Okay, I’ll admit that some things have taken me by surprise recently. Two things come to mind. The first is that my nephew, Lewis, after spending four years earning a university degree, has settled into his new profession – as an armpit sniffer. No, really, it’s a thing. He’s been hired by a research company that tests deodorant products and earns a starting salary of $67,000 annually (before an annual bonus) to smell the armpits of people who have just run on a treadmill. I didn’t tell him his job stinks.

iStock-1366925328

The next surprise worth mentioning affects every Canadian resident and has to do with tax increases that became effective Monday. No, there were no government announcements about it. I bet your local member of Parliament isn’t even aware of it. But it’s real. Let me explain.

The increases

You’ve no doubt experienced the impact of inflation over the past two years. Inflation peaked at 8.1 per cent year-over-year in June, 2022, and although the pace of inflation slowed in 2023, it still clipped along at a 3.1-per-cent rate in November, 2023. So your money has lost purchasing power.

To make matters worse, there are certain tax provisions that ignore inflation. And when this happens, life becomes more expensive on an after-tax basis. That is, the amount of goods and services that you – or your business – can purchase using your after-tax dollars declines meaningfully over time.

Consider the example of Peter. He’s a small-business owner living in Ontario. The first $500,000 of his active business income is taxed at 12.2 per cent. The problem? The $500,000 threshold has not changed since 2009. If that threshold had been indexed to inflation each year, it would be $684,300 at the end of 2023. If the threshold had been indexed to inflation, he’d pay $26,355 less in corporate taxes on the first $684,300 of income. But alas, no such adjustment for inflation has been made.

Now, consider the example of Janice. Janice bought a new condo to live in last year and paid $650,000, plus $32,500 of GST for it, for a total of $682,500. She had wanted to claim the GST/HST new housing rebate, which allows a buyer to recover some of the GST, or federal part of the HST, that’s paid on a newly built residence. But she didn’t qualify because her purchase price was not less than $450,000. The $450,000 threshold has been the same since 1991. If that threshold had been indexed to inflation, it would be $851,300 today and the calculation for the rebate would have allowed her to recover the full amount of the GST she paid. This would have reduced the cost of purchasing her condo by $32,500.

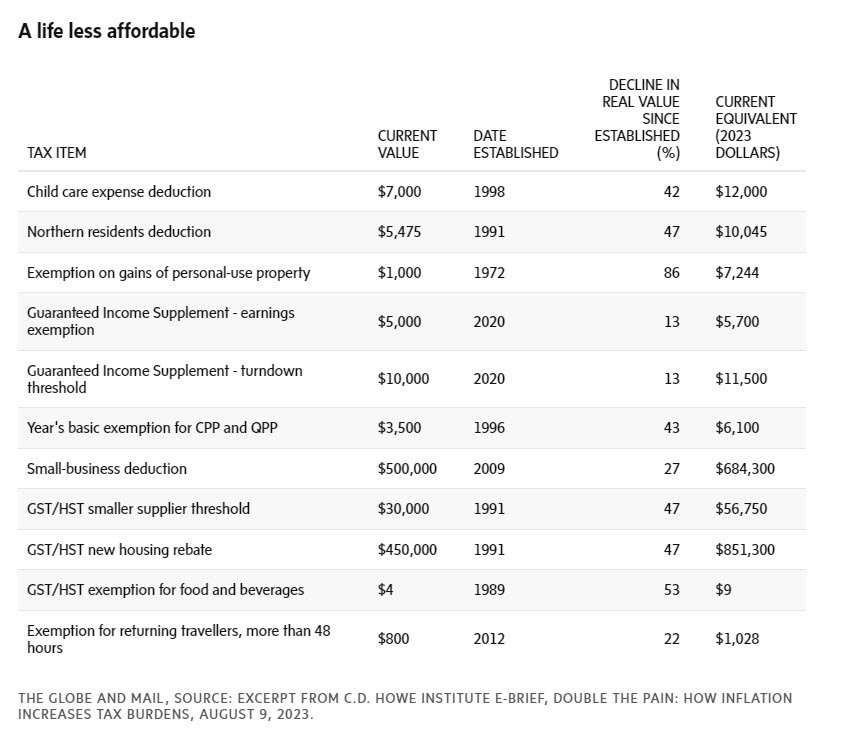

While it’s true that some tax amounts are indexed annually, such as tax brackets and basic personal credits, there are a host of items that aren’t indexed. Some of the key items are listed in the table and were calculated by the C.D. Howe Institute and published in an e-brief called Double the Pain: How Inflation Increases Tax Burdens, on Aug. 9.

The moral

Here’s the bottom line: When our government fails to index important amounts to inflation, the effect is to increase the tax burden with no transparency or legislative oversight. Sure, lower inflation is an effective way to reduce the impact of these covert tax increases, but even at the Bank of Canada’s target inflation rate of 2 per cent, the increased burden is meaningful over the course of time. Perhaps the government should start by indexing amounts that haven’t been indexed for many years. Canadians will appreciate how this can make life more affordable.