider not just the cost of setting it up, but also the ongoing administrative costs of managing it.

In most cases, people don’t find it worthwhile. But in certain situations, it does make sense. I had one client whose elderly mother put her house into a trust at 80 years old under the guidance of a different advisor.

She’s now 102, and because of Canada’s 21-year deemed disposition rule, the trust had to pay capital gains on all the appreciation since she was 80. That resulted in a large tax bill—something her previous advisor had not anticipated.

Putting a house in a trust can be useful, but it can also be costly if not structured properly or if circumstances change. You really need to map out the “what-ifs.”

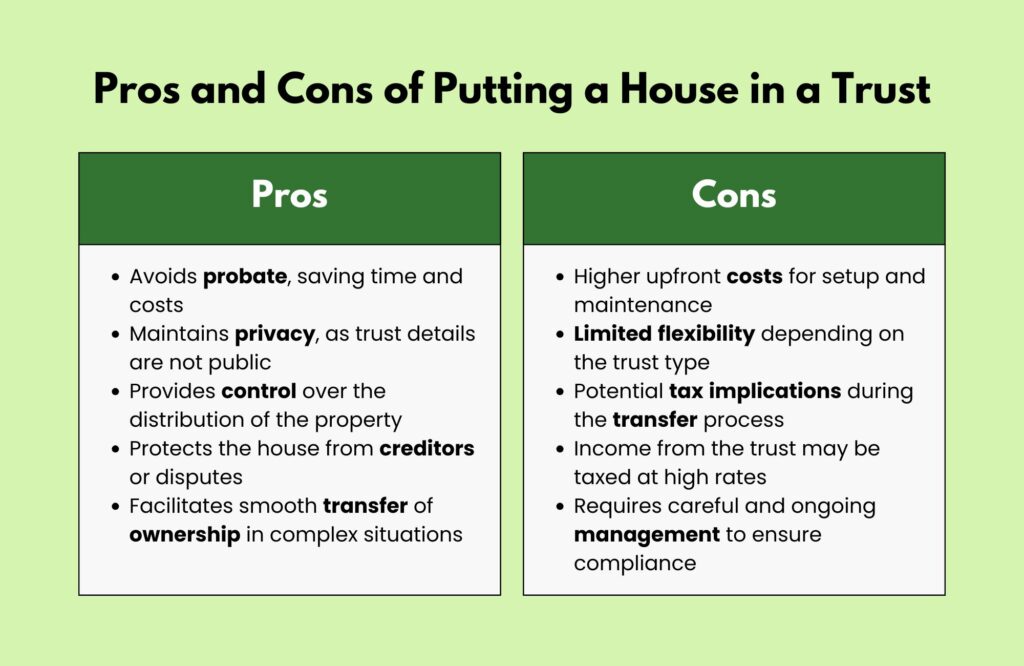

Pros and Cons of Putting a House in a Trust

| Pros | Cons |

|---|---|

| Avoids probate, saving time and costs | Higher upfront costs for setup and maintenance |

| Maintains privacy, as trust details are not public | Limited flexibility depending on the trust type |

| Provides control over the distribution of the property | Potential tax implications during the transfer process |

| Protects the house from creditors or disputes | Income from the trust may be taxed at high rates |

| Facilitates smooth transfer of ownership in complex situations | Requires careful and ongoing management to ensure compliance |

How can I minimize tax on the inheritance of a cottage or other vacation property?

To minimize tax on the inheritance of a cottage or vacation property, consider strategies like transferring the property gradually using the principal residence exemption or gifting it during your lifetime.

Setting up a family trust can also help spread the tax burden among beneficiaries. Capital gains tax is often the biggest concern, so it’s essential to document the property’s adjusted cost base and track eligible expenses to reduce the taxable gain.

Consulting a tax professional and estate planning expert ensures the most effective approach for your specific situation.

👉 Read the Definitive Guide to Living Trusts in Ontario

How can I minimize tax on the inheritance of a rental property?

Minimizing tax on the inheritance of a rental property often involves careful planning, such as structuring ownership through a family trust or holding company.

Transferring the property incrementally or gifting it to beneficiaries over time can help reduce the capital gains tax burden.

Keeping detailed records of property improvements and expenses is crucial to increase the adjusted cost base and lower taxable gains. Additionally, exploring strategies like joint ownership with beneficiaries can provide long-term tax benefits. Professional advice ensures compliance and maximizes savings.

Client Case Study: Ensuring a Real Estate Legacy for Minor Children Using a Trust

The Problem:

Deepak*, a 57-year-old real estate investor in Ontario, came seeking a solution to a very specific concern: how to ensure that his $7 million in investment properties would go directly to his two minor children when he passed away, without being diverted or lost along the way.

Although he was still married, Deepak did not want these particular assets to pass to his spouse. His concern was that if she remarried or later changed her estate plans, the children might never receive the inheritance he intended for them.

He wanted to maintain control and certainty over who would ultimately benefit from his real estate business.

His personal assets (including RRSPs, a cottage, and a principal residence) were already designated for his wife. It was the business and real estate holdings that he wanted to earmark specifically and solely for his children.

The Solution:

To address this, a two-part estate planning strategy was implemented:

- Trust Structure: A trust was created to receive the business and investment properties. Because his children were minors, they could not legally hold title to the assets directly. The trust allowed Deepak to ensure that these assets would be held and managed for the benefit of his children according to his wishes, without going through his spouse.

- Life Insurance: To cover the tax liability associated with transferring the properties into the trust, life insurance was set up. This helped ensure that, upon his passing, the estate would not be forced to liquidate assets to pay taxes. The insurance was designed to cover the tax up to the point of transfer, allowing the properties to pass intact to the trust.

Why This Worked:

- Asset Protection for Minors: The trust ensured that Deepak’s minor children would receive the assets in the future, with clear legal safeguards in place.

- Clarity of Intent: The trust bypassed the spouse for these specific assets, aligning with Deepak’s wishes without compromising her financial stability (she was still provided for through other assets).

- Tax Liability Management: The life insurance addressed the inevitable taxes from the asset transfer, preserving the full value of the real estate holdings for the next generation.

- Simplicity and Precision: The process focused on deeply understanding Deepak’s personal goals. He had previously spoken with other professionals but didn’t get the clarity he needed. This customized, client-centered approach gave him confidence.

The Outcome:

Deepak was genuinely pleased with the outcome.

After years of uncertainty and conversations that hadn’t delivered clear answers, he finally had a structured plan in place. The process gave him a sense of calm, knowing that his legacy would be preserved exactly as he intended, with protections for both his children and his spouse. And he no longer had to spend hours scouring the internet looking for solutions!

*Names have been changed to protect the identity of SWPP’s clients.

Discover the Benefits of a Living Trust in Ontario

Are you an Ontario resident considering a living trust as part of your estate planning?

At Strategic Wealth Protection Partners, we’re here to guide you through every step of the process with expert advice and personalized support. Begin your estate planning journey today with a Living Estate Plan Consultation from our experienced team.

Our mission at SWPP is to help you create an estate plan that secures your legacy, shields your assets from unnecessary taxation, and ensures your loved ones are cared for. By designing a living trust tailored to your goals, our experts will help you build a plan that truly reflects your values and priorities.

Take control of your future—start planning today!

Schedule a Living Estate Plan Consultation

Planning your legacy is about more than numbers—it’s about ensuring your family remembers you and your values are honoured for many years to come.

Estate planning and trusts can feel overwhelming, especially if it’s your first time. That’s why we’re here.

With our simple, 5-Step Living Estate Plan, we make the process easy, helping you create a comprehensive estate plan or trust that protects your assets from taxes and probate fees while preserving your legacy. Tools like The Final Word Journal capture your story, wishes, and essential details like accounts and end-of-life plans, ensuring your family has clarity and comfort.

Take the first step today—schedule a consultation call and give your family the ultimate gift: peace of mind and the assurance they were always your priority.

Read More

If you’re starting your estate planning process, you may find these articles helpful:

- Guide to Holding Property in a Trust in Ontario

- Is a Living Trust Better than a Will in Canada?

- What Is the Cost of a Living Trust in Canada?

About the Author

RON COOKE, PRESIDENT & FOUNDER OF STRATEGIC WEALTH PROTECTION PARTNERS

With over 30 years in financial services, I’ve seen the challenges families face when a loved one passes—lost assets, unnecessary taxes, and emotional stress. That’s why I created the Living Estate Plan, a comprehensive process to protect assets, eliminate estate and probate fees, and create legacies that are remembered for many years to come.

This plan ensures your family receives not just your wealth, but a meaningful reminder of your care and love. Tools like The Final Word Journal capture your story, wishes, and essential details, offering clarity and comfort during difficult times.

Your final gift should be more than money—it should be peace of mind, cherished memories, and an organized estate.

Schedule a Call

Schedule a 30-minute consultation call with Strategic Wealth Protection Partners.

Click HERE to schedule a consultation.